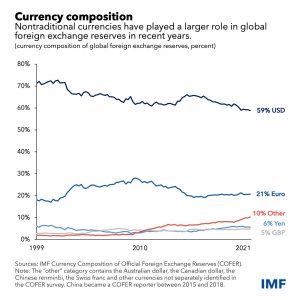

As the majority of international payments are either settled in the dollar or euro, countries are left scrambling for cover when the US currency appreciate or fluctuate. Brazil, Russia, India, China and South Africa — which form the BRICS grouping — are working to create a new reserve currency to serve their economic interests. The reserve currency will be based on the currencies of these five emerging market economies.

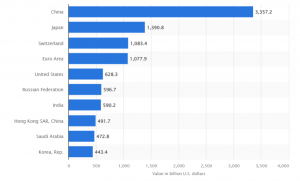

This is not the first time that the idea of a common reserve has been floated. The BRICS nations had first mooted the idea of a common reserve currency back in 2011. Between them, BRICS nations hold nearly half of the world’s foreign exchange reserves. This is at a time when the reserves of the United States and European nations are depleting.

The situation puts BRICS nations in an advantageous position as they look to issue a new currency similar to the IMF-issued special drawing rights (SDRs). Not only do these countries together have the power to create a new currency for trade between themselves, they also have the financial clout to attempt a global alternative.

Foreign exchange reserves of major countries

The BRICS reserve currency is expected to reduce the reliance on the dollar, euro and the SDRs. The reason that these currencies hit fresh highs is because of other countries’ reliance on them. Further merit for a common reserve is based on the fact that the dollar and the US economy showed remarkable weakness and vulnerability during the Great Recession of 2008. The recession sprung from the American housing market, but quickly spread to the rest of the world, shaking most global economies.

READ | Chinese economy: Experts see growth engine cranking up soon

The biggest problem with dollar dependence is that it globalises the American crises. We already discussed how the US sub-prime crisis brought the world economy down in 2008. More recently, US inflation has become a global crisis that affected all major currencies.

Russia had said at the 14th BRICS Summit that it was ready to work with all fair partners and was also partaking in a five-nation plan to issue a new global reserve currency. All BRICS members have also taken steps to de-dollarise and improve their autonomy in the global financial system. That the BRICS nations have recognised the importance of facilitating intra-BRICS trade in local currencies is crucial in firewalling their global financial interests.

The countries have also been looking to facilitate trade despite restrictions brought on by the pandemic and the conflict in Ukraine. Take for example the Russia and India trade. The two countries have been courting each other despite frowns from the West. India continued to import cheap oil from Russia despite facing severe criticism.

Russia, hence, possesses a strong interest in the alternative reserve currency as it has seen at least half of its foreign exchange reserves frozen due to sanctions imposed by the US and its European allies after the invasion of Ukraine early this year.

If the move comes to fructify, not only will it help these nations achieve financial autonomy by breaking the dollar-euro duopoly, but the move may also cool off prices of these two currencies that currently hold a large sway globally.

READ | Electronics industry: Policy choices for manufacturing success

China is expected to call the shots as it has the largest foreign exchange reserves in the world and is the second largest economy in the world after the United States. Among the BRICS nations, China is the biggest economy and it has never made a secret of having its currency Yuan or Renminbi taking on the dollar as a global reserve currency. China also has great economic influence due to its ambitious infrastructure scheme Belt and Road Initiative under which it has given massive loans to other countries.

Roadblocks in creating BRICS exclusive currency

In order to develop a reliable alternative to dollar and euro, countries need to engage actively to share financial information. Moreover, the present geopolitical situations may also pose a great hindrance in making the move successful. That Russia is currently facing international sanctions and was ousted from SWIFT is no help.

Further, the countries are also faced with a challenge arising from uncertainties and volatilities. Mere inclusion of the Russian rouble in its basket will bring in volatility as Russia’s trade and capital account have been under pressure since the invasion of Ukraine.

Also, the dollar has been appreciating rapidly this year while other currencies have been on a free fall. This makes analysts sceptical of the feasibility of a new reserve currency. The first question is whether such a basket will be able to attract significant foreign exchange reserves from countries looking to hold it. Analysts are also worried if the alternative reserve currency will be able to stand up to the criteria of a global reserve currency in terms of safety, liquidity, and returns. There is a reason due to which the dollar is considered a safe haven.

Earlier as well, the countries had been in talks to create an alternative which fizzled out due to more pressing national and international matters. It remains to be seen whether these countries can weather the current crisis and come up with a global alternative to the dollar.