Impact of demonetisation: Prime minister Narendra Modi’s announcement on November 6 2016, demonetising Rs 1000 and Rs 500 notes in circulation was unprecedented on several counts. The stated objective of the move was to end corruption, manage black money, and promote a cashless economy by pushing digital transactions. The note ban led to a crisis of sorts due to the unplanned nature of its implementation and resulted in a shortage of currency notes in the system. The crisis waned when the new bank notes became available and it led to the creation of a digital payments ecosystem in the country.

The most important objective of demonetisation, according to the pronouncements of officials, was to curb the growth of black money in the Indian economy. There is no clear indication on how successful the move was in curbing black money as data is not available. Ending the black economy will need major institutional and behavioural changes. However, the number of people filing income tax returns shot up from 7 crore to 11 crore in a matters of 3-4 years, showing a major shift to the formal economy.

READ I Cryptocurrency race: Cautious India may miss the bus

A demonetisation score card

The government expected to unearth black money worth Rs 3-4 lakh crore, but 99% of that amount came back to the RBI through banks. The people who were holding black money used different means like buying gold in bulk and using multiple accounts to deposit money to ensure that their money did not turn to waste overnight. In 2019, the government reported that Rs 1.3 lakh crore of black money was recovered through multiple means, but there is no clarity on the contribution of demonetisation.

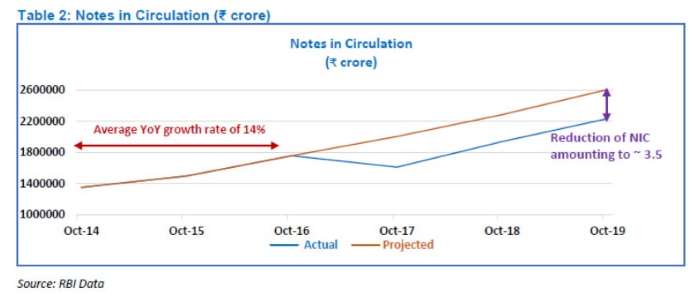

Battling counterfeit currency was another one of demonetisation’s stated objectives. In 2016, 6.32 lakh fake notes were seized across the country. In the next five years, fake currencies have been seized including in the new Rs 2000 and the Rs 500 notes, which were claimed to be immune to counterfeiting. Of the seized fake notes in 2020-21, 3.9% was detected at the Reserve Bank and the rest 96.1% by other banks. According to Reserve Bank data statistics, the banknotes in circulation increased 16.8% in value terms and 7.2% in volumes during FY 2020-21.

READ I Can Indian economy emulate the Chinese miracle?

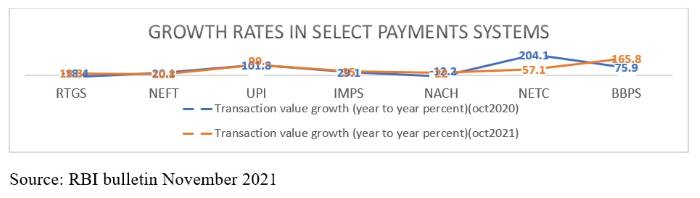

During 2020-21, the payment systems witnessed a growth of 26.2% in terms of volumes. However, The RTGS transactions value decline is attributable primarily to subdued economic activity. The digital transactions share in non-cash retail payments increased to 98.5% during 2020- 21, up from 97% in the previous year. The transaction values and volumes through all major payment systems demonstrated robust growth during 2021. (Fig-1)

The number of points of sale (PoS) terminals increased by 6.5% to 47.2 lakh and the number of Bharat Quick Response (BQR) codes deployed rose 76% to 35.7 lakh by end-March 2021. Similarly, the number of ATMs marginally increased by 2% from 2.34 lakh in end-March 2020 to 2.38 lakh in end-March 2021.The total number of credit and debit cards also rose during 2018-19 and 2019-20. However, the number of card payment transactions through credit cards and debit cards during 2020-21 declined by 19% and 20.6% respectively (Fig-2).

The government’s efforts to make the Indian economy cashless met with some success since the number of transactions through the unified payments interface (UPI) rose exponentially since demonetisation. The transactions in value terms touched over Rs 7.71 lakh crore from 421 crore transactions.

So, the economy derived some benefits from demonetisation by way of building a robust digital payments infrastructure, but its impact on the rural economy, unemployment, and GDP growth outweighs these gains. The opinion is sharply divided on the success of demonetisation, with the government claiming a resounding success and economists calling it a total disaster. Essentially, the only enduring success of demonetisation is the creation of a digitally enabled fourth industrial revolution.

(Dr Naliniprava Tripathy is Professor of Finance at IIM Shillong. Harsh Alipuria is a management consultant.)