Inflation and interest rates: The Reserve Bank of India’s monetary policy committee meets in the backdrop of sharp swings in the markets with the sentiment shifting swiftly from taming inflation to concerns on global outlook. Accordingly, the deliberations will likely be centred around the global monetary policy cycle amid the outlook for global growth and inflation, recent meltdown of global commodity prices, and the consequent impact on domestic macros especially the external sector risks and the associated pressures on the rupee.

The MPC may effect a front loaded 50 basis point hike in the August policy keeping in view the external sector pressures as major central banks continue the fight against inflation and as India’s inflation hovers around 7% at least till September. However, the government’s supply side intervention, impact of monetary tightening along with softer global prices is expected to ease inflationary pressures towards the end of the year.

READ I Indians feel the heat of Ukraine conflict; natural gas prices to rise further

Interest rates and easing inflation

The inflation will gradually glide towards an average of 5.3% in the fourth quarter of the current financial year. Further, inflation in the first quarter at 7.3% is 20 basis points lower than the Reserve Bank of India’s estimate in the June policy. In the second quarter of the financial year, inflation should be 30-40 basis points lower than RBI’s estimate of 7.4%. Overall, RBI is likely to realign its FY23 inflation forecast to 6.5%, compared with their its earlier estimates of 6.7%. On the growth front, the MPC could retain its economic growth forecast at 7.2%.

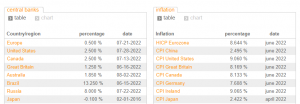

Global benchmarks for inflation, rates

While we expect the need for frontloaded policy tightening, the terminal interest rate does not need to be very elevated in the current cycle especially given the idiosyncrasies of the nature of inflation. We continue to expect Repo rate at 5.75% by end of the current financial year. Meanwhile, we also need to focus on the liquidity stance of the RBI, which needs to be realigned to ensure that the MPC’s operative target interest rate i.e., weighted average call rate (WACR) is consistently closer to the Repo rate.

After a brief spike in the overnight rate last week, rates are back towards the lower end of the LAF corridor. Much headway is needed to achieve this goal alongside the policy rate hikes. Such simultaneous actions will ensure real policy rates will be close to the natural rates and hence would equate to a neutral policy stance. Until then, the discussion around the stance seems vague.

(Upasna Bhardwaj is Chief Economist, Kotak Mahindra Bank. This article is a reproduction of her speech at a discussion organised by EGROW Foundation, a Noida-based think tank.)