The Indian economy has shown impressive resilience and growth in the past decade, culminating in a remarkable 8.2% GDP growth rate in the fiscal year 2023-24. This is a significant achievement, considering the various global and domestic challenges faced during this period. The latest numbers have underlined India’s position as the fastest-growing major economy worldwide.

Last year saw the Indian economy outperform expectations, driven by robust growth across multiple sectors. The manufacturing sector, in particular, witnessed a substantial 9.9% growth, a testament to the government’s initiatives aimed at revitalising this segment. The high-frequency indicators suggest that the economy remains buoyant and resilient despite global uncertainties, such as elevated inflation, geopolitical tensions, and disrupted global supply chains.

Government initiatives like the production-linked incentive (PLI) scheme have played a significant role in boosting manufacturing output. Furthermore, the infrastructure sector has seen continued investment, with a focus on building roads, railways, and urban infrastructure. The government-led capex push has been instrumental in maintaining investment demand, as evidenced by the 6.5% growth in gross fixed capital formation (GFCF) in the fourth quarter of FY24. However, private consumption, a critical component of domestic demand, remained subdued, growing at a modest 4%.

READ I China plus One: Will India’s manufacturing gambit work?

Challenges for Indian economy

Despite the robust growth figures, several areas of concern need attention if the economy were to sustain this momentum. The services sector, a significant contributor to GDP, showed signs of deceleration, with growth slowing to 6.7% in the last quarter. This slowdown is worrying given the sector’s substantial share in the economy and its role in job creation. Additionally, private consumption demand has been tepid, indicating underlying issues in consumer confidence and spending power. Factors such as high inflation, particularly in food items, have constrained household budgets, impacting consumption growth.

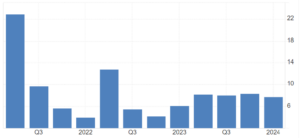

Indian economy annual GDP growth (%)

India annual consumer inflation rate (%)

Agricultural growth has been modest, impacted by uneven rainfall and other climatic factors, highlighting the sector’s vulnerability to weather patterns. The agriculture sector grew by only 0.6% in the fourth quarter and 1.4% for the entire year, underlining the need for reforms and support to boost productivity. Furthermore, while the investment demand has been robust, it is primarily driven by government spending, with private investment yet to pick up substantially.

Trends in global economy

The global economy remains fraught with challenges, including high inflation, tight monetary policies, and geopolitical tensions. These factors are expected to continue influencing the Indian economy, necessitating prudent and adaptive policy measures. The IMF projects a global growth rate of 3.2% for 2024 and 2025, which, while positive, indicates a slow recovery with uneven impacts across different regions.

Inflation remains a significant concern globally, with major economies experiencing persistent high prices despite tightening monetary policies. For India, easing core inflation and deflation in fuel prices have provided some relief, but food inflation remains a critical issue. Supply shocks and climatic factors have kept food prices volatile, necessitating ongoing policy interventions to stabilise them.

Future prospects and strategic priorities

The Indian economy is poised for continued growth, with real GDP expected to grow at around 6.8% in FY25. Key drivers of this growth will include sustained government investment in infrastructure, advancements in emerging sectors like renewable energy and semiconductors, and improvements in agricultural productivity due to favourable monsoon predictions. The government’s focus on fiscal consolidation alongside its capex push is expected to create a conducive environment for private investment.

Enhancing private consumption is vital for sustaining economic growth. Boosting consumer confidence through targeted fiscal policies, such as tax incentives and subsidies, particularly in rural areas, will be crucial. Ensuring food inflation remains in check by stabilising supply chains and increasing agricultural productivity can also support consumption growth. The government’s recent initiatives to enhance rural incomes, such as direct benefit transfers and agricultural reforms, will play a pivotal role in this regard.

Stimulating private investment is another critical priority. Creating a more favourable business environment through regulatory reforms, easing of credit availability, and incentivising private sector investments in key sectors can stimulate private investment. The government’s recent initiatives to simplify regulations and improve the ease of doing business are steps in the right direction. Encouragingly, the investment under the PLI scheme is expected to gain further momentum, creating new employment opportunities and strengthening domestic demand.

Strengthening the services sector is essential for maintaining overall economic growth. Fostering innovation and competitiveness in the services sector, particularly IT and financial services, which have shown signs of slowing down, can help sustain growth in this vital segment of the economy. The government’s support for the IT sector, including incentives for startups and investments in digital infrastructure, is expected to drive growth in this area.

Agricultural reforms and climate resilience

Implementing comprehensive agricultural reforms to improve productivity, such as adopting modern farming techniques, better irrigation facilities, and ensuring timely availability of inputs, can mitigate the sector’s vulnerability to climatic change. The government’s focus on promoting environmentally sustainable farming practices and diversifying crop production towards high-value and climate-resilient crops will also support agricultural growth.

The government’s initiatives to promote renewable energy, such as the National Green Hydrogen Mission and incentives for solar energy adoption, are expected to reduce dependence on fossil fuels and mitigate the impact of climate change. Additionally, India’s commitment to reducing its carbon footprint and promoting sustainable development through initiatives like the International Solar Alliance positions the country as a leader in global climate action.

Global trade and investment

Leveraging bilateral and multilateral trade agreements to expand market access and integrating more deeply into global value chains will be crucial. The inclusion of India’s sovereign bonds in major global bond indices is expected to attract foreign portfolio investment and support capital inflows. Furthermore, maintaining macroeconomic stability and a favourable investment climate will attract FDI.

India’s share in world remittance receipts is expected to increase, providing a stable source of foreign exchange and supporting the balance of payments. Opportunities in bilateral and multilateral trade agreements to facilitate greater participation in global value chains, expanding reach to newer markets, and leveraging international trade in the rupee, would boost exports and FDI inflows, and strengthen external sector’s resilience.

Financial sector and regulatory measures

Capital and asset quality of banks and NBFCs remain healthy, supporting the growth in bank credit and domestic activity. Pre-emptive regulatory measures aimed at curbing excessive consumer lending and bank lending to NBFCs, and investments in alternate investment funds are expected to contain the build-up of potential stress in balance sheets of financial intermediaries and contribute to financial stability.

Recent regulatory and supervisory measures by the RBI have strengthened the resilience of financial intermediaries. These measures include guidelines on governance, risk management practices, and capital buffers. The RBI’s focus on identifying and mitigating risks early through enhanced supervision and regulatory measures will ensure the stability of the financial system.

The government’s commitment to fiscal consolidation and enhancing tax revenues through digitalisation of the tax system will support public finances. The central government’s reduction in market borrowings and the extension of financial assistance for states’ capital expenditure will enhance the flow of funds to the private sector, supporting private investment.

By addressing the existing challenges through strategic policy measures and leveraging its competitive advantages, India can sustain its growth trajectory and emerge as a global economic powerhouse. The path ahead requires a delicate balance of sustaining growth, managing inflation, and fostering inclusive development to achieve the nation’s long-term aspirations.

The outlook for the Indian economy remains bright, backed by strong macroeconomic fundamentals, robust financial and corporate sectors, and a resilient external sector. Continued government focus on capital expenditure, fiscal consolidation, and regulatory reforms will create a conducive environment for investment and consumption demand. With favourable global economic conditions, strategic policy interventions, and continued focus on sustainability and innovation, India is well-positioned to achieve its developmental aspirations and become a leading global economy in the coming years.