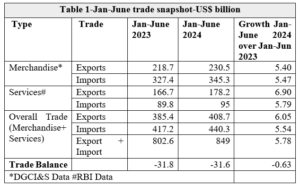

India’s foreign trade soared to a record $849 billion in the first half of 2024, a 5.8% increase compared with the same period in 2023. This growth, driven by a 6.05% rise in total exports, highlights India’s resilience and adaptability in a rapidly evolving global trade environment. Industrial products exports worth $140.79 billion highlight India’s shift towards a more diversified and industrialised export base. However, this growth is tempered by challenges in traditional sectors like agriculture, where exports saw a slight decline, notably with a 40.47% drop in sugar exports.

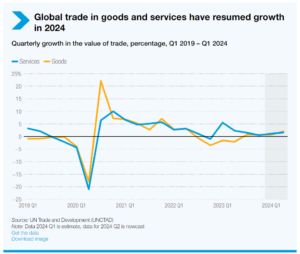

India’s growing influence is evident in the latest world trade figures. Global trade grew 1% quarter-over-quarter in both goods and services in the first quarter of 2024. The rise is propelled by contributions from India, China, and the United States. India’s 7% rise in exports positions it as a key global player, even as it faces stiff competition from other major economies. However, the positive momentum is threatened by potential disruptions such as geopolitical tensions, rising shipping costs, and protectionist measures that could alter the trade dynamics.

READ I State-led growth key to unlocking India’s economic potential

Sector-wise performance

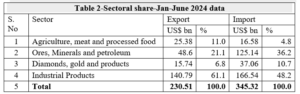

India’s export performance in the first half of 2024 reveals both strengths and vulnerabilities across various sectors, says a study by GTRI, a New Delhi-based think tank. The industrial products sector, particularly telecom, computer, and electronics products, saw significant growth, with exports of smartphones and electronic components rising by 33.1% and 19.49%, respectively. This aligns with global trends where sectors like green energy and AI-related products are experiencing robust growth. For instance, the global trade value of high-performance servers and electric vehicles increased by 25%, reflecting a broader shift towards technology and sustainability-driven industries.

However, not all sectors are performing equally well. Agriculture, meat, and processed food sectors have faced challenges, with sugar exports plummeting by 40.47% and marine product exports declining by 11.7%. Diamonds, gold, and related products also saw a decrease in exports, driven by a 22% decline in cut and polished diamonds. These sectoral challenges highlight the need for India to diversify its export base and address vulnerabilities in traditional sectors.

On the import side, India’s trade deficit with China remains a major concern. Imports from China surged to $50.1 billion, far outpacing India’s exports to China which stood at $8.5 billion. This imbalance underscores the ongoing challenge of managing trade relationships with key partners. However, the United States has emerged as India’s largest trading partner from January to June 2024, with total trade increasing by 5.3%. This shift could provide a strategic counterbalance to India’s trade deficit with China and signal a reorientation towards more balanced trade relationships.

Global trade not out of woods

The global trade in goods and services has seen modest growth, with a projected addition of $250 billion to goods trade and $100 billion to services trade in the first half of the year. China, India, and the United States have been the main drivers of this growth, with India’s 7% increase in exports outpacing the global average and underscoring its rising prominence on the world stage. However, Europe’s exports remained flat, and Africa experienced a 5% decline, highlighting the uneven nature of this recovery.

The first quarter also saw an encouraging increase in South-South trade, which rose by about 2% in both imports and exports. This trend underscores the growing importance of trade among developing countries. However, on an annual basis, South-South trade fell by 5% when comparing the first quarter of 2023 to the first quarter of 2024, indicating potential volatility in this segment of trade.

Rising global trade risks

Despite the positive trade growth in the first half of 2024, the outlook for the rest of the year remains uncertain. Geopolitical tensions, particularly those involving major economies like the United States and China, pose significant risks to global trade stability. Additionally, rising shipping costs and protectionist measures, especially in developed countries, could disrupt trade flows and create new challenges for exporters.

India’s trade policies will need to adapt to these changing dynamics. The increasing trend of protectionism, particularly in the European Union and the United States, could impact India’s export competitiveness. For example, the European Union has introduced several regulations aimed at curbing imports under the guise of climate change policies. These regulations, while addressing environmental concerns, could also serve as trade barriers, particularly for developing countries like India.

To maintain its trade momentum, India must focus on enhancing product quality, expanding into high-growth sectors like green energy and technology, and improving supply chain competitiveness. India should also be cautious about surrendering policy space in international trade negotiations, especially concerning new issues in Free Trade Agreements (FTAs) and the Indo-Pacific Economic Framework (IPEF). By maintaining a strategic and proactive stance, India can leverage its growing trade relationships while mitigating risks from disruptions.

India’s trade performance in 2024 is a story of resilience and strategic adaptation. While the global trade environment presents both opportunities and challenges, India’s ability to navigate these dynamics will be crucial in sustaining its growth trajectory and strengthening its position in the global economy. As the world’s trade patterns shift, India must continue to innovate, diversify, and strategically engage with global markets to ensure long-term success.

Anil Nair is Founder and Editor, Policy Circle.