The rapid integration of Artificial Intelligence into Indian financial markets signifies a transformative era with immense potential but substantial challenges. As AI algorithms reshape trading, investment, and risk management, stakeholders must navigate the complex landscape of regulatory frameworks, technological skills, consumer protection, and data governance. The Indian financial sector—defined by dynamic markets and a tech-savvy, youthful demographic—now stands at a critical juncture, where the balance between advancement and oversight will shape its future success.

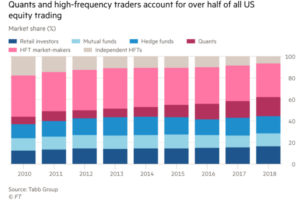

AI has dramatically reshaped stock, debt, and bond markets by offering unprecedented analytical capabilities for swift, precise decision-making. The automation of trading strategies and risk assessments marks a new era where returns may be optimised like never before. However, these advancements come with significant concerns, particularly in regulatory oversight. Operating at speeds and complexities beyond traditional models, AI-driven systems carry the risk of market instability, volatility, and potential systemic failures.

READ I Building trust: Indian banks must reclaim their social purpose

AI regulatory knowledge gap

The intricate nature of AI algorithms presents a formidable challenge to regulatory bodies, which often lack the expertise to manage these rapid advancements. Effective oversight in AI-driven financial systems demands a deep understanding that regulators must urgently develop. Closing this knowledge gap is essential; fostering a cooperative relationship between regulators and technologists will ensure market stability while encouraging innovation. Without proactive engagement, regulatory lag could lead to unforeseen disruptions.

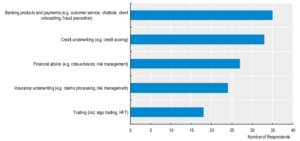

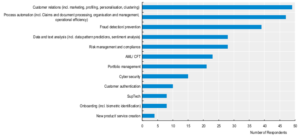

AI development or use involved in numerous products across sectors

Use cases and tasks involving the use of AI in finance

Many AI models lack interpretability, adding another layer of complexity to the financial landscape. The opaque nature of deep learning algorithms makes it difficult to trace the logic behind critical financial decisions, raising ethical and accountability concerns. As AI becomes integral to investment strategies, ensuring fairness and inclusivity should be a top priority. Regulators must stand against biases arising from flawed data, advocating for transparency and fairness in AI applications.

Need for strong safeguards

Market manipulation is another pressing concern. AI-powered trading strategies can unintentionally exploit market vulnerabilities, leading to artificial price movements and misleading signals. Detecting and mitigating such manipulation requires a robust regulatory framework that evolves with technology. In an interconnected global financial landscape, consistency in regulatory approaches across jurisdictions is essential for maintaining integrity and trust.

AI’s reliance on vast amounts of data exposes financial systems to risks of breaches and data misuse. Establishing strong data governance protocols is essential for safeguarding sensitive information while maximising AI’s utility. Stakeholders must invest in comprehensive frameworks to protect user data, fostering public trust in AI-driven financial services.

Opportunities and challenges for young investors

For India, characterised by a young population and a burgeoning digital landscape, AI’s integration into financial markets is both an exciting opportunity and a serious challenge. Young investors, increasingly comfortable with technology, are eager to leverage AI for optimised trading strategies and informed investment decisions. The democratisation of investment through AI-powered platforms empowers this demographic to engage confidently with financial markets.

Yet, enthusiasm is tempered by a growing awareness of the risks of inadequate regulatory oversight. The tech-savvy younger generation insists that regulatory bodies must possess the expertise to handle AI’s complexities. They recognise that while innovation is essential, it must not compromise market integrity or consumer protection.

Transparency and accountability are critical for young investors, who demand clarity about the operations of AI-driven financial services. As algorithms increasingly drive financial decisions, the assurance that these systems are bias-free and aligned with consumer interests is paramount. Furthermore, the need for stringent data protection measures resonates deeply with this demographic, who prioritise privacy in an AI-driven era.

As AI continues to redefine Indian financial markets, a comprehensive, multi-pronged approach to regulation is essential. Collaboration among regulators, technologists, and market participants is crucial to foster an environment that encourages innovation while protecting market integrity. Addressing the challenges of regulatory complexity, market volatility, interpretability, bias, and data governance is necessary for India to fully leverage AI in financial services.

The voice of India’s young demographic, eager for progress and stability, will play a pivotal role in shaping AI’s future adoption. Embracing this transformative journey requires a commitment to responsible innovation, ensuring the benefits of AI are realised without compromising fairness and trust.

Srinath Sridharan is a strategic counsel with 25 years experience with leading corporates across diverse sectors including automobiles, e-commerce, advertising and financial services. He understands and ideates on intersection of finance, digital, contextual-finance, consumer, mobility, Urban transformation, and ESG. Actively engaged across growth policy conversations and public policy issues.