The lockdown is expected to be lifted on May 18, 2020 by the Union government after 54 days. The economy has been partially open, with essential services and banking, accounting for nearly 37% of the GDP being operational throughout the lockdown. The industrial sector, including MSMEs, NBFCs, and the informal sector observed total lockdown.

The industry is spluttering to start operations, but migrant labor, nearly 10 crore people, or 20% of the total work-force, has either already moved back to their native places or are being sent back in dedicated trains. Some of the migrant labour may not return, settling down to MGNREGA in their native place or return to a different location. Thus, industry will face a shortage of labor in the current year.

Prepare for a long haul

The Covid-19 pandemic may not be a short-term phenomenon. Illustratively, the pandemic of 1918 came in 3 major waves lasting for more than 18 months and the second wave was far more devastating than the first and the third. Thus, the governments, central and states, and public authorities must prepare for the long haul, and should keep their powder dry for a long battle ahead.

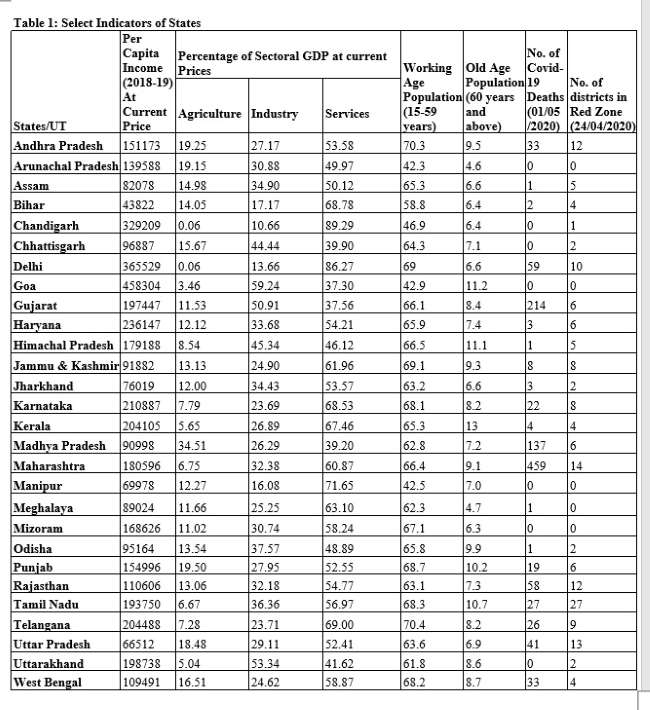

Also, the incidence of Covid-19 follows different patterns in a continent-size country like India. The states are at different stages of economic growth, demographic cycle and social development. The presence of red zones/ centers is also different (Table 1). Thus, the states will open the lockdown in a different pattern, given local contingencies that need not necessarily follow the national pattern. There will be unevenness in the opening of the economy, with some states lagging behind.

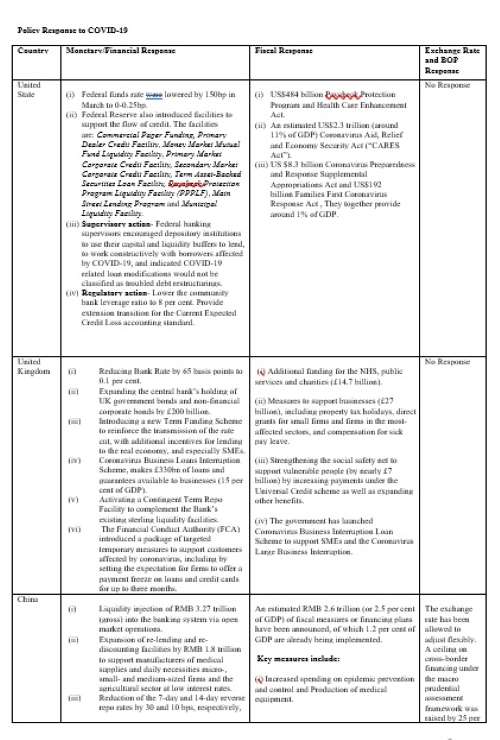

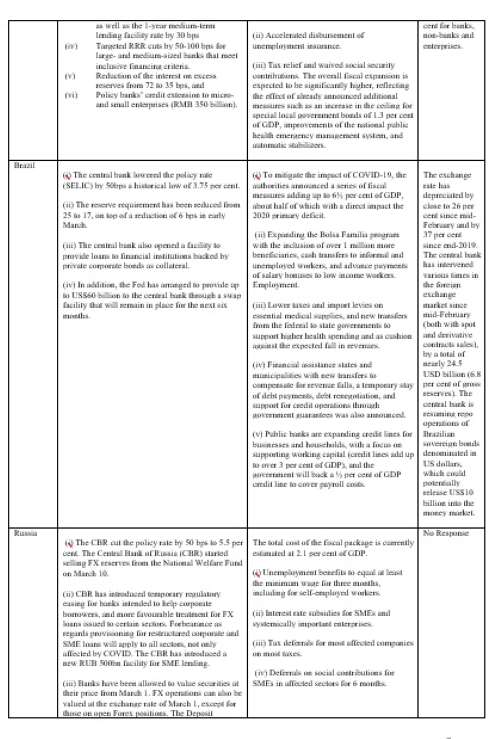

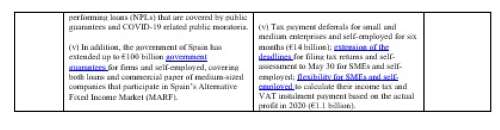

The cross-country evidence shows that different countries have used different policy measures to sustain demand. However, use of fiscal, financial and monetary policy is more extensive, while exchange rate policy has rarely been used (Table 2).

Growth of the economy

The projections for growth in 2020-21 are not very optimistic. The IMF estimates that the global growth rate would be negative (-) 3%, while that of the US would be -5.9% and in Euro area, -7.5%. India’s growth has been projected at 1.9% for 2020, highest in the world. My own projections are around 3% if the government is able to take some remedial measures, like permitting longer working hours for the industry, as well as curtailing holidays for the rest of the year. In fact, Covid-19 is happening during the lean period in the economy. The impact of the first wave would be over by end-August when the busy season begins. In the busy period, domestic manufacturing, large industry and MSMEs should be able to recover and recoup the output that has been lost in the 3 previous months. The informal sector would also have the opportunity to recover the loss in first few months.

The agriculture sector may not directly get impacted in terms of production, but in harvesting, distribution and pricing, some impact can be expected. Consequently, the income level of farm sector can suffer. Large and medium industry may be able to withstand some shock, given their size and reserves, but may need some government support as demand would be impacted.

Changing pattern of work culture

Covid-19 will change many things in business practices besides opening new avenues for businesses. The health industry is expected to flourish, as well as pharma, along with nursing and medical profession. The work culture is expected to change with emphasis on working from home. This change itself is expected to usher in many changes in business practices. The digital meeting/conference platforms will flourish as well as the usage of electronic methods of conducting business interaction. The fashion industry will provide accessories and material for working from home, as well as masks and protective gear would be new items of mass production. The immunity-enhancing herbs, mainly found in India, would be in demand across the world. The workforce, engaged in working from home, may prefer to have home-delivered food more often than cooking or regularly visiting restaurants. Thus, the need for delivery persons will increase manifold and lakhs of people engaged in travel and tourism, taxis and autos, may shift to catering to home-delivery of two meals a day in many more households than before Covid-19.

The global slowdown is expected to last more than a year. Thus, traditional exports from India are bound to suffer and the producing companies in India will need to explore hinterlands. New products, illustratively like immunity-building herbs and new geographical areas of interest to India will have to be explored. The Indian embassies can be a big help in this effort. The fear of public transport and crowds will encourage people to buy more two-wheelers and small cars, a sector which should witness smart growth. The production of medical equipment, and demand for better medical facilities and hospitals, are expected to increase.

The sectors like tourism, travel and hospitality are expected to suffer and will have to innovate to survive. Similarly, sports, gym and entertainment industry will have to explore innovative alternatives. The education sector is also expected to undertake online classes more extensively, opening new vistas of spreading education and literacy. In the services sector, some segments like real estate and construction activities could suffer because of slowdown and demand restrictions arising from salary cuts and increased work from home culture.

Fiscal policy imperatives

The slowdown in the economy is expected to reflect in tax collection during the year while expenditure, mainly on transfers and subsidies is expected to increase substantially. In the US, the government is contemplating raising corporate tax, that possibility is ruled out here. The central government will have to prepare its fiscal policy rather more seriously, given that Covid is just not a single-wave pandemic. As the whole world has been impacted simultaneously, external borrowing to meet India’s demand may not be a feasible solution. The monetization of deficit is an alternative which needs to be explored.

The Gross Fiscal Deficit (GFD) of the Central Government is in the range of 3.5 percent of GDP and debt to GDP ratio is less than 50 percent. Thus, numerically, there is scope for fiscal expansion but as mentioned earlier, the Central Government should be prepared for challenging times for more than a year. However, the Government could consider, to inspire confidence in economic agents, to pause Fiscal Responsibility and Budget Management Act for at least two years, until the economy recovers the growth trajectory.

So, to revive the economy, from where will financial resources emerge – states or local authorities? The state finances are in better shape than the Central Government. GFD of states has generally been range bound between 1.5 and 3 percent of GDP. There have been few outliers like Andhra Pradesh, Madhya Pradesh and Punjab where GFD exceeded 3 percent but in most of states, GFD is low revealing that there is fiscal space for stimulus, if need be. Similarly, debt to State GDP is also very comfortable with Maharashtra recording a ratio of 16.6 percent; Gujarat, 19.8 percent; and Madhya Pradesh, 24.7 percent. Similar to GFD, some states are outliers too like Punjab and UP, where the ratio is 40.7 percent and 38 percent, respectively. Thus, most of the states can directly raise resources from the market without dependence on the Central Government. As in case of Central Government, the states could also unshackle the budgetary strings by pausing state-level fiscal responsibility restrictions, to prepare themselves for any emergence support.

My suggestion is that, given the long haul, the third tier of the Government, viz. local authorities, mainly in large cities, including mega metropolitans, where most migrant labor works, should be extensively used in raising resources. The mode of raising resources could be through bonds which should be issued in series of COVID Bonds to build local assets/infrastructure projects, and support local MSMEs through local NBFCs. The resources raised by Municipal Corporations would be more effectively used, as local corporators are more familiar with local population and local infrastructure gaps, and are held accountable too, being close to the population. The financial resources raised by local bodies could be most effectively used by tapping NBFCs.

Fiscal stimulus needs a rethink

The issue of fiscal stimulus has been discussed by trade associations and economists, extensively. True, in an emerging country like India where tax to GDP ratio is traditionally low around 18% of the GDP, as compared to above 30% in advanced countries, fiscal stimulus would also have to be calibrated according to fiscal strength and sustainability in the medium to long term. However, the point that has been regularly missed in discussions is the industry’s response to the PM’s appeal to continue to pay monthly wages to employees and providing free food, through FCI – fair price shops, NGOs, Trusts and households to millions of people. In the USA, 33 million out of total workforce of 160 million people have been laid off in the last few months, and are on unemployment allowance by the Government. In India, if an estimate is made of wages paid to employees by households and industry for the lock down period, and free food distributed, the stimulus provided in the economy would exceed 20 percent of GDP. In addition, in many states, CMs are pleading with migrant labor not to leave. Thus, the calculation of fiscal stimulus has to be revisited, when cross-country experience is compared.

Monetary policy changes

The monetary policy, in these difficult times, will have to support the fiscal policy. The Government could consider pausing the Inflation Target regime and ask the RBI to focus on growth, as inflation is a secondary issue in the current economic conditions. In view of the global monetary policy, the RBI’s interest rates are still very high and need to be globally synchronized. In most countries, the interest rates are less than one percent while in India, the official Repo rate is still at 4 percent. The low interest rates don’t necessarily spur investment and growth immediately but certainly infuses confidence in the minds of stressed industry that the RBI is attempting extra-ordinary measures to support growth. That initiative, psychologically, creates a conducive environment for investment and growth.

Also, given past experience, when unconventional monetary policy, implying easy monetary policy is practiced in advanced countries, money flows in India. The substantial flow of foreign institutional investment in India only disturbs the fundamentals in Indian stock markets. The minimizing of the interest rate differential will help ease the pressure of unnecessary capital flows to Indian markets.

The Government could consider setting up a high-level coordinating Committee between the finance ministry and the RBI to ensure well-lubricated and active interaction between the fiscal and monetary authority. The Government could also consider appointing suitable individuals with a vision to revive the economy on the Board of the RBI.

Financial sector

In an emerging country like India, finance is generally provided by the banking sector to agents of production. The real and financial sector are closely connected in any economy. In the economy, where growth in real sector is being impacted, the challenges in production will stress profits of companies in private sector which will be transmitted to balance sheets of commercial banks. The RBI, being a regulator and supervisor of the financial sector, mainly banks and non-bank financial companies, will have to exhibit more forbearance for next few months, accommodating the stress emanating from private sector. In addition, given the dynamic situation, the RBI should be able to inspire confidence in the regulated entities that all support in terms of liquidity would be provided, and accommodation in monitorable parameters, would be accorded, provided that loans are being dispensed with objective of revving the engine of growth. Thus, the period of moratorium would have to be extended to make financial institutions lend in the market.

Conclusion

In public policy making, India can serve to plan an important role in the global arena. The initial first step in imposing a lockdown in the early stages of COVID has helped to save many human lives. The objective of the PM in saving human lives is most appropriate policy. The pandemic being a long-term phenomenon, coordinated approach between all the three tiers of the Government, and between the Government and the RBI, will be necessary. There is also a need for a coordinated approach in reviving the economy. The central Government, along with State Governments and local bodies has to provide stimulus, which is laser beamed to entities that need it most and can resume production. In view of shortage of financial resources, the stimulus has to be optimally used in critical areas that will yield maximum results. The role of local bodies, especially in stimulus to MSMEs, cannot be overstated in this regard.

To revive the economy, after the lockdown is a major challenge. A tectonic shift is expected in work culture and sectors of production. Some sectors like tourism could face immediate challenges while others like digital interactive platforms will be in great demand. The transition will have to be carefully monitored and if necessary, directed, in identifying sunrise sectors, exiting from sunset sectors, and then skilling and reskilling workforce. In addition to the economic impact, there could be sociological and psychological issues that may emerge. The rate of unemployment is expected to increase, both in organized and unorganized sector.

The rising unemployment levels could lead to higher rate of suicides, domestic violence, petty crimes and even social unrest. Similarly, and highly co-related are psychological disorders, when anxiety and tension increase due to financial stress. While the country is facing the COVID boldly with medical profession leading the battle, after the lockdown is over, India would need battalions with expertise of sociological and psychological understanding, applying the healing touch wherever required. As disaster management requires varied expertise but rapid action, the Government could consider constituting a high-level taskforce, with experience and expertise, analyzing the fast-developing socio-economic situation and offering sound advice to the policy maker.

(Dr Charan Sigh is a Delhi-based economist. He is the chief executive of EGROW Foundation, a Noida-based think tank.)

Dr Charan Sigh is a Delhi-based economist. He is the chief executive of EGROW Foundation, a Noida-based think tank, and former Non Executive Chairman of Punjab & Sind Bank. He has served as RBI Chair professor at the Indian Institute of Management, Bangalore.