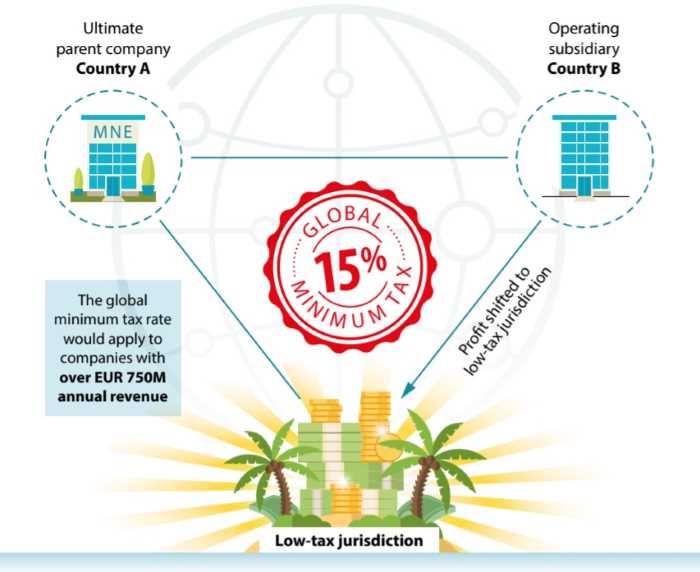

Revenue impact of global minimum tax: The G20 finance ministers recently endorsed the OECD framework on base erosion and profit shifting that aims at reallocating profits of multinational companies to market jurisdictions and taxing them with a global minimum tax rate of 15%. This historic agreement will hopefully reduce the tax rate mismatch between nations and provide adequate taxing rights to market jurisdictions. As of date, 137 OECD member countries have endorsed the two-pillar solution to address the tax challenges arising from the digitalisation of the global economy.

Pillar one deals with the reallocation of profits of multinational companies to the market jurisdictions where the users are located. This would help countries like India that have a large consumer base. The reallocation of profits to a country where consumers reside would not require the multinational companies to have a permanent establishment in that country.

READ I Global minimum tax explained: Abuse of tax havens to end, big tech to come under tax net

Thus, taxing rights will be given to countries like India where the users are based, even though a foreign company does not have a physical presence by way of employees or office premises there. This change could significantly impact large tech companies that do not require a physical base to earn profits from consumers located in another country.

Pillars of global minimum tax

Pillar one kicks in only if a minimum turnover threshold is breached. It provides that only entities with a turnover of above 20 billion euros would fall within its ambit. Further, the pillar one provides that it will require the participating countries to do away with unilateral measures to tax digital services and commit to not introducing such measures in future. Currently, India levies an equalisation levy on certain digital services provided by foreign companies. The threshold for the levy to kick in is fairly low and thus covers a large number of overseas digital service providers.

Given that the threshold stands at 20 billion euros and is aimed at the big fish, India would need to let go of some tax revenue it would otherwise have earned by way of the equalisation levy on smaller foreign companies. Further, India had also introduced a provision in its domestic tax law whereby a foreign company would be considered to have a business connection in India if it has a significant economic presence (SEP), even without actual physical presence. In May 2021, India notified the SEP provision with a threshold of 240,000 euros worth sales or 300,000 Indian users. India will be required to withdraw this provision.

READ I The global minimum tax: A great beginning despite inbuilt biases

The second pillar relates to a global minimum tax of 15% and applies to large multinational companies that have a turnover of 750 million euros or more. The pillar two solution would hopefully deter multinationals from stashing profits in low tax jurisdictions where they pay little or no taxes. Adoption of global minimum corporate tax would slow down the race to the bottom among countries when it comes to lowering their domestic corporate tax rates.

Uncertainty over revenue impact

Though the tax rates in India have traditionally been on the higher side, the country recently reduced its corporate tax rates for manufacturing companies to 15%. However, India taxes the non-manufacturing sector in the range of 25-30% which is significantly higher than the global minimum tax rate and thus may need to reduce tax rates on this front to attract further foreign investment.

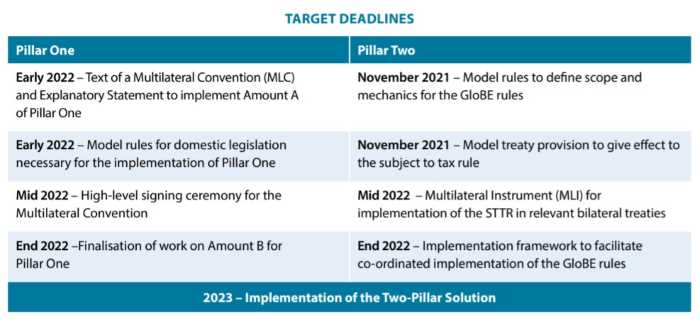

OECD member countries are planning to sign the multilateral agreement in this regard in 2022 and implement the new international taxation system in 2023. Before the rollout of the global minimum tax in 2023, countries will negotiate around the rules of allocation of revenue, industry specific deductions, exemptions to companies set up in special economic zones and the elimination of double taxation.

While the G20 tax reform is certainly a step in the right direction, only time will tell as to which countries benefit the most from it. While the reform is likely to help India tax big tech companies, India would end up losing some revenue as a large number of multinational tech companies would not be taxable under the new regime. The new law will help put an end to the unilateral tax measures being initiated by countries to tax digital income and create a simpler and more stable global tax environment. While these measures may by themselves not sound the death knell for low tax jurisdictions, the impact on them will be significant.

(By Abhay Sharma is Partner and Priyanka Jain Senior Associate in the tax practice at Shardul Amarchand Mangaldas & Co.)