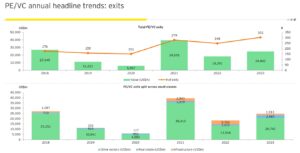

Indian companies are experiencing a decline in funding, with private equity and venture capital (PE-VC) pulling out $24.8 billion from the country in 2023, marking a 36% year-on-year increase. This significant rise from $18.3 billion the previous year was reported by the IVCA-EY PE-VC roundup. Notably, half of these exits occurred in the open market, reaching a record high of $12.8 billion. Despite this downturn, buoyant capital markets facilitated the second-best year for PE-backed initial public offerings.

PE-VC investments in India fell 11% year-on-year to $49.8 billion across 853 deals in 2023, down from $56.1 billion across 1,273 deals in 2022, a 33% drop in volume. Moreover, investments in Indian startups halved over the year. Lenskart, PhonePe, Perfios, and Zepto were among the top-funded companies in 2023, a year that saw only two new unicorns – Incred and Zepto – compared with 23 in the previous year.

READ | Green hydrogen: Can India achieve global leadership in green energy

Maturing market for PE-VC investments

The funding downturn may signal several things. Optimistically, it could indicate that the Indian PE-VC market is maturing. As startups evolve, they often pursue IPOs or seek other successful exit strategies, such as mergers and acquisitions. The increase in exits suggests that more companies are achieving growth and profitability levels that make them appealing to public markets or larger entities. This is evidenced by the rise in public listings to 30 in 2023, up from 18 in 2022, according to the report.

This trend may also reflect challenging times, leading to increased risk aversion among PE-VC firms. Global economic uncertainties, heightened by the ongoing Russia-Ukraine war and the Gaza-Israel conflict, have contributed to market volatility, making investors more cautious and inclined toward investments with proven success.

Despite India’s strong and stable economic fundamentals, a gap in valuation expectations between buyers and sellers led to a bid-ask spread, significantly affecting transaction closures throughout 2023. For startups with high cash burn rates, the pool of potential investors has drastically shrunk, primarily due to increased capital costs and growth concerns.

While overall PE-VC investments in India have declined, the real estate and infrastructure sectors have seen significant increases, supported by real assets. E-commerce companies faced a funding slowdown, but healthcare and financial services remained vibrant sectors, with healthcare receiving a notable $5 billion investment boost. This shift highlights the infrastructure sector’s leading role with $11.6 billion in investments. This suggests a potential strategic shift in investment approaches, with a rise in sectoral focus and a potential resurgence in alternate capital investments as India prepares for general elections in April-May.

In December 2023, Policy Circle pointed out that although the downturn in investments may be discouraging, it offers a prime opportunity for deeper collaboration between investors and founders. Founders need mentorship and guidance from experienced investors to help startups generate capital, fostering resilient and impactful businesses better equipped for future market challenges.

The buoyant Indian equity markets have attracted substantial PE-VC capital in the listed space, enabling funds to exit large, listed positions with minimal discount and supporting numerous PE-VC portfolio company IPOs. With significant dry powder available and global funds looking to increase India’s capital allocation, analysts at EY are optimistic about prolonged growth prospects for the Indian PE-VC ecosystem.

While the factors affecting startup investments are expected to persist, a peak in interest rates and the narrowing bid-ask spread between investors and sellers could lead to growth in deal segments, including growth, buyouts, and PIPE trades. Thus, 2024 might yet be a promising year for Indian PE-VC investments. The venture capital scene in India is undergoing recalibration, focusing on sustainable investments, but 2024 is anticipated to witness a resurgence in startup investments, especially for businesses with solid fundamentals.