The global manufacturing has been undergoing significant changes over the past few years. The US-China trade war and the COVID-19 pandemic have prompted many international corporations to diversify their production bases, leading to the rise of the China Plus One strategy. This strategy involves reducing dependence on China by establishing or expanding operations in other countries. India, with its large domestic market, abundant labour force, and favourable government policies, is often cited as a prime candidate to benefit from this shift. However, the reality is more complex, and India’s ability to capitalise on the China Plus One strategy faces both opportunities and challenges.

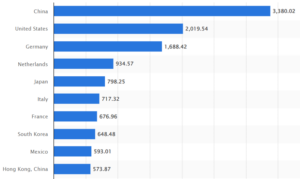

Despite the heightened interest in diversifying supply chains away from China, the data suggests that China’s dominance in global exports has only increased. Between 2018 and 2023, China’s share of global exports rose from 12.9% to 14.9%, while traditional exporting nations like Germany, Japan, Korea, France, and the UK lost market share. Meanwhile, India’s share in world exports grew modestly from 1.7% to 1.9% over the same period. This indicates that, so far, India has not significantly benefited from the China Plus One strategy.

World’s top exporting nations in 2023 ($ billion)

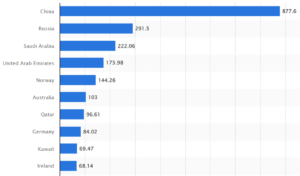

Countries with highest trade surplus ($ billion)

One of the primary reasons for this limited benefit is the difference in the export baskets of India and China. While China’s top exports include high-value industrial products such as electrical machinery, nuclear reactors, and vehicles, India’s exports are dominated by mineral fuels, jewellery, and organic chemicals. This disparity in export profiles means that India is not directly competing with China in many key sectors where the latter has a strong comparative advantage.

READ I India’s workforce transformation: More contract workers, less security

India: Comparative advantages

When assessing which countries are likely to benefit most from the China Plus One strategy, several factors come into play. These include export similarity with China, labour costs, domestic market size, foreign direct investment (FDI) inflows, geographical proximity to major import markets, foreign trade agreements, logistics performance, ease of doing business, corruption levels, and government support for exports.

India fares well in several areas compared to other emerging markets. It has competitive labour costs, a large and growing domestic market, and significant FDI inflows. Government initiatives like the Production-Linked Incentives (PLI) scheme and improvements in logistics performance have also bolstered India’s attractiveness as a manufacturing destination. However, India still lags in global value chain participation, ease of doing business, and the scope and coverage of free trade agreements. These areas need substantial improvement to enhance India’s competitiveness.

While India may not directly compete with China in high-value manufacturing sectors, it has a distinct comparative advantage in services, particularly IT, healthcare, and engineering services. These sectors have the potential to integrate with global manufacturing processes through Global Capability Centres (GCCs), which can provide critical support functions for multinational companies. By leveraging its strengths in services, India can offer a unique value proposition that complements its manufacturing aspirations.

Policy initiatives, infrastructure push

The Indian government has recognised the importance of creating a conducive environment for manufacturing. In recent years, there has been a significant increase in government capital expenditure, rising from 3.6% of GDP in FY20 to an estimated 6% in FY24. This increase is aimed at building infrastructure, improving logistics, and creating a more favourable business environment.

Programs like Make in India and the Skill India Mission are designed to boost manufacturing capabilities and develop a skilled workforce. The government’s focus on developing sectors such as electronics, semiconductors, and mobile phone manufacturing through targeted incentives has started to yield positive results. For instance, companies like Apple have expanded their manufacturing operations in India, with suppliers like Foxconn setting up assembly units.

China plus One: Challenges for India

Despite these positive developments, India faces several challenges that could impede its ability to fully benefit from the China Plus One strategy. Bureaucratic hurdles, regulatory inconsistencies, and infrastructure deficiencies remain significant obstacles. The ease of doing business in India needs substantial improvement to attract more foreign investment and ensure long-term stability for businesses.

Environmental sustainability and social responsibility are increasingly important for multinational corporations. India’s environmental regulations, while improving, still face challenges related to enforcement and compliance. Additionally, labour laws and practices must evolve to meet global standards, ensuring fair wages and safe working conditions. Addressing these issues is essential for India to become a preferred manufacturing hub for companies looking to de-risk from China.

Furthermore, India’s late entry into high-tech manufacturing sectors such as semiconductors means it faces stiff competition from established players like Taiwan and South Korea. Ensuring a reliable supply of critical raw materials and addressing power and water supply issues are crucial for supporting high-tech manufacturing.

India has the potential to benefit significantly from the China Plus One strategy, thanks to its large domestic market, competitive labour costs, and favourable government policies. However, realising this potential requires addressing key challenges related to infrastructure, ease of doing business, and participation in global value chains. With targeted improvements in these areas, India can enhance its attractiveness as an alternative manufacturing hub and capitalise on the shifting dynamics of global supply chains.

For India to fully realise its potential under the China Plus One strategy, a long-term strategic vision is necessary. This vision should include continuous improvements in infrastructure, education and skill development, and regulatory reforms. Collaboration between the public and private sectors, as well as with international partners, will be crucial in building a sustainable and competitive manufacturing ecosystem that can attract and retain global investments.