Labour market trends: Over the past two decades, India has experienced significant growth, primarily driven by economic reforms and policy changes. This period of growth has seen India’s GDP increase at an average annual rate of nearly 7%, accompanied by a decrease in poverty rates and a shift in job trends. There has been a structural shift from the agriculture sector to industry and services in terms of production and employment share.

Despite these positive developments, the Indian labour market is characterised by high levels of labour market segmentation and a predominance of informal employment. A persistent issue is the gender wage gap: across all employment categories, women earn less than men, a concern that continues to challenge policymakers. This wage inequality is evident at all educational levels.

Another significant issue is the low wages and increasing wage inequality in India, posing a risk to the labour force, and hindering the nation’s progress towards achieving favorable working conditions and inclusive growth. In the past decade, various policy shocks have impacted the economy, affecting growth, employment, inflation, and wage rates. A study by Srivastava and Padhi (2020) highlighted that, before March 2018, there was a more than 5% decrease in the growth rate of wages and salaries across industries over seven years.

READ I Social security in India: The fragile shield faces growing economic challenges

Wage trends in India’s labour market

Regarding wage trends in India, the Periodic Labour Force Survey (PLFS) conducted by the National Statistical Office (NSO) plays a crucial role. This survey, which began in July 2017, replaced the earlier Employment Unemployment Surveys (EUS) conducted by the National Sample Survey Organisation (NSSO). The PLFS marks a significant shift in the approach to collecting and reporting employment and unemployment data in India.

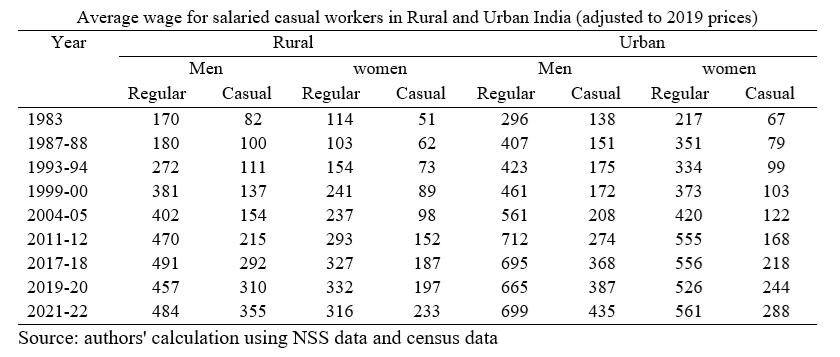

The data from both PLFS and EUS provide vital insights into employment wages and salaries at national and state levels. Between 1983 and 2021-22, the average daily wages tripled, with a more rapid increase in rural areas compared to urban areas and for casual workers compared to regular workers. The average wages for women increased more rapidly than for men. In 2021-22, the average wage in rural India was approximately ₹347 per day, compared to ₹495 in urban areas. High earners, primarily in urban areas and skilled professions, receive significantly higher average wages. Regular workers in both urban and rural areas earn almost twice as much as casual workers, but overall, low pay and high wage inequality remain pervasive issues.

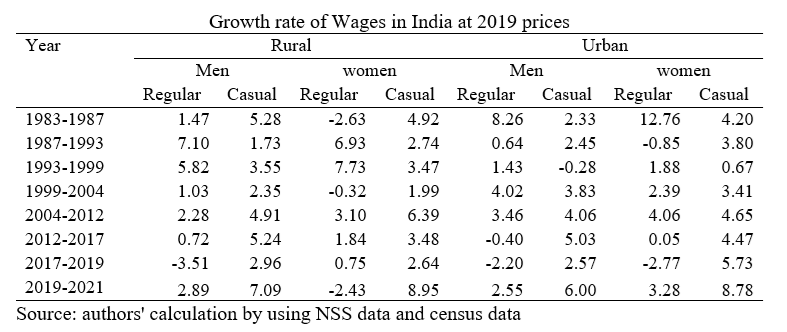

The wage growth for both regular and casual workers in rural and urban areas shows a varied trend. From 1999-2004, a sharp decline in wage growth was observed for rural workers, indicating a crisis period. However, urban areas did not experience a similar decline during this period. In urban areas, wage growth was either negative or nearly zero between 1987-1993 and 1993-1999, followed by periods of high wage growth. However, both rural and urban regular workers faced a low growth phase from 2012-2017 and 2017-2019. This period saw a pronounced negative wage growth, particularly for regular workers in urban areas and for both male and female workers. Casual workers, however, did not experience such reductions in wage growth. The negative wage growth, or ‘wage collapse,’ raises serious concerns about the Indian labour market, whether driven by policy changes or external shocks. From 2019-2021, there was a recovery in wage growth for rural men and urban workers of both genders.

This wage collapse between 2012-2019 can be attributed to various policy shocks. One significant event was the demonetisation of high-value currency notes on November 8, 2016, which aimed to eradicate black money and promote digital transactions. This move severely impacted the informal sector, which employs 90% of the workforce and contributes half of the domestic output. It led to a contraction in the rural economy and kept rural wages low. Additionally, the introduction of the Goods and Services Tax in 2017 further disrupted the economy, particularly affecting small and informal enterprises, as well as government finances and revenue sharing between the central and state governments.

(Dr Ann Mary Jose is Assistant Professor at Department of Finance and Economics, Rajagiri Business School, Kochi, Kerala.)