Fed short of options: The US economy is in a precarious position. While not officially in a recession, the booming economy of 2023 has begun to cool significantly. The latest economic data point to slower growth, cautious consumer spending, and an increasingly fragile labour market. Despite these warning signs, the Federal Reserve is still in a dilemma. Its upcoming decision on interest rates could make the difference between a mild slowdown and a full-blown recession.

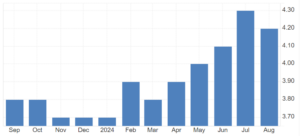

Over the last few months, the US has seen a marked softening in economic activity. The labour market, once a bastion of resilience, is showing cracks. Hiring has slowed considerably, as evident in August’s disappointing jobs report, and the number of unemployed Americans has risen by one million since last summer. Inflation, the primary concern for much of 2022 and early 2023, has subsided to more manageable levels, yet economic growth remains anaemic.

READ I GST Council may step in to diffuse centre-state tension

The economic slowdown

Worse still, the economy is now experiencing the effects of what is called a “two-track economy,” where lower-income Americans are bearing the brunt of the slowdown. With wage growth failing to keep pace with inflation, many households are struggling to make ends meet. A report from Dollar General reveals that a significant number of consumers are running out of money by the end of the month, further evidenced by declining sales at discount retailers.

This fragile state has cast uncertainty over the Federal Reserve’s monetary policy. Having raised interest rates to combat inflation, the Fed now faces a new challenge — how to ease borrowing costs without further damaging the labour market.

Fed’s interest rates dilemma

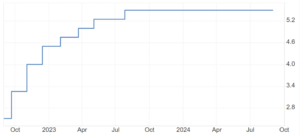

The most urgent lever that the Fed can pull is the interest rate. Currently sitting at nearly 5.5%, the benchmark rate is at a two-decade high, a result of the Fed’s aggressive strategy to tame inflation. This high rate has succeeded in reducing inflation but is also hampering business investment and making it harder for consumers to borrow. The labour market, as a result, is suffering.

One potential solution is for the Fed to cut interest rates decisively at its upcoming meeting. Federal Reserve Chair Jerome Powell has signalled that a rate cut is on the table, but the magnitude of this cut is still uncertain. Wall Street is divided on whether the Fed will opt for a modest 25-basis-point reduction or a more aggressive half-percentage-point cut.

US Fed funds interest rate (%)

Given the gravity of the situation, a strong case can be made for the larger cut. A 50-basis-point cut would send a clear message that the Fed is taking the slowdown seriously and is committed to supporting the labour market. As some economists have argued, the risk lies not in cutting too much but in doing too little and allowing the downturn to spiral into a recession. By acting swiftly and decisively now, the Fed could restore confidence among both consumers and businesses.

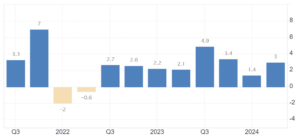

A soft landing for the US economy

The Federal Reserve is attempting what economists call a soft landing — the delicate act of cooling inflation without tipping the economy into a recession. So far, the Fed has made progress on inflation, with price growth easing to 2.5% in July, just shy of the central bank’s 2% target. However, the focus must now shift to ensuring that the labour market remains robust.

United States GDP growth rate (%)

United States unemployment rate (%)

It is important to note that the slowdown in hiring has been driven more by cautious businesses than by large-scale layoffs. Yet, job growth is still weak, and employers are reducing hours and leaving positions unfilled. This hesitation could lead to a self-fulfilling prophecy, where reduced hiring leads to less consumer spending, which in turn further slows business activity. By cutting interest rates now, the Fed can encourage businesses to hire again and help boost consumer confidence.

Fixing the US economy

The consequences of a policy miscalculation are significant, particularly for the most vulnerable Americans. Low-income households, already struggling with high borrowing costs and stagnant wages, would be the first to feel the effects of a recession. Unemployment has risen most sharply among Black and Asian workers, as well as those without high school diplomas, and further inaction from the Fed could deepen this disparity.

Moreover, young Americans trying to enter the labour market for the first time are at risk of being shut out. The longer they remain unemployed, the more likely they are to suffer from long-term scarring effects, such as lower lifetime earnings and reduced career opportunities. In short, if the Fed missteps, it is these workers who will bear the brunt of the fallout. That is why it is critical for policymakers to act now and act boldly.

There is still time to prevent the worst-case scenario, but it requires decisive leadership from the Federal Reserve. A significant interest rate cut this month would demonstrate the Fed’s resolve to keep the economy on solid ground. By providing relief now, the Fed can avoid the need for drastic action later when the political stakes are higher.

Beyond monetary policy, there is a need for broader economic measures to address the structural issues exacerbating this downturn. Investing in workforce development, particularly for low-income and marginalised communities, is essential. Additionally, policies that boost consumer spending — such as targeted tax relief for low- and middle-income households — could help lift demand and stimulate economic growth.

The US economy is at a crossroads. The choices made today will determine whether the country experiences a mild slowdown or a deeper recession. By acting decisively, the Fed can help steer the economy toward a more sustainable path.