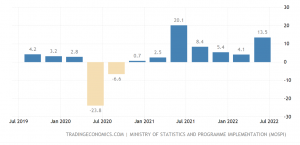

Indian economy expanded 13.5% in the first three months of the current financial year, way below the expectations of the government as well as private forecasts. The RBI had projected 16.2% GDP growth for the three months ended June, while independent forecasts predicted growth in a wide range between 9% and 21.5%.

The growth rate was the highest in a year, helped by a revival in domestic demand and a favourable base effect. The economy had posted 20.1% growth in the April-June quarter of the last financial year. Private consumption rose by 25.9% and investment was 20.1% higher from the same period, last year.

India GDP growth rate

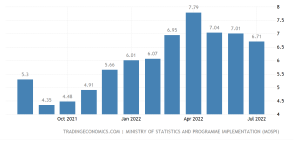

India annual inflation

Despite below par quarterly growth numbers, India is still the fastest growing major economy. However, the economy is threatened by slowing growth in the world’s largest economies, unabated inflation, high interest rates, and large-scale unemployment prevalent in the economy.

READ I Crimes against women: What causes the rise in gender-based violence

Rate hikes hit GDP growth

The RBI has raised the benchmark repo rate by 140 basis points since May to tackle the annual inflation that has breached its comfort zone below 6%. It is expected that the central bank will go in for two more hikes of 0.5% and 0.25% in the current rate hike cycle. The government expects the economy to expand 7% in the current financial year, while independent economists expect growth to be slightly higher than the official forecast.

The GDP at current prices stood at Rs 64.95 lakh crore compared with Rs 51.27 lakh crore in the same period last year, growing at 26.7%. The main driver of GDP growth was a revival in contact-intensive services from restrictions imposed to curb Covid infections in Q1 last year.

India’s agriculture sector that employs more than 40% Indians grew by 4.5%, double the growth rate in the same quarter last year. Manufacturing disappointed, but managed to come out of a contraction seen in the previous quarter. Industrial sector posed a growth rate of 8.6%, while services grew by 17.6%.

According to an analysis by Morgan Stanley, there has been a significant shift in policy towards increasing the economy’s productive potential and the growth. The analysis released earlier this year said Indian policymakers have adopted some changes that will result in a spike in private capital expenditure.

The analysts’ confidence in India’s growth prospects is backed by a fall in global crude oil prices. Crude prices fell by a quarter from the March 2022 peak, which will lead to improved macro stability, helping the RBI end the current rate hike cycle.

Moody’s Investors Service on Thursday cut its growth forecast for 2022 to 7.7% from its earlier estimate of 8.8%. It expects economic growth slow down to 5.2% in 2023. The rating agency blamed high interest rates, uneven monsoons rains and slowing growth in large economies for the cut in growth projection.

Anil Nair is Founder and Editor, Policy Circle.