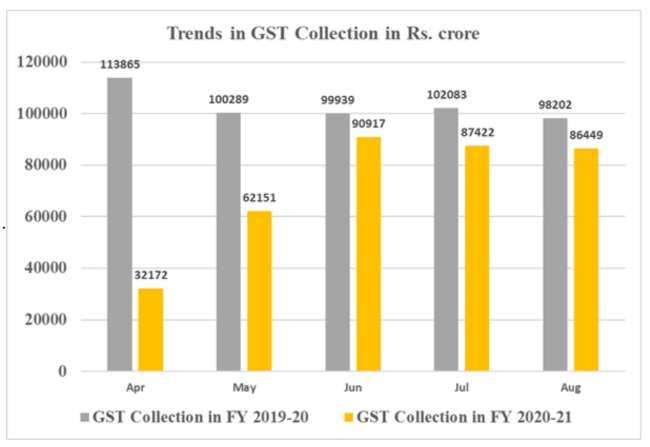

Goods and Services tax collections for August stood at Rs 86,449 crore, slightly below the previous months figure of Rs 87,422 crore. Of the gross GST mop-up, Rs 15,906 crore came from central GST, Rs 21,064 crore from state GST, and Rs 42,264 crore from integrated GST. The IGST figure includes Rs 19,179 crore collected from imports and Rs 7,215 crore from cess. The GST collection in August revenues was 88% of the mop-up in August 2019. The revenue collection from import of goods in August was 77% and the revenues from domestic transactions were 92%.

READ I Carbon emissions and economic growth: Learnings for the Indian economy

The 41st GST Council meeting on Thursday has been a stormy affair with several states opposing the two options given to them to bridge the revenue shortfall. The payments are pending from April and the estimated compensation shortfall for the year could be in the vicinity of Rs 2.35 lakh crore. The first option offers a window to states to borrow the Rs 97,000 crore compensation that covers the shortfall on account of GST implementation. This amount doesn’t cover the shortfall due to Covid-19 pandemic. The second option will allow states to borrow the entire Rs 2.35 lakh crore and bearing the interest burden though principal will be repaid from the cess proceeds. The GST shortfall will not be counted as states’ debt, while the rest Rs 1.38 lakh crore will be part of the states’ debt.

States have surrendered their taxation rights, except on petroleum, alcohol, and stamp duty. GST comprise more than 40% of states’ revenues, while tax revenues comprise around 60% of states’ gross revenues. The economies of at least a dozen states are under strain due to non-payment of GST dues. This has forced them to cut capital expenditure and to delay salary payments.