By Reji K. Joseph

COVID-19 has once again rung the alarm bell on the perils of excessive import dependence on a single country for bulk of the requirements of active pharmaceutical ingredients (APIs) which are used for the production of formulations. The disturbance in the supplies from China not only led to the increase in the price of some medicines in India but also forced the Directorate General of Foreign Trade (DGFT) to restrict export of medicines for a short period. The Union Cabinet adopted a decision in March 2020 for the promotion of domestic production of APIs and intermediates. This Policy Brief provides a crisp narration of the nature of import dependence on China and key features of the new decision. It also proposes a few additional measures for the achievement of the objective of reducing import dependence.

Development of indigenous API industry

At the time of India’s independence in 1947, the indigenous pharma industry was very weak and was mostly confined to drugs produced from plant extracts. Foreign firms accounted for 99 percent of patents granted in pharmaceuticals and domestic firms were not allowed to produce them. Formulations were imported into India at heavy prices; APIs were not produced in India.

As Government of India encouraged the development of an indigenous pharma industry, domestic firms began to produce formulations based on imported APIs. The Hathi Committee (1975) which had looked into why Indian firms were not engaging in the production of APIs found that the capital invested to turnover ratio of APIs is much lower as compared to formulations. This ratio was 1:1 for APIs at best and 1:2.6 for formulations on average and in some cases as high as 1:7.2. Subsequently various measures were adopted, such as assigning leadership role to the public sector enterprises for the acquisition, development and dissemination of suitable technologies and entrusting CSIR laboratories with the task of development of appropriate process technologies required by the industry. Drugs for which the CISIR laboratories had developed process technologies included ciprofloxacin, omeprazole, salbutamol, vitamin B6, lamivudine, diclofenac sodium, and azithromycin.

READ I India must fortify foreign investment screening rules to escape WTO scrutiny

These measures enabled Indian pharma industry to become completely self-reliant in the case of formulations and 70% self-reliant in the case of APIs. However, the emergence of a thriving API industry in China and liberalisation of import restrictions on pharmaceutical products by Government of India in the early 1990s resulted in gradual flooding of Indian market with APIs from China and uprooting of indigenous API industry.

Rising import dependence on China for APIs

Much of the understanding on import dependence on China is based on the share of that country in India’s total import of APIs. Joseph (2020) points out that, on average, about 60 percent of the imported APIs is sourced from China. However, Dhar (2019) points out that this share was more than 75 percent in 2017-18. We do not have much information about the dependence on imports in relation of production of APIs in India. This is mainly due to lack data on the production of APIs in India. But we do get some idea about this aspect of the dependence from reports published by the industry sources.

A report published by Boston Consulting Group (BCG), Confederation of Indian Industry (CII) and Ranbaxy (Bart, Aggarwal, Sandeep 2013) shows that in the case of many APIs like Penicillin-G there was no production at all in India and the entire requirement was met through imports from China. In the case of some other APIs, only a fraction of the requirement was produced in India. For example, only 10 percent of the Levofloxacin requirement was met by production in India and rest of the requirement was met by imports from China. Even for those APIs produced in India, in many cases, the entire requirement of intermediates was imported from China. For example, entire requirement of 4-amino phenol for the production of Paracetamol was met by imports from China.

READ I Crouching Dragon: Chinese influence set to rise in post-Covid global economy

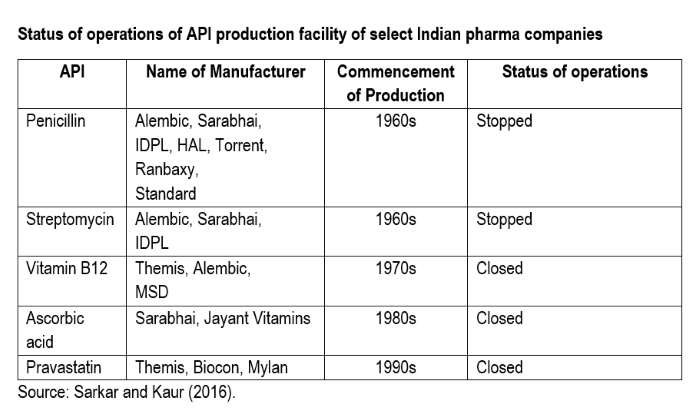

Rise in the import of APIs has led to the closure of many API manufacturing facilities in India. An illustrative list of API manufacturers who have stopped production is given in the table below.

The Chinese Government’s support for the development of biotechnology in the 1990s led to the emergence of a fermentation-based API industry in China. Chinese firms were able to develop cost effective technologies, which contributed to their acquiring a competitive edge. Apart from technology, there are other factors such as larger scale of operations which contributed to their competitive advantage.

READ I FDI from China: India must balance strategic and economic interests

Most of the chemicals and pharmaceuticals parks in China have common utilities and effluent treatment facilities, mostly owned by the Government, which are provided to firms at subsidised rates. This places Chinese producers at an advantageous position. While electricity costs Rs. 4.5 per KWH for firms in China, it costs Rs.7 per KWH in India. Similarly, effluent treatment costs Rs. 102 per KL in China whereas it costs Rs. 1920 per KL in India. All these make Chinese APIs cheaper by 35-40% as compared to India (CII 2020).

Steps taken for the promotion of domestic production

As the vulnerability of Indian pharmaceutical industry became increasingly clear in the wake of COVID-19, which led to temporary restriction of export of certain medicines from India, the Union Cabinet approved a decision for the promotion of domestic manufacturing of APIs and intermediates . Key features of the decision are:

- Establishment of three API parks with common facilities having a financial implication of Rs. 3,000 crore over five years. Maximum grant in aid to each park is Rs. 1,000 crore. Minimum area required for each park is 1,000 acres.

- 53 APIs, for which the dependence is very high on China, have been identified for domestic production. Out of the 53 APIs, 26 are fermentation-based and 27 are chemical synthesis based.

- Production linked incentive (PLI) scheme with a financial implication of Rs.6,940 crore over a period of 8 years. PLI of 20% and 10% of incremental sales value for fermentation and synthetic chemistry based APIs, respectively.

- The incremental sales value over 8-year period is expected to be Rs 46,400 crore.

READ I How India lost out to China, rest of Asia in development race

The underlying assumption of the decision is that the common utilities at API Parks and PLI will make Indian API manufacturers to overcome the price disadvantage as compared to their Chinese counterparts. However, that need not be the case. There are two key aspects to the price competence that Chinese firms have acquired – their larger scale of operations and superior technologies. The average size of SEZs in India is about 1% of average size of SEZs in China. The Chinese producers have developed technologies which require cheaper raw materials like cauliflower whereas producers in India still use costlier raw materials like glucose and lactose for fermentation. Thus, Indian firms are not in a position to compete with Chinese counterparts in terms of size of operations and cost-effectiveness of technology.

According to some officials form pharma industry, establishment of API parks may take about 5-7 years and another 3-4 years for the commencement of commercial production . It is likely that Chinese firms would come up with even better technologies which would further push the prices down. This amounts to a major business insecurity for the potential Indian investors in the proposed API parks. As we have a structural disadvantage in terms of the size of SEZs, we need to focus on cost effective and greener technologies for the production of APIs if we have to achieve self-reliance in key APIs. In the current scheme of things, this technology dimension has not found a place.

READ I Screening FDI: Need of the hour in the time of non-transparent capital flows

What needs to be done

Identification of suitable process technologies

Identify process technologies that have already been developed which can be used for production of APIs in a cost effective and environment-friendly manner. This could be collected from patent database and research conducted at public sector academic institutions. For example, one such technology that could potentially be used was developed by University of Calicut for the production of Penicillin from waste fruits, using cost-effective solid-state fermentation technology as against the widely-used submerged fermentation technology in India. Organisations like National Research Development Corporation (NRDC) can play an important role in identification of such technologies and facilitation of their scaling up for industrial use.

Launching a scheme for development of new technologies

Launch a scheme dedicated for development of new technologies for API production if newer technologies are to be developed. Simultaneously, public sector research laboratories and universities can be entrusted with the task of developing such technologies. During the 1970s and 80s, the CSIR laboratories had developed new process technologies and transferred them to the industry.

READ I WTO using Covid-19 pandemic to push expansionist free trade agenda

Incentive schemes for producers of APIs

In order to promote indigenous production of APIs, it was proposed that formulations based on indigenously produced APIs and intermediates be exempted from drug price control. Small and medium enterprises (SMEs) are major producers of APIs, especially those produced through chemical synthesis process. Most of these firms are not into the business of formulations. Exemption from price control while benefiting the formulation producers, would not benefit the actual producers of APIs. Such schemes need to be designed to benefit the actual producers of APIs.

API parks on the model of Medtech Zone in Andhra Pradesh

The business insecurity for private players in investing in API parks is already discussed in the context. This insecurity will be overcome if the API parks with common utilities are established by the Government and then enterprises are invited to establish their production units there. This will considerably reduce the cost for producers and partly offset the disadvantage India is having in terms of size of operations as compared to China.

(This is a policy brief prepared by Dr Reji K. Joseph, Associate Professor, Institute for Studies in Industrial Development, New Delhi, India).