The GST Council meeting today will deliberate on reducing the GST rate on health and life insurance policies. The government is considering four options for the tax treatment of health insurance, with the potential cost to the exchequer ranging from Rs 650 crore to Rs 3,500 crore. Given the potential revenue loss, the Fitment Committee is unlikely to make specific recommendations and may leave the decision to the GST Council, which includes representatives from the Centre, States, and Union Territories.

In India, there is a common saying that much of a person’s income is spent on their children’s weddings or in the event of a family health crisis. Currently, India imposes an 18% GST on health insurance, which many in the government now agree is too high and should be reduced. With medical costs escalating at an annual rate of 14%, the 18% GST on health insurance premiums urgently requires reassessment.

READ | US economy: Fed hits a fork in the road on interest rates

A case for waiver of GST on health insurance

Policy makers are currently debating whether healthcare services should be exempt from GST altogether, considering that access to quality healthcare is a necessity, not a luxury. This is especially relevant for a country with high income inequality and a struggling healthcare system. Despite these challenges, India’s insurance coverage remains low compared with other nations, and the tax on health insurance only exacerbates the issue.

According to a NITI Aayog report, around 30% of India’s population, or 400 million people, lack financial protection for healthcare, leaving millions vulnerable to exorbitant medical bills. While the Economic Survey forecasts an increase in India’s insurance coverage from 3.8% of GDP in FY23 to 4.3% by FY35, the immediate burden of the 18% GST on health insurance—one of the highest in the world—requires urgent review.

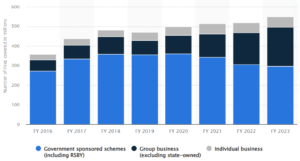

Number of Indians covered by health insurance schemes (mn)

While there is broad consensus on lowering the GST on life insurance, concerns persist about waiving the tax on health insurance. In a recent Lok Sabha response, it was revealed that health and reinsurance premiums generated Rs 24,500 crore in GST revenue over the past three fiscal years, ending in FY23-24. The issue has sparked significant political debate.

State governments are concerned that insurers may not pass on any tax savings to consumers, particularly in the absence of an active anti-profiteering body. Although there is growing pressure to reduce the burden on consumers, insurance companies have been raising premiums since the COVID-19 pandemic, citing increased claims. Even as COVID-related claims have declined, insurers have not offered relief to policyholders, arguing that the cost of handling claims remains higher than the premiums collected. The government’s focus is to ensure that any cost savings are passed on to consumers and not pocketed by insurance companies.

The Government’s Four Options for Health Insurance GST

The government is considering four options, following a detailed analysis by the GST Council’s Fitment Committee, which includes revenue officials from both central and state governments. These options are:

- Full exemption for all health insurance premiums and reinsurance

- Reduction of the GST rate on health insurance from 18% to 5%

- Exemption of premiums paid by senior citizens and those with coverage up to Rs 5 lakh

- Exemption of premiums paid by senior citizens only

Each option carries different financial implications for the exchequer: the first would cost Rs 3,495 crore, the second Rs 1,730 crore, the third Rs 2,110 crore, and the fourth Rs 645 crore.

Separately, the panel has considered exempting life insurance premiums from GST. It recommended limiting this exemption to pure-term individual life policies and reinsurance, which could reduce government revenue by Rs 210 crore. However, the panel stressed that any reduction in life insurance taxes should be conditional on insurers passing the benefits to policyholders.

The health insurance debate

Although the issue of GST on insurance has been discussed multiple times in the GST Council, the debate continues to resurface. The insurance industry has been actively advocating for the removal of the tax, as it significantly increases the cost of coverage for policyholders. High taxation rates pose a financial burden that may deter individuals from obtaining or increasing their insurance coverage.

Reducing the GST on health insurance premiums remains crucial to achieving higher insurance penetration in India, as seen in other countries. If the government cannot make significant investments in improving the quality of healthcare, lowering the tax on health insurance is a practical way to support individuals. Without such measures, the Insurance Regulatory and Development Authority of India (IRDAI)’s ambitious goal of achieving “Insurance for All by 2047” may remain out of reach.