India is looking to emerge as a world leader in green hydrogen and it has all the reasons to look for alternatives to fossil fuels. The economy is heavily dependent on imported crude oil for its energy needs. With the Ukraine crisis leading to a more than 50% increase in global crude prices, India is looking at renewable energy sources to power its growth.

Like many other economies looking for alternatives to fossil fuels, India is also focusing on green hydrogen as a potential energy source that can replace crude oil and coal. The fossil fuels are responsible for most of the global greenhouse gas emissions, blamed for global warming and climate change. India’s global commitments to reduce greenhouse gas emissions necessitates an energy transition away from fossil fuels.

Energy experts consider green hydrogen as the end of their search for a fuel that emits no exhaust. It is produced by splitting water using renewable energy. It can be stored and transported using the existing infrastructure for oil and natural gas and is capable of powering energy hungry industries such as steel, cement and fertilizers.

READ I Ukraine war: Soaring gas prices make green hydrogen a viable fuel option

India sets ambitious green hydrogen target

India has set an annual green hydrogen production target of 5 million tonne by 2030 under its national green hydrogen policy. The government has announced a slew of benefits to the industry including tax breaks to boost investment. It also has allotted land to bring down the investment requirement. India has huge potential for renewable energy, a prerequisite for producing green hydrogen at competitive prices. It also has a large number of rivers and a long coastline that provide the second ingredient, water, in large quantities.

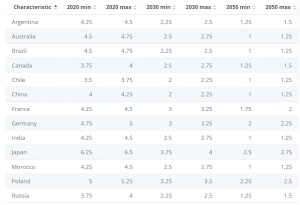

Projected green hydrogen production cost

Prospects look bright for India with some of the largest corporates have taken the plunge into the green hydrogen dream. India’s largest conglomerates the Reliance Group and the Adani Group have committed billions of dollars for green hydrogen production. The industry needs heavy investments and the viability and profitability are uncertain. So, the it needs powerful investors like Ambani and Adani who could absorb the risk involved. Reliance and Adani look to produce green hydrogen at $1 per kilogram, compared with the current cost of around $6.

Reliance Industries has committed $75 billion to green energy, a major part of which is expected to go into green hydrogen production. Adani Group plans to invest $70 billion in renewable energy infrastructure by 2030. Greenko Group, based in Hyderabad, has plans to set up the largest electrolyser plant outside China in collaboration with John Cockerill of Belgium. State-run Indian Oil Corporation has also formed a joint venture to develop green hydrogen.

READ I Economic policy for achieving sustainable, inclusive growth

Hurdles to India’s leadership dream

While India has taken definitive steps to become a global leader in green hydrogen, the journey towards the goal wouldn’t be easy. India is not a technology leader in solar energy or in electrolyser production.

At COP26 in Glasgow last year, India had announced a renewable energy generation capacity of 500 GW by 2030. It has revised its 2022 solar power target to 100GW after achieving the earlier target of 20 GW way ahead of the schedule. However, expanding the solar infrastructure would be a challenge for India that is dependent on imports for critical components. The country imports more than 80% of its solar cells and modules from China. It needs to reduce import dependence if it were to emerge as a major force in renewable energy.

Availability of cheap credit is another key concern with most of the financing deals happen at around 12-14% interest. The country needs to ensure diversified supply of components and cheap finance if it were to achieve its ambitious targets for solar energy and green hydrogen. The government has brought solar module manufacturing under the PLI scheme, which can go a long way in reducing import dependence. There is a need to protect the fledgling manufacturing sector using both tariff and non-tariff measures.

Another problem for India is in the field of technology. China is the market leader in electrolysers, but Europe has developed a number of innovative technologies for green hydrogen production. The European Union has launched a plan to catch up with China in mass production of electrolysers. The EU executive has plans to have an installed electrolyser capacity of 40 gigawatts by 2030 that can produce 10 million tonnes of green hydrogen.

The EU is keen to fortify its leadership in electrolyser manufacturing. India can provide the ideal foil to its ambitions as a market for technologies as well as a mass producer of green hydrogen. It can lean on Europe for green hydrogen technologies and to reduce dependence on China for electroliers and other green technologies.

The government seems to be taking the right steps in this regard. During Prime Minister Narendra Modi’s European visit, Union power minister RK Singh and Germany’s minister for economic affairs and climate change Robert Habeck signed a joint declaration of intent on Indo–German Green Hydrogen Task Force. Singh extended an invitation to the German industry to build a green hydrogen ecosystem in India.

Under the agreement, an Indo-German Green Hydrogen Task Force will be set up to strengthen cooperation in production, utilization, storage and distribution of green hydrogen through collaboration in research and development. Trade of green hydrogen and its derivatives would be the focus of the agreement. India needs a powerful partner to help achieve its green hydrogen ambitions and it seems it has found one in Germany.

Sajna Nair is a former banker. Her areas of interest are environment, art and culture.