By Anandadeep Mandal and Neelam Rani

The COVID-19 outbreak unsettled the Chinese economy and its spillover effect is evident across the world. The coronavirus has infected 20.1 million people and killed 737 thousand as this article is being published. In less than eight months, the deadly virus has an almost 15% hospitalisation rate (globally) that has overwhelmed healthcare systems in most nations in the world.

The current global financial meltdown is due to the unprecedented health emergency unleashed by the Covid-19 pandemic. To contain the transmission of COVID-19, a large number of governments enforced social distancing norms. Strict lockdown measures were enforced in Europe, the UK, parts of the US and India. This led to a rapid decline in demand and a fear of recession. The governments are addressing the economic emergency using bailout packages and other fiscal/ monetary measures. To understand the possible economic impact of the outbreak, we outline seven scenarios on how COVID-19 might evolve in the coming months and its impact on the macroeconomic systems and financial markets.

READ I All Inclusive Economic Development: The GDP alternative offers a better yardstick

The scenarios illustrated below show that even a contained outbreak is bound to have a significant impact on India and the global economy in the short run. The demonstrated scenarios show that the scale of cessations might be avoided with greater investment in the healthcare system. This holds good for countries where the population density is high, but the healthcare system is less developed, like in most developing economies like India.

To explore the impact of epidemiological scenarios in an economy, we transform COVID-19 related impact to economic shocks. These shocks relate to:

- Labour supply: reduction in labour supply (mortality and morbidity)

- Cost of production: disruption in supply chain networks and rising cost of doing business

- Consumption demand: decline in consumption due to changes in consumption behaviour, income and product prices

- Equity risk premium: rise in equity risk premium based on exposure to COVID-19

- Government expenditure: rise in government expenditure based on exposure to the disease as well as vulnerabilities to changing macroeconomic conditions.

READ I Cold storage infrastructure key to farm sector growth

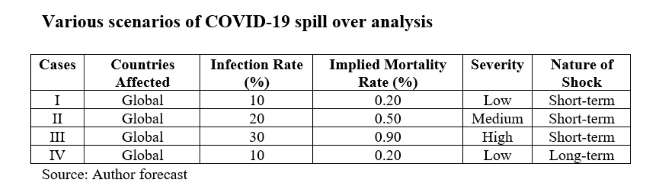

We examine the above epidemiological scenarios for four cases based on infection rate and mortality rate, as summarised in the table below. Cases I-III are pandemic scenarios where the spillover from China to the rest of the countries is through trade, capital flows and impact of changes in risk premia. In Case IV, we consider that COVID-19 will be a recurring event every year with less severity for indefinite future with the emergence of viral drug or vaccine.

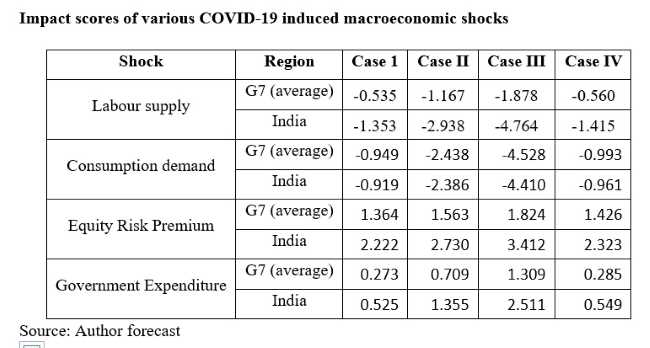

For analysing the impact on labour supply, we consider three components: infection-led mortality, ii) infection-led morbidity and iii) caregiving-led morbidity that affects it. Further, COVID-19 has influenced the consumption behaviour and spending pattern through various channels, including relative price changes, changes in income, and future uncertainty of disposable income. Thus, in examining the consumer demand behaviour, we use the sector exposure index, i.e. the share of the exposed sector within the GDP of every nation. For examining the equity risk premium shock, we consider an aggregate of country risk index and the mortality component of the labour shock.

READ I Indian Railways: Confusion must go before privatisation

In investigating the government interventions, we use the change in Chinese healthcare expenditure during 2003 SARS outbreak as benchmark and take the aggregate of Index of Governance and Index of Health Policy in estimating the potential increase in the countries’ health-budget. The scores of India and the aggregate of the G7 countries are provided below.

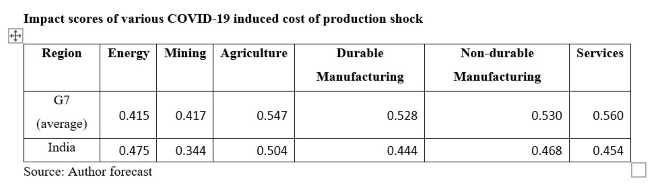

COVID-19 disrupted the supply chain inputs such as trade and transportation (land, sea and air). We, therefore, consider these inputs and estimate their aggregate shocks during COVID 19 lockdown period. Table below reports the shocks to cost of production. The table illustrates that except for the energy sector, India’s shock to cost of production is below the average estimates of the G7 countries.

Overall, the COVID-19 pandemic has caused a sharp decline in labour supply and consumer demand, while cost of production, equity premium and government expenditure have significantly increased. Indian economy will suffer more on all these parameters except cost of production when compared with the G7 countries. The shape of recovery for India and other developing countries will depend on the structure of the economy and way the governments respond to contain the coronavirus outbreak.

(Dr Anandadeep Mandal is an assistant professor in finance at the University of Birmingham, UK. Dr Neelam Rani is an associate professor in finance at IIM Shillong.)

Dr Neelam Rani is an Associate Professor in the area of Finance at IIM Shillong.