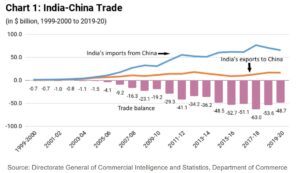

India’s trade relationship with China has increasingly become asymmetrical, with rising imports from China and declining exports. India’s dependence on Chinese imports is particularly strong, raising concerns about its economic stability and industrial self-reliance. The significant trade gap with China highlights the need for India to reassess its trade strategy and industrial policies to foster a more balanced relationship.

India’s dependence on upstream imports from China, particularly in goods used for further exports, has increased sharply in recent years. Sectors such as electronics, chemicals, and machinery have seen significant reliance on Chinese imports. Between 2017 and 2023, India’s imports from China grew at an annual average of 6%, with chemicals and pharmaceuticals increasing by 10% annually.

READ | Fiscal paralysis: Welfare funds lie idle while millions struggle

The most striking surge was in microprocessors, memory chips, and semiconductor manufacturing equipment, where imports rose tenfold from $500 million in 2017 to $5 billion in 2023. The reason behind this trend is India’s restrictive approach to Chinese foreign direct investment following the Galwan border conflict in 2020. This policy prevented Chinese companies from establishing manufacturing units in India, leading to increased reliance on imports rather than local production.

Declining exports to China

Despite the increasing import reliance, India’s exports to China have declined by an average of 2% per year since 2017. In FY24, India exported $16.65 billion worth of goods to China while importing goods worth $101.74 billion. Major Indian exports to China include iron ore ($3.63 billion), engineering goods ($2.65 billion), and marine products ($1.37 billion). In contrast, India’s top imports from China include electrical machinery and equipment ($31.35 billion), nuclear reactors and parts ($22.47 billion), and organic chemicals ($11.49 billion). This trade imbalance reveals India’s structural dependency on Chinese supply chains, particularly in high-tech and industrial sectors, limiting its ability to develop a self-sufficient industrial base.

India’s merchandise trade deficit stood at $22.99 billion in January 2025, with imports outpacing exports. A significant portion of this deficit is due to rising imports from China. Over-reliance on Chinese imports also exposes India to risks such as supply chain disruptions due to geopolitical tensions, trade restrictions, or pandemic-related shutdowns. Additionally, India’s tariff reductions aimed at trade rationalisation raise the risk of Chinese goods flooding the market, which could harm domestic manufacturers. These structural imbalances make India vulnerable to economic shocks and restrict the growth of indigenous industries.

To address this challenge, the government must prioritise boosting domestic manufacturing by strengthening initiatives such as the Production Linked Incentive (PLI) scheme. Expanding domestic production in key sectors like electronics, semiconductors, and pharmaceuticals is crucial for reducing import dependence. Diversification of import sources is another essential strategy, with India looking to explore trade partnerships with countries such as Vietnam, South Korea, and Taiwan to reduce over-reliance on China. Encouraging foreign direct investment and joint ventures from non-Chinese sources can help India develop its own supply chains and enhance industrial capabilities.

Reducing dependence on Chinese imports

While India is rationalising tariff rates for industrial goods, it must also strengthen anti-dumping measures to prevent unfair competition from Chinese imports. Strategic use of tariffs and trade remedies can help create a level playing field for domestic manufacturers. At the same time, India must enhance its research and development investments, particularly in high-tech industries, to build domestic capabilities and reduce reliance on imported components. Strengthening trade ties with ASEAN and Western economies will also help India integrate with global supply chains, increasing export opportunities and reducing trade imbalances.

Another critical step is reviving export competitiveness. Addressing non-tariff barriers in major markets and investing in export-oriented industries can help counterbalance the import-heavy trade relationship with China. Policymakers must also focus on improving ease of doing business, ensuring better infrastructure, and reducing bureaucratic red tape to support local industries. Enhancing domestic innovation, fostering entrepreneurship, and incentivising firms to invest in high-tech manufacturing will be key to ensuring long-term economic resilience.

India’s dependence on Chinese imports presents a significant challenge to its economic resilience and strategic autonomy. While geopolitical factors and policy decisions have contributed to this reliance, the government has opportunities to reduce it through domestic manufacturing, diversification of trade partners, and strategic policy interventions. Strengthening India’s industrial base, fostering innovation, and enhancing trade competitiveness will be crucial in addressing this issue and ensuring a balanced and sustainable trade relationship with China.