Exuberance in stock market: The year 2021 was one of the best years for Indian markets with the BSE Sensex gaining more than 10,000 points. In absolute terms, it was clearly the best year for the benchmark index. The year also saw the best performance by the index in four years. The Sensex was the best performing Asian index in 2021 and the second-best performer globally.

The stellar performance of the Indian market came amid the rampaging Covid-19 pandemic that affected all sectors of the economy. There is hardly anything in India’s economic performance that may have inspired such a rally despite the Narendra Modi government taking several initiatives to keep the growth momentum going. A successful vaccination drive helped the country to put the economy back on track before the third wave of Covid-19 struck.

READ I Budget 2022 must keep focus on economic revival amid Omicron surge

Indian economy leads global bounceback

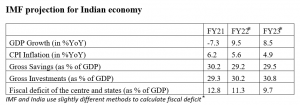

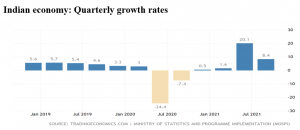

Though Indian economy has just managed to reach the pre-pandemic levels, it is leading the global bounceback from the Covid-induced economic crisis. Data published by the Organisation for Economic Co-operation and Development (OECD) shows that the Indian economy has expanded by 12.7% in the third quarter of 2021. OECD attributes this to fixed investment and private consumption. An IMF report also points to steady recovery of the Indian economy. (Table 1)

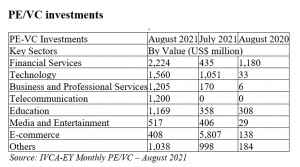

The Indian economy expanded by 8.4% in the July-September quarter of 2021, living up to the expectations of the market (Figure 1). The private equity and venture capital investment reached $47.3 billion till August 2021. (Table 2).

Although real GDP growth rates represent past economic activity, the numbers showcase the inherent resilience of the Indian economy in the face of a global pandemic. They augur well for the future of the stock market.

READ I Five issues that will shape US-India ties in 2022

Robust recovery despite MSME distress

The index of industrial production (IIP) rose by 1.4% on a year-on-year basis in November 2021. The manufacturing industry grew 0.9% in November 2021, the electricity generation by 2.1%, and the mining industry expanded 5%. Financial markets remained steady and capital inflows enhanced foreign exchange reserves.

To cushion the impact of lockdowns on businesses and households, the government announced some extraordinary monetary and fiscal stimulus measures to micro, small and medium enterprises. These incentives contributed to company earnings. There has been a significant recovery across all sectors of the economy in 2021.

The drop in company earnings is not as sharp as expected initially. Most companies reported positive earnings growth which reflect the ability of companies to innovate in response to new challenges. All these influence the decision making of stock market investors. This led to increases in the stock prices. Analysts expect companies to report better earnings in the coming years.

READ I Budget 2022: Focus on infrastructure, jobs, social security

Low interest rates, IPOs and stock market

Another reason for the exuberance in the market is low interest rates that make bonds and bank deposits less attractive. Low interest rates often push investors to the stock markets. Further, they result in an increase in home purchases. Lower rates allow companies to refinance their existing debt obligations at lower costs and borrow for new investments. This is also another factor behind the stock market rally.

Share issuance decisions can also affect stock performance. If a stock is doing well, a company might be inclined to issue more shares. Companies go public when they have confidence in their future prospects. The initial public offering (IPO) activity increased in the year 2021. Resource mobilisation through IPOs, follow-on public offers (FPOs), and rights issues increased by 43.1% to Rs 1.1 lakh crore during 2020-21.

Vaccination drive and investor confidence

The government launched the world’s largest vaccination programme which helped the economy turn the corner. Several sectors saw higher earnings which boosted investor confidence. This seems to be the most important reason behind the stock market rally, despite uncertainties about the future course of the economy.

The equity market had received a net FPI inflow of Rs 2.8 lakh crore in 2020-21. Another reason is the sharp rise in direct participation of retail investors through more than 1.43 crore new demat accounts in 2020-21. All these factors influenced stock values and led to a rise in stock indices.

If the momentum continues, markets could rise further in the future. It is estimated that the Sensex is forecast to rise by mid-2022, The market is likely to remain positive unless it faces an unprecedented shock that could break the positive momentum and lower the sentiment.

(Dr Naliniprava Tripathy is Professor (Finance) at IIM Shillong.)

Naliniprava Tripathy is an Indian economist based in Shillong. She teaches finance at IIM Shillong.