OCEN can be a godsend for MSMEs: Micro, small, and medium enterprises are crucial to India’s economy, contributing 29% to the nation’s GDP—a figure the government seeks to raise to 50%. MSMEs are responsible for a third of India’s manufacturing output and half of its exports. They employ more than 110 million people, and this number is expected to grow to 150 million in the near future. Remarkably, during the economic slump brought on by the COVID-19 pandemic, the MSME sector played a pivotal role in economic recovery.

Despite being the backbone of economic development in India, the MSME sector faces persistent challenges that hinder its growth and sustainability. Critical issues include a shortage of skilled workers, limited access to affordable credit, complex regulatory compliance, and outdated technology.

Notably, the most significant hurdle is obtaining affordable formal credit. It begs the question: why is there such a substantial credit gap in the MSME sector, given its enormous contribution to the economy? It is essential to recognise that MSMEs typically purchase with cash and sell on credit, leading to profitable yet cash-deficient operations. Therefore, access to low-cost finance for working capital and sustaining business operations is crucial.

READ I Explained: India’s struggle to eradicate multi-dimensional poverty

MSMEs lack access to formal credit

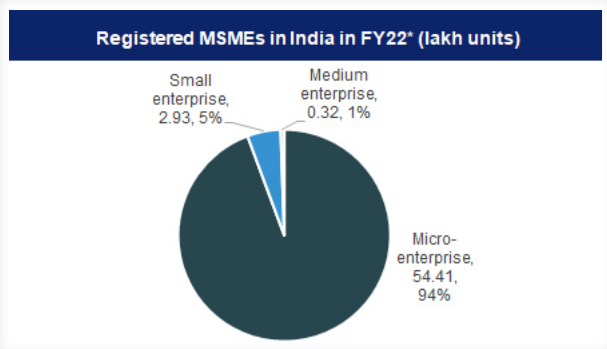

Regrettably, MSMEs receive a disproportionately small share of formal financing in India. Research by the International Finance Corporation indicates that over 80% of small businesses do not obtain credit from the formal financial sector. A 2012 IFC report revealed a $200 billion loan requirement for the MSME sector, a number that has since increased to $300 billion. However, only 16% of this credit demand is met by formal financial institutions. Furthermore, the BLinC Invest MSME Lending Report 2022 highlights an enormous financing requirement of Rs. 69.3 trillion for about 63.3 million MSME enterprises, with formal lending institutions disbursing less than 15% of the necessary loans.

The core of this issue lies in the absence of collateral or credit history. Banks and financial institutions (FIs) evaluate businesses based on audited financial statements, credit profiles, and collateral value. A poor credit score makes loan acquisition challenging for these enterprises, which often lack tangible assets to offer as collateral. High interest rates, complex documentation, and lengthy processing times exacerbate the difficulty in accessing credit, pushing MSMEs toward informal lenders who charge exorbitant interest rates. Consequently, this does not improve the businesses’ credit profiles, perpetuating a vicious cycle of credit inadequacy.

The Union government has launched several initiatives to extend credit to MSMEs, such as the Emergency Credit Line Guarantee Scheme and the MSME Self-Reliant India Fund. Efforts have been made to include Informal Micro Enterprises (IMEs) in Priority Sector Lending (PSL). Nevertheless, the credit gap persists, particularly for micro, small, and newly established enterprises. This situation calls for an innovative solution to a traditional problem.

Hopes ride on OCEN

A potential breakthrough for the MSME sector’s financing woes could lie in advancing digital technology. An example is the Open Credit Enablement Network (OCEN), introduced by Nandan Nilekani at the Global Fintech Festival 2020. OCEN, an integrated digital structure designed by the government, aims to democratise the small-ticket loan market in India. In 2023, through pilot projects, OCEN disbursed credit worth Rs 15,000 crore, with individual loans ranging from Rs 160 to Rs 10 lakh, averaging around Rs 40,000.

Remarkably, loan processing and disbursement occur within minutes. The OCEN framework comprises identity, payment, and data layers, offering MSMEs direct access to credit products on their business platforms. The resulting big data helps establish firms’ creditworthiness and may enable financial institutions to create customised credit products, potentially resolving the issue of under-borrowing.

OCEN holds great promise for enhancing MSME credit access. It marks the beginning of a digital ecosystem that fosters innovation and new opportunities for MSMEs. However, the success of OCEN requires a shift in habits as many small and micro enterprises are not yet fully engaged with digital technologies. Trust in technology remains a significant barrier in India. The government should focus on training and capacity-building initiatives to equip MSMEs with the skills and knowledge to adopt and leverage technology. By fostering a blend of technology, competency, and attitude, the MSME sector can unlock its full potential, significantly contributing to India’s thriving economy.

(Dr Samta Jain is Assistant Professor (Finance & Accounting) at FORE School of Management, New Delhi.)