India’s rural economy has long been a critical driver of the nation’s economic trajectory, serving as both a producer and consumer base with substantial contributions to GDP, employment, and demand. An in-depth analysis of multiple surveys on rural financial inclusion, consumption, income, and savings highlights a resilient yet complex economy, which, despite post-COVID challenges, continues to thrive on consumption-led growth.

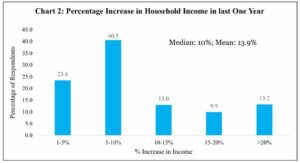

The recent NABARD All India Rural Financial Inclusion Survey (NAFIS), a high-frequency rural economy survey, reveal trends that reflect the current state of the rural economy. The survey, covering over 100,000 households across 700 districts, provides a comprehensive view of income, consumption, savings, debt, and investment in rural India. The survey indicates that while rural households have experienced a rise in average monthly income, a distinct divergence exists between agricultural and non-agricultural households, with non-farm income sources—like wage labour and salaried employment—gaining prominence.

READ | Rupee’s fall: A tipping point for economic stability

Rising income, higher consumption

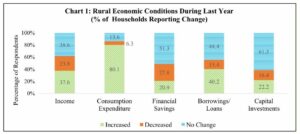

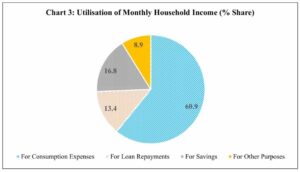

Despite the encouraging rise in rural incomes, a key finding is that consumption expenditure has been outpacing income growth. The NAFIS data reveal that, for rural households, consumption expenditure growth (10.4% for agricultural households and 11.1% for non-agricultural households) has exceeded income growth, signalling an increasing reliance on savings and debt to sustain consumption.

Interestingly, the percentage of households reporting regular savings increased from 50.6% to 65.6% over the survey period. While savings growth is evident, the rate remains lower than expenditure growth, suggesting a cautious yet positive trend in financial inclusion. The survey also indicates that investment in physical assets, particularly in agriculture and land, rose significantly, with a 177% increase over the last survey period. This growth aligns with the rise in rural incomes and indicates an increasing propensity for long-term asset building.

Trends in debt and financial inclusion

The surveys also reveal a rise in borrowing, with the share of households reporting debt increasing from 47.4% to 52%. However, despite this increase, the average debt level has not surged significantly, possibly due to farm loan waivers and COVID-related financial support. Another encouraging sign is the shift towards institutional lending, with dependence on non-institutional sources of credit dropping from 30% to 23.4%. Improved access to institutional credit facilities like the Kisan Credit Card reflects advancements in rural financial inclusion, although more support is needed for small and marginal farmers.

Despite this positive trajectory, the rural economy faces critical challenges. One pressing issue is land fragmentation, with the average landholding size decreasing from one hectare in 2016-17 to 0.7 hectares. Fragmented land restricts economies of scale, a critical factor for improving agricultural productivity. Policymakers must explore land pooling and collectivization strategies to address this issue.

Another area of concern is crop insurance, where coverage remains low at 10.8% despite government-backed schemes. This limited penetration leaves many rural households vulnerable to climate shocks, highlighting the need for broader awareness and accessibility to agricultural insurance. Additionally, while there has been an improvement in financial behaviour—72.8% of households now exhibit sound financial management practices—gaps remain in financial literacy, a crucial element for economic stability in rural areas.

Structural shifts and emerging trends

Encouraging trends also emerge in the form of rising non-farm income and a shift in consumer preferences. The share of non-farm income in rural households has grown, with increased engagement in wage labour and salaried employment. This diversification of income sources highlights a transition from agriculture-dependent income to varied revenue streams, enhancing rural resilience and economic stability. There is also a notable rise in the ownership of consumer durables like televisions, mobile phones, and two-wheelers, which reflects a growing demand for goods and an improved standard of living in rural areas.

This trend could play a role in driving domestic demand for consumer goods and boosting rural market dynamics. Furthermore, rural households exhibit optimism about income and employment prospects over the coming quarters. Approximately 54% of rural households expect income growth in the next quarter, with this sentiment rising to nearly 70% over the next year. This positive outlook is promising for rural demand and economic stability.

Policy prescriptions for a stronger rural economy

The rural economy’s performance aligns closely with national macroeconomic indicators, challenging the notion that it lags significantly behind urban counterparts. Consumption expenditure, savings, and investment trends reveal a robust consumption-led growth model in rural India. Despite the pandemic’s impact, the rural economy has shown signs of resilience, with consumption-driven growth supported by financial inclusion measures and policy support.

Given the insights from these surveys, several policy recommendations emerge. While financial inclusion is improving, there is an urgent need to enhance financial literacy among rural households. Strengthening financial knowledge can empower households to manage debt, save more efficiently, and make informed investment decisions. Additionally, land fragmentation is a persistent issue hampering productivity. Government initiatives to encourage land pooling and collectivization can help rural households access advanced agricultural equipment, improve yields, and reduce inefficiencies in production.

Expanding crop insurance schemes to cover a broader base of farmers, particularly smallholders, is also essential to enhance rural resilience to economic and environmental shocks. Given the growing importance of non-farm income in rural India, policies that promote rural entrepreneurship and skill development could further diversify income sources, reducing dependency on agriculture and providing rural households with additional economic buffers.

The story of India’s rural economy is one of resilience, consumption-led growth, and structural transformation. While challenges like land fragmentation, debt, and low insurance coverage persist, the economy’s shift toward diversified income sources, growing consumer demand, and financial inclusion is promising. With supportive policy measures, India’s rural economy can continue to thrive, contributing robustly to the nation’s economic growth and stability.