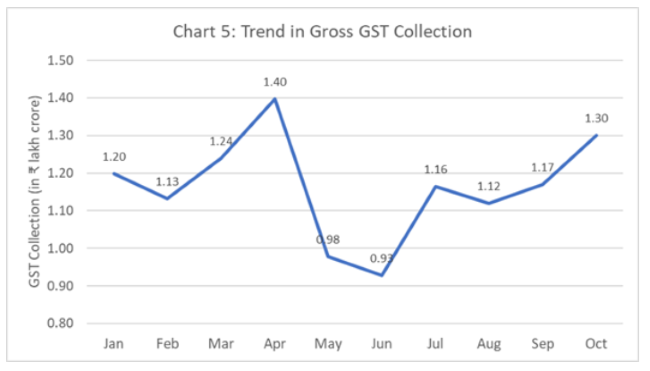

Indian economy on recovery path: Revenues from goods and services tax topped Rs 1,30,000 crore in October, recording a 24% growth over the same month last year. This is the second highest GST collection since the introduction of the indirect tax. Busy year-end activity had pushed revenue mop-up to a record Rs 1,40,000 crore in April this year. The robust GST collections clearly point to a recovery from the economic slowdown induced by the Covid-19 pandemic. The finance ministry expects revenue growth to continue through the second half of the financial year 2021-22.

Does the fourth consecutive month of GST collections in excess if Rs 1,00,000 crore mean that the worst is over for the Indian economy? One cannot be sure as India was already in the grip of a slowdown when the pandemic struck in 2020. The economy is expected to expand at a respectable 9.5% in the current financial year (2021-22) from a low base. The economic growth projections assume that the formal and informal sectors grow at a similar pace as there is a lack of reliable data for the latter. But in reality, the pandemic has dealt a deadly blow to many informal sectors and they are nowhere near a recovery to pre-Covid levels.

READ I The global minimum tax: A great beginning despite inbuilt biases

Indian economy on recovery path

There is a huge uncertainty about the possible growth trajectory for the Indian economy in the financial year 2022-23. Economists and policy makers are not sure whether the Indian economy will be able to break the low-growth cycle that preceded the pandemic when the economy was growing below 5%. India needs to grow at high single-digits rates to generate enough jobs to support a recovery in consumer demand.

The International Monetary Fund has projected Indian economy to grow at 6% in the medium term. The multilateral lending institution has forecast a deceleration in growth to 6.6% in 2022-23, 6.3% in 2023-24, and to 6.1% by 2026-27. This won’t be good enough for the Indian economy which saw a huge contraction during the pandemic crisis.

The biggest concern about the recovery is its uneven nature. While services and manufacturing have recovered to the pre-pandemic levels, sectors such as travel, tourism and hospitality are still struggling. The MSME sector that employs more than 12 crore people is in total disarray. Huge job losses in the MSME sector need to be reversed for a real growth in demand. The government had taken some temporary measures during the pandemic crisis, but more needs to be done for a pickup in demand well into the next financial year.

READ I Common household database panacea for human development woes

Consumption, investment key concerns

There is a slowdown in rural demand as rural employment in September was way below the pre-demonetisation levels. Mahatma Gandhi National Rural Employment Guarantee Act scheme, the Union government’s flagship employment scheme for rural areas, has already exhausted the budgetary allocation for the financial year. MGNREGA, which will be a huge factor in the recovery of India’s rural economy, is currently running on a deficit of Rs 8,686 crore. The states have run out of funds in the face of increased demand. The Union government should provide more funds, despite the possibility of higher fiscal deficits.

The brightest spot amid economic gloom is a smart pickup in exports. The country’s exports grew 64.4% in rupee terms in the first five months of the financial year. This may just be the result of a fast economic recovery in India’s export markets. Increase in fuel prices could trigger a spike in transportation cost, leading to a weakening of exports growth. A cut in taxes on petroleum fuels can help sustain the recent spurt in exports.

Recovery in investment will be the single most important factor in India’s economic recovery. A recovery in private investment will happen after the economy gets back to normal, triggering a revival in capacity utilisation. There is a need to increase government spending, especially in infrastructure sector. The IMF doesn’t expect investment to recover in the medium term to the peak of 39.7% achieved in 2011-12. It says investment will grow in the coming years to 31.3% by 2026-27, from 29.7% in the current year.

The government needs to increase public spending to sustain economic growth well into the next financial year. Extraordinary situations call for extraordinary measures. The government should ignore the threat of fiscal imbalance and pump up public investments to generate jobs and fuel growth.

Anil Nair is Founder and Editor, Policy Circle.