The Pradhan Mantri Jan Dhan Yojana is a landmark scheme that redefined financial inclusion in India. While the scheme’s achievements are remarkable, they are accompanied by some worrying figures — more than one in five accounts under PMJDY had turned inoperative by December 2024. These 11crore inactive accounts reveal a critical gap in engagement despite the scheme’s success in ensuring universal access to banking facilities.

Since its launch on August 28, 2014, the Jan Dhan Yojana has spearheaded financial inclusion by providing banking access to the country’s underserved and marginalised communities. Over the past decade, more than 53 crore accounts have been opened, a 3.6-fold increase from March 2015 when only 15.67 crore accounts existed.

READ | E-commerce regulation: Govt’s new playbook for consumer protection

These accounts now hold deposits totalling Rs 2.31 trillion, reflecting a 15-fold rise since August 2015, with an average deposit of Rs 4,352 per account. The initiative has particularly impacted rural and semi-urban areas, which account for 66.6% of the total accounts, and women, who own 55.6% of the accounts. This focus has significantly narrowed the gender gap in financial services, reducing it from 20% in 2011 to 6% in 2017.

PMJDY has also driven the growth of digital transactions through the issuance of 36.1 croreRuPay debit cards, contributing to a surge in transaction volumes from 2,338 crore in FY19 to 16,443 crore in FY24. During the COVID-19 pandemic, Jan Dhan Yojana accounts became a lifeline for over 20 crore women, who received timely financial aid through direct benefit transfers. Beyond banking access, the scheme has enhanced formal credit to micro-industries, reduced crime rates in high-balance regions, and bolstered economic resilience.

Persistent challenges

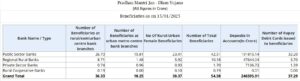

Despite the impressive milestones, the Jan Dhan Yojana is plagued by significant challenges. Inoperative accounts remain a pressing issue. According to RBI guidelines, accounts without customer-initiated transactions for two consecutive years are considered inoperative. Leading public sector banks like Bank of Baroda (2.9 crore inactive accounts), Punjab National Bank (2 crore), and State Bank of India (1.8 crore) are among the worst-affected. A considerable portion of these accounts holds unutilised funds; collectively, inoperative accounts contain Rs 14,750 crore.

The problem is aggravated by low awareness among beneficiaries about the benefits tied to their accounts, such as accident insurance of Rs 2 lakh and overdraft facilities up to Rs 10,000. Many beneficiaries withdraw funds immediately after direct transfers, rendering the accounts dormant. Furthermore, the initial rush to meet high account-opening targets led to multiple accounts being opened by the same individuals, some of which have become redundant or converted into regular savings accounts. Around 8.4% of PMJDY accounts currently hold zero balances, indicating limited engagement beyond DBTs.

State-level data reveals Uttar Pradesh as the state with the highest number of accounts (9.63 crore), out of which 2.34 crore are inactive. West Bengal, with 5.25 crore accounts, has 78.5 lakh inoperative accounts. These figures underscore regional disparities in account activity and the need for tailored interventions.

To address these challenges, the government has initiated a massive re-KYC exercise. Led by the Department of Financial Services, this initiative involves using biometric and facial recognition technologies to verify accounts. While the re-KYC process aims to reactivate dormant accounts, it imposes logistical burdens on banks, which have been directed to replicate the zeal displayed during PMJDY’s launch.

The way ahead for Jan Dhan Yojana

To sustain the momentum of financial inclusion and address the scheme’s challenges, immediate measures are necessary. Increasing awareness through nationwide campaigns tailored to rural and semi-urban populations can educate beneficiaries about the full range of benefits associated with PMJDY accounts. Promoting greater engagement by linking accounts to recurring deposit schemes, micro-insurance plans, and other financial instruments could encourage active usage.

Simplifying the re-KYC process is crucial to minimise inconvenience. Deploying user-friendly digital tools and additional staff can expedite verification. Enhanced digital literacy programs are equally important to enable beneficiaries to leverage RuPay cards effectively and participate in the digital economy.

Regular audits and data-driven monitoring of account activity will help identify systemic issues and guide corrective measures. Partnerships with fintech companies could also introduce innovative financial products tailored to PMJDY account holders, fostering deeper inclusion.

The Pradhan Mantri Jan Dhan Yojana has made strides in democratising financial access and empowering crores of Indians. Yet, its success is tempered by persistent challenges, including the high proportion of inoperative accounts and limited beneficiary awareness. By addressing these gaps with renewed focus and innovative solutions, PMJDY can transition from being a vehicle for financial access to a comprehensive enabler of financial empowerment, ensuring that its transformative potential benefits every Indian citizen.