There is some good news on the climate change front. The cost of production of green hydrogen, seen by energy experts as the energy source that will replace fossil fuels in the future, is likely to crash to around $1 per kg by 2030 because of a fall in electrolyser prices.

Hydrogen costs 2021: getting ready to scale, a study by Wood Mackenzie, says many countries will be able to produce green hydrogen below $2 per kg. According to the study, the prices of alkaline and PEM electrolysers may fall by 35% and 50% by 2025. The prices of solid oxide electrolysers are expected to see the sharpest fall in the next eight years because of economies of scale, new entrants to the market, greater automation and increased modularity, says the study.

READ I Climate change: Focus on CO2 may hurt mitigation efforts

Green hydrogen gains over fossil fuels

A sharp reduction in capital expenditure will result in a fall in the cost of green hydrogen to under $1/kg. For this, the renewable energy used in the process need to cost less than$10/MWh, possible in wind/solar hybrid projects. Grey hydrogen produced from methane cost $1.7 per kilogram in 2019.

The recent spike in natural gas prices could have made green hydrogen cheaper than grey hydrogen. The study says that green hydrogen will be competitive in 12 markets including Brazil and Chile. By 2050, 20 of the 24 countries studied by Wood Mackenzie will have competitive green hydrogen prices.

The increase in European natural gas prices has already made green hydrogen cheaper than grey hydrogen. The price of grey hydrogen in the UK is higher than green hydrogen in the last three months.

READ I COP26: Green hydrogen gets a leg up at climate change meet

The cost of production of grey hydrogen in the UK has increased from $1.9 per kg in April to $8 per kg in October, while the cost of green hydrogen remained unchanged at $4.5 per kg, according to ICIS. The prices of renewable energy are more stable because they are bound by long-term power purchase agreements.

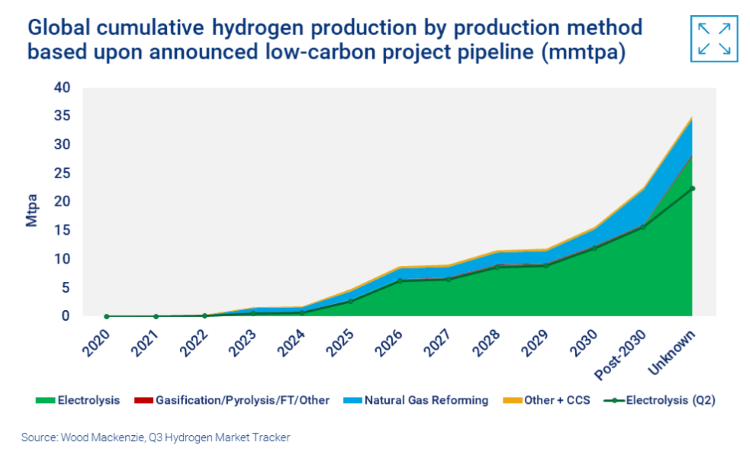

The prices of grey and blue hydrogen, however, would fall with drops in the cost of coal and natural gas. Sharp fluctuations in price involve business risks for fuel importing nations. This makes green hydrogen ideal for countries that are not endowed with fossil fuel deposits. Currently, green hydrogen has a negligible share in the global energy market because of high prices. But the push towards net-zero and green power will see heavy investment in this alternative fuel because of its long-term potential to reduce the carbon footprint of the industry.

Global interest in green hydrogen is increasing, especially after the recently concluded COP26 climate change summit in Glasgow. Countries that have pledged net-zero look at green hydrogen as the fuel that will help achieve the goal. The interest in this fuel comes from the fact that you need only water, a big electrolyser and electricity to produce hydrogen. If renewable energy from wind, solar or hydro is used, then the hydrogen is green. The biggest problem here is that electrolysers are not plentily available now.

READ I Electric vehicles: Building charging station infrastructure a huge challenge

The estimated global capacity for electrolyser manufacturing was a meagre 200 MW in 2019 which jumped to 6.3 GW in mid-2021. As the year comes to a close, electrolyser manufacturers are setting up gigawatt-scale factories. Companies such as Sunfire, FFI, Ohmium, Clean Power Hydrogen and Green Hydrogen Systems have recently announced mega hydrogen projects recently.

Hydrogen can lower carbon emissions in sectors such as transportation, steel, cement and power. Its flexibility is one of the reason behind a surge in investments in this clean fuel. The biggest advantage is that renewable energy can be stored and transported as hydrogen from the places it is produced to the markets it is consumed.

In India, green hydrogen industry is gaining momentum. The country will produce 75% of its hydrogen output from renewable energy by 2050. Currently, the production of H2 in the country is done using fossil fuels. Prime Minister Narendra Modi launched a National Hydrogen Mission on August 15, 2021 to make India a green hydrogen hub. Leading the way are some of the largest private and public sector firms such as Reliance Industries, GAIL, NTPC, Indian Oil, Larsen and Toubro, and the Adani group.

Sajna Nair is a former banker. Her areas of interest are environment, art and culture.