Mergers and acquisitions play a crucial role in driving economic growth, fostering innovation, and enabling businesses to scale efficiently. India’s merger and acquisition regulatory framework remains a complex labyrinth, posing challenges for companies seeking consolidation. While recent amendments have streamlined certain aspects, procedural bottlenecks, regulatory delays, and burdensome compliance requirements continue to hamper efficiency. A simplification of these procedures is imperative to enhance ease of doing business and to attract both domestic and foreign investments.

Recognising these challenges, the government has initiated efforts to simplify procedural requirements and to expand the scope of fast-track mergers. The ministry of corporate affairs is currently engaging in stakeholder discussions with various ministries to finalise proposals aimed at reducing regulatory hurdles. Finance minister Nirmala Sitharaman, in her Budget speech, had emphasised the need for rationalising approval processes and widening the scope of fast-track mergers for both listed and unlisted companies. Some of these changes can be implemented through regulatory rules, while others may require amendments to existing laws. The fast-track merger mechanism, which currently exempts small companies, start-ups, and wholly owned subsidiaries from National Company Law Tribunal intervention, is expected to be expanded, offering relief to a broader range of companies struggling with procedural delays.

READ I India’s GDP growth puzzle: Recovery on track, but challenges remain

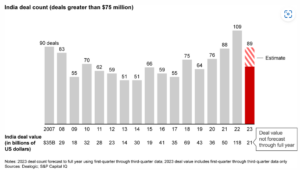

India’s applications market witnessed a significant resurgence in 2024, bouncing back from the previous year’s slowdown. As of November 2024, deal values had surged to $36.14 billion, reflecting a 43.2% increase from 2023, with deal volumes rising by 24.4%. Domestic transactions have led this revival, bolstered by increased foreign direct investment, which reached $88 billion—up 10% from the previous year. Notable deals include the $8.5 billion merger of RIL’s Viacom18 and Star India, cementing India’s largest media conglomerate.

The manufacturing sector dominated deal-making, followed by pharmaceuticals and financial services, driven by consolidation, digital transformation, and regulatory shifts. Additionally, geopolitical shifts have influenced India’s attractiveness as a strategic M&A hub, with many companies pursuing a “China-plus-one” approach to diversify supply chains. While high valuations have led to longer deal closures, India remains a compelling investment destination due to its robust growth prospects, improving regulatory framework, and expanding capital markets.

Current merger and acquisition regime

India’s merger and acquisition regulatory framework is primarily governed by multiple laws, each addressing different facets of mergers and acquisitions.

- The Companies Act, 2013 governs procedural aspects of mergers, demergers, and arrangements under Sections 230-240. It mandates approvals from shareholders, regulators, and in many cases, the National Company Law Tribunal (NCLT).

- The Competition Act, 2002 ensures M&As do not lead to anti-competitive behaviour by requiring pre-merger notifications and approvals from the Competition Commission of India (CCI).

- The Foreign Exchange Management Act, 1999 (FEMA)regulates cross-border M&As, ensuring compliance with foreign investment norms.

- The Securities and Exchange Board of India (SEBI) Act, 1992 monitors M&As in publicly listed companies to protect investor interests.

- The Insolvency and Bankruptcy Code (IBC), 2016 governs distressed asset acquisitions as part of corporate insolvency resolution processes.

Despite these legal safeguards, the procedural aspects of M&As remain cumbersome, resulting in prolonged approval timelines and uncertainty.

Challenges in the M&A regulatory process

One of the most pressing challenges is the heavy reliance on NCLT for approvals. As of November 30, 2024, MCA data shows 309 merger and acquisition applications were pending before the NCLT, causing significant delays. The backlog is aggravated by the NCLT’s additional responsibilities under the Insolvency and Bankruptcy Code, further stretching its capacity.

Fast-track mergers, which bypass the NCLT process, are currently restricted to small companies, startups, and mergers between holding companies and wholly owned subsidiaries. However, listed companies cannot utilise this mechanism, even for internal restructurings, leading to unnecessary regulatory hurdles.

Recent amendments to the Competition Act, 2023 introduced deal-value thresholds, requiring merger and acquisition transactions above Rs 2,000 crore ($240 million) to be notified to CCI if the target company has substantial business operations in India. While this enhances regulatory oversight, it adds an additional compliance burden, particularly for mid-sized transactions that may not significantly impact market competition. Furthermore, the definition of ‘control’ has been broadened to include ‘material influence,’ creating uncertainty regarding which deals fall under CCI’s jurisdiction.

The involvement of multiple regulatory agencies, including SEBI, RBI, CCI, and MCA, leads to overlapping mandates and increased compliance costs. The filing fees have also risen significantly—Form I fees increased from Rs 20 lakh to Rs 30 lakh, and Form II fees from Rs 65 lakh to Rs 90 lakh—raising the cost burden for companies.

Reforms needed to simplify the M&A process

Expanding the scope of fast-track mergers: The government should broaden the eligibility for fast-track mergers to include listed companies undergoing intra-group mergers and reorganisations. This would significantly reduce procedural hurdles and expedite approvals for transactions that do not impact competition.

Reducing NCLT dependence: To ease the burden on NCLT, procedural approvals for non-contentious mergers should be handled by the Ministry of Corporate Affairs (MCA) or regional registrars of companies (RoC). This would free up NCLT to focus on complex disputes and insolvency cases.

Refining CCI’s deal value thresholds: The Competition Commission of India should clarify the criteria for ‘material influence’ and set objective parameters to determine whether an M&A transaction falls under its jurisdiction. Moreover, a tiered approach to deal-value thresholds can help ensure that smaller deals with minimal competition concerns are not unnecessarily scrutinised.

Harmonising multi-agency approvals: SEBI, RBI, CCI, and MCA should collaborate to establish a unified approval mechanism for M&As. A single-window clearance system could streamline approvals, reduce redundancy, and improve efficiency.

Digitalising the approval process: A digitised platform integrating all regulatory approvals for M&As should be introduced, allowing companies to track the status of their applications in real time. This would improve transparency and cut down procedural inefficiencies.

India’s recent amendments to the merger and acquisition regulatory framework mark a positive step towards enhancing the ease of doing business. However, procedural bottlenecks remain a significant hurdle. A simplified legal framework that expands fast-track mergers, reduces NCLT dependency, and harmonises regulatory approvals will create a more efficient M&A ecosystem.

By adopting reforms, India can accelerate corporate consolidation, encourage strategic investments, and reinforce its position as a global M&A hub. The government’s ongoing discussions on easing procedural requirements should prioritise these measures to ensure that the regulatory framework facilitates economic expansion through mergers and acquisitions.