Just months after Tata Group-owned Air India placed the largest-ever aircraft order for 470 planes from Boeing and Airbus, rival IndiGo has surpassed it with an even bigger order for 500 Airbus A320neo family planes. This further solidifies the budget carrier’s position in the thriving Indian aviation industry, making it the largest-ever order placed by an airline in terms of the number of aircraft ordered.

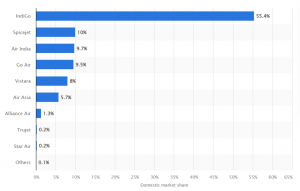

IndiGo’s latest order comes in addition to its previous purchase of 480 planes, which is expected to be fulfilled by the end of this decade. Along with the latest purchase, the airline is set to receive nearly 1,000 planes by 2035. These planes will replace older ones, and the budget airline will have a substantial fleet over the next 12 years. The latest order ensures a steady supply of aircraft until 2035 and enables the airline to achieve its long-term objective of sustaining growth in the aviation market. Currently, IndiGo dominates the Indian aviation sector with a market share of over 60%.

Market share of airlines in India

READ | Modi’s US visit: Pharma supply chains, affordable medicines on agenda

Following Tata Group’s significant aircraft order, it was expected that other companies would follow suit. In fact, other Indian carriers were also anticipated to place substantial orders to boost the underdeveloped Indian aviation sector. Before the massive Air India order, the record for the largest order in aviation history was held by American Airlines which signed a deal for 460 planes in 2011. For Indian airlines, IndiGo’s order for 300 aircraft in 2019 was the largest.

What this order means for IndiGo is clear. The airline management is optimistic about the growth potential of India’s aviation market, and for good reason. In May, India’s domestic passenger traffic reached a record high of 132 million flyers, surpassing even pre-pandemic levels. The sector continues to experience rapid growth.

IndiGo means business

However, the fact that IndiGo is willing to invest significant capital in fleet expansion indicates the carrier’s desire to maintain dominance in the Indian skies. Chief Executive Officer Pieter Elbers echoed this sentiment, stating that with the latest order, IndiGo is secured for the next decade as aviation is a long-term business.

Supported by the government’s vision to develop India into an aviation powerhouse and establish global hubs, even new companies are eager to enter the airline business, despite the sector witnessing the demise of several players in the last decade, such as Naresh Goyal’s Jet Airways. However, new players continue to emerge, with investor Rakesh Jhunjhunwala partnering with the recently launched low-cost carrier, Akasa Air.

All the positivity surrounding the aircraft orders do not mean that everything is hunky dory with the Indian airline industry. While IndiGo and Air India have confidence in the growth prospects of Indian aviation, Go First has filed for insolvency, and SpiceJet is facing its own challenges. Indian aviation has a history of turbulence, with several airlines struggling financially and eventually ceasing operations. Jet Airways and Vijay Mallya’s Kingfisher Airlines are notable examples, as are small regional carriers like Costa Airlines. Analysts have established that several airlines have faced difficulties due to the price sensitivity of the Indian market.

The airline industry also faces governance challenges, including high prices for aviation turbine fuel (ATF). The high tax on jet fuel has been a long-standing complaint of the aviation industry with some states charging as much as 30%. This tax constitutes the largest cost for airlines. Other issues include shortage of trained pilots and intense competition.

Meanwhile, IndiGo has ambitious plans to expand its network and capacity within India and internationally. The airline currently operates over 1,800 daily flights, connecting 78 domestic airports and a few overseas destinations, with a fleet of over 300 planes. The low-cost carrier is expected to double its fleet size by the end of the decade, utilising the 480 aircraft scheduled for delivery by 2030 to support this expansion.

However, IndiGo will face stiff competition from Air India, which is undergoing a rebuilding phase under Tata ownership, as well as the larger streamlining and consolidation efforts among the four Tata airlines. With Air India also aiming to establish itself as a preferred airline in the aviation segment, the competition between the two carriers will be intense in the coming years, as both have substantial financial resources to fund future expansions and undercut their competitors. Together, Tata Group airlines and IndiGo command a cumulative market share of over 85% and have close to 1,500 aircraft on order between them.

This scenario benefits Indian customers as they not only have more options but also enjoy the advantages of healthy competition, which helps keep airline prices in check.