The Reserve Bank of India’s monetary policy committee began its three-day meeting on Wednesday amid expectations of the third consecutive increase in the repo rate in three months. Ideally, the interest rate should not be hiked by more than 25 basis points as the global crude oil and gold prices have started moderating. The trade balance may be impacted because of the continued depreciation of the rupee against the dollar. The US currency may get stronger, upsetting India’s balance of payment position further.

There is uncertainty across the world and the strengthening of the dollar against the Indian currency could have wide-ranging implications. It is for this reason that the International Monetary Fund scaled down the growth forecast for India to 7.4% in 2022 and to 6.1% in 2023 in its latest revision. For both the years, the scaling down has been by 0.8%.

READ I RBI may raise key rate by 50 bps on global cues

No need for interest rate differential

The argument that there should be a minimum rate differential between the US and India may not hold in the current situation. The US has aggressively increased its benchmark rate because inflation is 5 times the normal level, but that is not the case for India. The CPI inflation in India is about 7%, just about 100 basis points outside the RBI’s comfort zone.

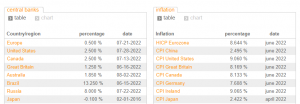

Inflation, policy rates in major economies

Also, of late, there are indications that the US economy is slowing and interest rates will not be raised as aggressively as originally planned by the Federal Reserve. Inflation in the US is also expected to moderate in the days to come, given oil prices are now moderating and the US Fed may not as aggressively raise the rates as originally anticipated.

More importantly, given the first round of aggressive rate hikes, whatever capital outflow had to take place has probably taken place. Now, even if there is a wider gap in rate differential, it is not necessary that capital will flow out.

READ I India feels the heat of Ukraine conflict; natural gas prices to rise further

Rate hikes may not contain inflation

Inflation as measured by the consumer price index and the wholesale price index are certainly above the tolerance level. But, in component wise analysis, the increase is more in vegetables. The rise in oil prices, fertilizers and other commodities have probably played their role. Now, the inflation, if it is only because of vegetables and fruits or paper products, would not get corrected by increase in interest rates.

The latest figures for index of industrial production (IIP) and core industries are encouraging as also high frequency indicators. The Reserve Bank of India will not like to impact the growth impulses by aggressively raising rates. Therefore, it would be ideal if the repo rate is increased by 25 basis points in the current monetary policy. A rate hike will show that the RBI is alert, but does not want to hurt the growth sentiments.

In case the US data expected to be released on Friday is adverse and the Fed resumes aggressive upward revision of benchmark rates, the RBI can always increase the repo rate off cycle as it has done in the past. Otherwise, aggressively raising the interest rates now in an attempt to match the incremental increase of 75 basis points by the US Fed may harm growth and employment generation in India.

Dr Charan Sigh is a Delhi-based economist. He is the chief executive of EGROW Foundation, a Noida-based think tank, and former Non Executive Chairman of Punjab & Sind Bank. He has served as RBI Chair professor at the Indian Institute of Management, Bangalore.