Finance minister Nirmala Sitharaman on Friday tabled the Economic Survey 2024-25, projecting India’s GDP growth between 6.3% and 6.8% in the next fiscal year. Despite concerns over slowing private consumption and geopolitical uncertainties, the Survey—authored by Chief Economic Advisor V Anantha Nageswaran and his team—says that India’s economic fundamentals remain strong, backed by a robust external account and calibrated fiscal consolidation.

However, India’s GDP growth is expected to slow to 6.4% in FY25, the lowest in four years, mainly due to weak manufacturing and investment trends. This is lower than last year’s projected growth of 6.5-7% and the Reserve Bank of India’s (RBI) estimate of 6.6%. The first half of the fiscal year saw growth driven by agriculture and services, supported by record Kharif production and strong rural demand.

READ | A junk food presidency: How Trump and the media feed each other

Inflation trends and challenges

Retail inflation has moderated from 5.4% in FY24 to 4.9% in April-December FY25, according to the Economic Survey. The RBI and the International Monetary Fund project that inflation will gradually align with the 4% target by FY26. A normal southwest monsoon in 2024 has improved reservoir levels, ensuring adequate irrigation for Rabi crop production.

However, inflationary pressures persist due to supply chain disruptions, particularly in essential food commodities like tomato, onion, and potato. When these items are excluded, average food inflation for April-December FY25 drops to 6.5%, nearly 1.9 percentage points lower than overall food inflation. The Survey highlights the importance of mitigating supply-side shocks through better agricultural productivity, climate-resilient crops, and efficient logistics.

Investment trends — FPI outflows, FDI recovery

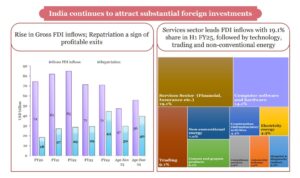

While foreign portfolio investment flows have been volatile, India’s macroeconomic fundamentals are expected to attract long-term capital inflows. Global uncertainties and profit-taking by investors led to significant FPI outflows in 2024. However, robust domestic growth prospects and a favourable business environment should stabilise FPI trends in the coming months.

Meanwhile, Foreign Direct Investment (FDI) inflows are showing signs of revival. Though net FDI declined in the April-November 2024 period due to an increase in disinvestment, gross FDI inflows have picked up in recent months, signalling renewed investor confidence in India’s growth story.

Exports and trade strategy

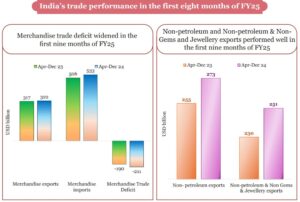

India’s total exports (merchandise and services) reached $602.6 billion in the first nine months of FY25, registering steady growth. Excluding petroleum and gems & jewellery, goods and services exports grew by 10.4%. However, imports rose 6.9% to $682.2 billion, driven by strong domestic demand.

The Economic Survey warns that global trade is becoming increasingly protectionist, necessitating a new trade strategy for India. To sustain its export momentum, India must focus on diversifying markets, increasing domestic manufacturing capacity, and enhancing trade competitiveness.

China’s dominance in Indian imports

The Economic Survey highlights China’s overwhelming presence in India’s import basket as a key vulnerability. Indian industries, particularly solar equipment and electronics, heavily depend on Chinese supply chains. The Survey recommends strategic efforts to boost domestic production capabilities and diversify import sources to reduce reliance on a single country.

The government must actively attract, promote, and facilitate both domestic and foreign investments to enhance India’s manufacturing competitiveness. A lack of indigenous production for critical goods exposes India to supply chain shocks, price volatility, and currency fluctuations.

India’s banking sector remains strong, with non-performing assets (NPAs) at a 12-year low of 2.6%, according to RBI’s Financial Stability Report, December 2024. The credit-GDP gap—which measures the difference between credit growth and GDP growth—has narrowed significantly, indicating sustainable credit expansion. This is a positive sign for financial stability and economic growth.

Need for quality job creation

The job market is showing resilience, with India’s unemployment rate for those aged 15 and above declining from 6% in 2017-18 to 3.2% in 2023-24. This improvement is largely due to a strong post-pandemic recovery and increased formal employment opportunities.

However, India must create 7.85 million non-farm jobs annually until 2030 to accommodate its growing workforce. The Survey stresses the need for high-quality job creation, especially for women. The share of women in salaried employment has declined, with many shifting to self-employment or informal work. In rural areas, the proportion of women in regular wage jobs fell from 10.5% in 2017-18 to 7.8% in 2023-24. A similar trend is visible in urban areas, where women’s salaried employment declined from 52.1% to 49.4%.

To ensure inclusive growth, businesses must prioritise workplace safety, fair wages, and job security. The Survey underscores that improving working conditions and employee well-being is crucial for sustainable economic development.

Agriculture: A Strong Pillar of Growth

The agricultural sector remains a key driver of India’s economy, growing 3.5% in Q2 FY25. The government continues to support this sector through programs like the Sub-Mission on Agricultural Extension (SMAE), which promotes knowledge dissemination and sustainable farming practices.

However, climate change and water scarcity pose serious risks. The Survey calls for climate-resilient agriculture, expanded micro-irrigation, and digital solutions to enhance productivity. Additionally, Farmer Producer Organisations are playing a significant role in empowering small and marginal farmers.

While India’s economic trajectory remains strong, structural challenges persist. The Economic Survey 2024-25 highlights the need for sustained policy measures in areas such as investment promotion, employment generation, trade competitiveness, and inflation control. Addressing these challenges proactively will be key to ensuring India’s long-term economic resilience and global competitiveness.