In 2023, Afghanistan’s Afghani emerged as Asia’s best-performing currency, defying conventional economic wisdom. Despite sanctions and limited foreign investments, the Afghani appreciated significantly due to factors such as stringent currency controls, personal remittances, international aid, and controlled money supply. The central bank’s effective monetary policies and macroeconomic management also played a crucial role, ensuring stability and confidence in the currency.

Additionally, strong trade performance, political stability, economic diversification, and substantial infrastructure investments contributed to Afghanistan’s economic progress. Despite ongoing challenges, the nation’s resilience and strategic initiatives boosted investor confidence, highlighting potential opportunities for future investments. However, persistent poverty and unemployment emphasise the need for sustained efforts, both domestic and international, to address complex socioeconomic issues for a more stable and sustainable future.

READ I Israel Iran conflict threatens to derail Indian economy’s onward march

Afghanistan economy: Challenges to stability

Nations often face challenges that test their financial stability and resilience. These challenges have been particularly acute for Afghanistan due to decades of conflict which discouraged foreign investors and stunted the nation’s development. Afghanistan, with a population of around 40 million, has about 34 million people living below the poverty line. Following the withdrawal of US forces in 2021, Afghanistan’s $9.5 billion in foreign exchange reserves was frozen by the US.

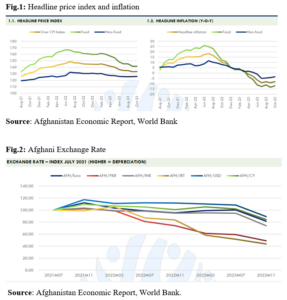

While the US later agreed to release $3.5 billion, this proposal was ultimately put on hold due to concerns regarding the independence of Afghanistan’s central bank. Despite these impediments, Afghanistan surprised many by emerging as an unexpected success story, with its currency standing out as Asia’s best-performing in 2023. The Afghani appreciated from 87-89 per dollar in January 2023 to 69 per dollar by December 30, 2023. This achievement is particularly remarkable given the country’s historical and geopolitical challenges.

Traditionally, strong currencies are associated with factors like a robust economy, significant export and investment inflows, and widespread global acceptance. However, contrary to this belief, the Afghani, despite Afghanistan’s poverty and isolation, became the best-performing currency globally for the September quarter of 2023, according to a Bloomberg report. During the quarter, the Afghani’s value increased by 9%, and by 14% over the entire year. By early December, Colombia’s peso (up 19%) and Sri Lanka’s rupee (up 15%) were the top-performing currencies globally, with Afghanistan’s Afghani ranking third.

The question arises – where is Afghanistan’s foreign exchange coming from, given the sanctions, lack of foreign investments, and limited exports? This article delves into the key factors behind the Afghani’s impressive performance in 2023. While various factors contributed to the Afghani’s resilience, some of the most prominent are:

Foreign exchange from international aid

The Afghani (AFN) benefitted from stringent currency export controls, a controlled domestic money supply, significant personal remittances, and aid from international organisations. UN cash shipments in dollars, coupled with strict outflow restrictions, also played a role. The Taliban imposed a cap on the amount of foreign currency one could carry when leaving Afghanistan — $500 by land and $5,000 via airport — which increased demand for the Afghani and contributed to its appreciation.

Between January and July 2023, Afghanistan received approximately $1.04 billion in aid, following $1.8 billion in 2022. This aid, delivered in cash due to sanctions barring Afghanistan from the global financial system, is converted into the local currency by the Taliban and infused into circulation. Local money changers, known as ‘sarraf,’ play a crucial role in foreign currency exchanges in Afghanistan.

Effective monetary policy

The Afghan central bank, Da Afghanistan Bank, ensured currency stability through prudent monetary policies. By controlling inflation and maintaining appropriate interest rates, the central bank instilled confidence in the Afghan currency among domestic and international investors. Strict macroeconomic management, including prohibiting capital flight, regulating imports, capping banking transactions, and tightening control over the informal hawala money market, further strengthened the Afghani.

Inflation, which peaked in mid-2022, transitioned into deflation by April 2023 due to the easing of supply constraints. Despite deflation complicating economic stability, the Afghani appreciated significantly against major currencies, including a 27.8% rise against the dollar, 23.8% against the Chinese Yuan, and 28.9% against the Indian rupee, reflecting the Taliban’s successful monetary approach.

In the first four months of fiscal year 2023, Afghanistan’s revenue collection reached AFN 63 billion, a 16% increase from the previous year, largely driven by border taxes. Imports surged by 36% to $3.1 billion, with food and minerals being major components. Afghanistan’s trade deficit widened, but the Afghani’s strength suggests potential unidentified sources supporting the current account deficit, beyond cash shipments and remittances.

Afghanistan’s relative political stability has contributed to its economic success. After decades of conflict, a more stable government enabled economic reforms, including efforts to reduce corruption and inefficiency. While Afghanistan still faces immense challenges, the combination of political stability, economic diversification, and significant infrastructure investments bolstered the Afghani’s performance.

Afghanistan has attracted infrastructure investments through its diplomatic connections, particularly with China. The extension of the Belt and Road Initiative (BRI) and investments in Afghanistan’s lithium resources, estimated to be worth around $3 trillion, are seen as major opportunities for future growth. The country is also focusing on diversifying its economy, moving beyond agriculture and into sectors such as manufacturing, mining, and services.

Afghanistan’s unexpected currency surge in 2023 offers valuable lessons on resilience in the face of adversity. The path ahead requires deeper structural reforms, investments in human capital, and a broadening of economic opportunities. Afghanistan stands at a crossroads: it can leverage its recent financial success to build a more inclusive and diversified economy, or risk falling back into the cycles of instability that have defined its past. The world will be watching to see which path it chooses.

(Saima Nazir is a research scholar at the department of commerce, University of Kashmir. Aamir Ahmad Teeli is a senior research fellow at the department of economics, Central University of Tamil Nadu. Sarathlal PS is Assistant Professor Economics at Christ University, Bangalore.)