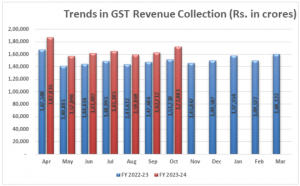

GST collections in 2023: Boosted by heightened consumer spending during the festival season and the government’s stringent anti-tax evasion measures, India’s Goods and Services Tax collections in October surged by 13% from a year earlier, reaching Rs 1.72 lakh crore. The finance ministry released these figures on Wednesday, highlighting that this amount is the second-highest monthly figure on record after the Rs 1.87 trillion amassed in April 2023. Additionally, this marks the eighth consecutive month where collections have exceeded Rs 1.5 lakh crore. Despite the uptick in GST collections, economists are split on the implications of these numbers.

Some economists caution against undue optimism, arguing that the figures, although impressive, are not in themselves a cause for celebration. Conversely, others contend that such robust mid-year figures, particularly in the light of the current festive-driven consumption, are indeed commendable and may signal a sustained upward trend.

READ | Explained: Direct listing of Indian firms on foreign stock exchanges

The sceptics point out the relatively modest growth in GST revenue, noting a deceleration to 10.6% in the second quarter of the current financial year, down from 11.5% in the first. The revenue growth from domestic transactions and imported services has also shown signs of slowing in recent months. Given that collections typically rise during the festive months of September, October, and November due to enhanced compliance and spending, analysts stress the need to isolate these seasonal effects to accurately assess the real increments in consumption and production. Inflation’s role cannot be overlooked either, as it has likely inflated GST figures for most goods.

The fiscal deficit in the first half of the current financial year was Rs 7.02 lakh crore which is 39.3% of the budgeted amount. The Union budget had set a target of Rs 17.87 lakh crore which is 5.9% of the GDP compared with 6.4% in the same period last year. Fiscal deficit is the amount borrowed by the government to meet its expenditure. The fiscal deficit was lower compared with the year-ago period for the second month running.

Several commentators have drawn attention to the worrying trend of declining revenues from goods imports, which have fallen four times this year, suggesting possible leakages. While GST revenue in October 2023 represents a 13% increase over the previous year, the cumulative growth for April to October stands at 11%, falling short of the budgeted 12% that includes CGST, SGST, and the compensation cess. Analysts highlight that even a 1% shortfall in GST revenue can have a roughly 0.03% impact on the fiscal deficit target for the financial year 2023-24.

Breaking down GST collections in 2023

October GST collections were 5.7% higher than in September, which had seen growth dip to a 27-month low of 10.2%. The 13.4% revenue increase in October is the steepest year-on-year rise since December 2022, breaking a three-month pattern of slowing growth. Revenues from domestic transactions and service imports were up by 13% in October. However, the finance ministry has not disclosed the revenue figures from goods imports, an omission that has not gone unnoticed. In addition, there was a noteworthy increase in GST cess collections, which includes Rs 1,294 crore on goods imports, reaching a record Rs 12,456 crore in October. The previous peak was Rs 12,025 crore in April.

Compliance deadlines may also have played a role in October’s improved collections. The government has intensified audits by harnessing information from various databases beyond the GST portal, enhancing compliance across sectors and states.

The higher-than-expected collections could be the result of quarter-end adjustments and the broader economic momentum. Additionally, dispute settlements for the fiscal year 2017-18 contributed, as the normal limitation period ended on September 30. The September to December period, rich with festivities, traditionally witnesses increased consumer expenditure on high-value items like real estate, vehicles, gold, and travel.

The total gross collection comprised central GST (CGST) at Rs 30,062 crore, state GST (SGST) at Rs 38,171 crore, integrated GST (IGST) at Rs 91,315 crore, and cess at Rs 12,456 crore (including Rs 1,294 crore on goods imports). Post regular settlements, the total revenue for the Union and state governments amounted to Rs 272,934 crore and Rs 74,785 crore, respectively.

Maharashtra led with a 14% increase in GST collections, with Karnataka and Uttar Pradesh following with 12% and 10%, respectively. Even states and Union Territories like Jammu & Kashmir, Mizoram, Ladakh, Lakshadweep, Meghalaya, and Sikkim reported increases, signifying heightened consumption and a broader taxable base. Manipur and Himachal Pradesh, however, reported negative growth rates of -19% and -2%, respectively. Nevertheless, the robust GST collections in October may reflect the underlying resilience of the Indian economy. The GST revenue for the current fiscal year is only 35% behind the full-year collection of the prior year, indicating a strong revenue trajectory.

With the government enjoying stable collections, it should now prioritise rate rationalisation as its next significant initiative. The current GST rate structure is complex and burdensome for businesses. The government should also focus on improving the GST portal and making it more user-friendly. An effort is called for to improve the performance of states that are lagging behind in terms of GST collections.