Public investments have long been a critical policy tool for addressing infrastructure gaps, stimulating economic growth, and crowding in private investment. In today’s volatile global economic environment, with slower growth and rising risks, it becomes even more essential to explore how public investment can act as a lever to strengthen long-term economic prospects. This article delves into the near-term outlook for the global economy, the role of public investment, its macroeconomic impacts, and the policy priorities for emerging markets and developing economies.

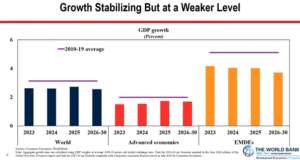

After years of volatility—from the pandemic to geopolitical conflicts—the global economy is stabilising, albeit at a subdued pace. In 2024, global growth is projected at 2.6%, with a slight improvement expected next year, aided by policy easing in both advanced economies and EMDEs. However, this growth remains lacklustre compared with the pre-pandemic decade’s average, reflecting lingering structural weaknesses and global uncertainties.

READ I Energy efficiency: The often overlooked key to climate action success

Global Economy and public investments

The global economic outlook is marked by considerable downside risks. Escalating geopolitical tensions, particularly in the Middle East, pose threats to energy supply chains and inflation stability. Rising protectionism and trade fragmentation could hinder global trade, disproportionately impacting export-dependent EMDEs. Furthermore, high interest rates, the persistence of core inflation, and the mounting effects of climate change amplify these challenges.

On the upside, faster-than-expected inflation moderation could accelerate monetary policy easing, while stronger-than-anticipated growth in the U.S. or China could boost global prospects. However, these possibilities remain speculative, underscoring the need for proactive investment policies to mitigate risks.

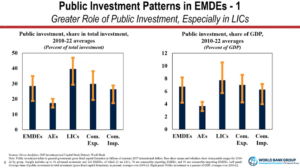

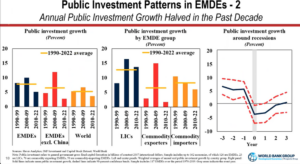

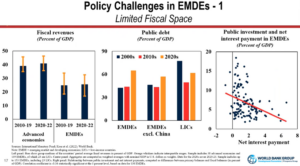

The infrastructure needs of EMDEs are immense, particularly in low-income countries, where annual investments of up to 8% of GDP are required to ensure a resilient, low-carbon pathway. Despite this, public investment has experienced a sharp decline over the past decade. For instance, average public investment growth in EMDEs fell from 10% in the 2000s to just 5% in the 2010s, marking the slowest pace in three decades.

Public investments play a disproportionately significant role in EMDEs compared to advanced economies. On average, it accounts for 7% of GDP in EMDEs, nearly double the level in advanced economies. This is largely because private sector activity is weaker in these regions, and large infrastructure projects, which require significant upfront costs, are often less attractive to private investors. The decline in public investment, therefore, poses a significant challenge to meeting infrastructure demands, particularly in sectors critical to long-term growth, such as transportation, energy, and digital connectivity.

Macroeconomic impact of public investments

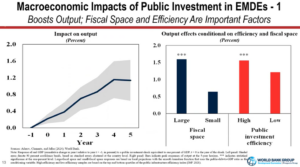

Public investment significantly impacts economic growth and private sector activity. Empirical studies indicate that a 1% of GDP increase in public investment results in an average output increase of 1.1% over five years. These effects are more pronounced in countries with ample fiscal space and efficient public investment mechanisms, where output can rise by up to 1.6%.

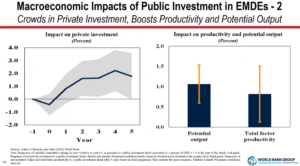

Additionally, public investment crowds in private investment. While short-term effects may show slight crowding out, the medium-term impact includes a 2% increase in private investment over five years. This is largely driven by the provision of critical infrastructure, which reduces uncertainty and enables private sector growth. Public investment also enhances long-term potential output by improving productivity. For every 1% of GDP spent on public investment, potential output increases by about 1% over five years. These findings highlight the dual benefits of public investment: immediate demand-side effects and sustained supply-side gains.

The effectiveness of public investment is particularly pronounced during recessions. Economic downturns amplify its multiplier effects, making public investment a vital counter-cyclical tool. However, inefficiencies, corruption, and fiscal constraints often limit its potential. Poorly planned projects, commonly referred to as “white elephants,” can burden economies with low returns while consuming scarce fiscal resources.

Challenges to public investment in emerging markets

Despite its importance, the implementation of effective public investment in EMDEs faces significant hurdles. Fiscal constraints are a major challenge, as many EMDEs struggle with limited tax revenues and high debt levels. Weak institutional capacity and governance exacerbate these issues, leading to inefficiencies and delays in project execution. The combination of these factors often results in suboptimal outcomes, with public investment failing to deliver its intended benefits.

High debt levels and rising borrowing costs further constrain fiscal space, forcing governments to cut or postpone essential public investment projects. This is particularly problematic given that public investment is most effective during economic downturns, when governments are often fiscally constrained. Addressing these challenges requires comprehensive reforms and greater support from international institutions.

Policy priorities for maximising impact

To fully harness the potential of public investment, EMDEs must focus on three critical policy areas. First, expanding fiscal space is essential. This requires improving tax collection efficiency, reducing unproductive expenditures such as subsidies, and adopting robust fiscal frameworks, including effective debt management strategies. Strengthening fiscal governance will allow governments to allocate more resources to critical investments.

Second, enhancing the efficiency of public investment is crucial. This involves tackling corruption, improving governance, and strengthening project management capacities. Effective public investment requires careful project design, cost-benefit analysis, and robust monitoring mechanisms. International organisations such as the World Bank and IMF provide valuable frameworks and best practices to help EMDEs optimise their public investment processes.

Finally, EMDEs need greater global support. Low-income countries, in particular, require substantial financial and technical assistance to address infrastructure gaps and implement necessary reforms. International financial institutions and advanced economies must step up to provide the resources needed for sustainable development. Coordinated technical assistance is equally important to ensure that financial support is used effectively and efficiently.

Public investment remains a cornerstone of economic policy, particularly for EMDEs striving to address infrastructure gaps and achieve sustainable development. By expanding fiscal space, improving investment efficiency, and leveraging global support, these economies can maximise the benefits of public investment. As the global economy navigates uncertainties, prioritising intelligent public investments will be key to building resilience, fostering growth, and paving the way for a more sustainable and inclusive future.

(This article is based on a presentation made by M Ayhan Kose, Deputy Chief Economist of the World Bank Group at an online discussion organised by EGROW Foundation, a Noida-based think tank.)