The most important objective of central banking is price stability. The practice of giving it numerical precision was introduced after monetary and exchange rate targeting failed in 1980s. The inflation targeting regime was finally accepted by most countries of the world in 1988 after several trials. In the years preceding the Covid-19 pandemic, the world experienced low inflation rates in the range of 1-2% which was considered the new normal and was celebrated as victory over inflation.

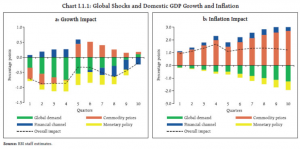

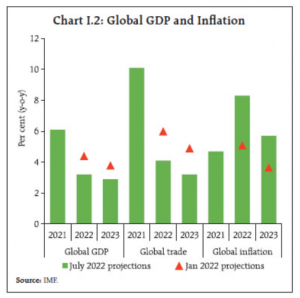

The global economy was hit by a number of shocks since 2020. The global output which had already been slowing down before the pandemic suffered a combination of exogenous shocks and endogenous events such as the Russian invasion of Ukraine. Inflation started rising in the last one year and has become an important risk factor in most advanced economies.

READ I Sticky retail inflation lands RBI in policy dilemma

Inflation and global economic growth

A large number of factors are responsible for the sharp rise in prices — supply chain disruptions, commodity price shocks, ultra-expansive monetary policy in the US Fed, liberal fiscal policy in most advanced economies, pent-up consumer demand and changes in consumer preferences. Inflation was triggered by rising food and energy prices, leading to aggressive monetary tightening in last few months.

This resulted in heavy capital outflows from emerging markets, accompanied by currency depreciation. Global economic growth is expected to slump by end of 2022 and early 2023 because of surging inflation, rising interest rates and the supply side disruptions. The global economy could face a stagflation, something not witnessed in last 50 years.

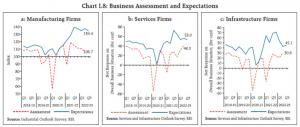

The economic recovery since 2021 led to an increase in demand for labour in many sectors. Initially, labour was slow to respond because of the ongoing pandemic and difficulties in finding child and family care services that impacted female labor force participation. This imbalance in demand and supply of labour led to wage pressure that saw average wages increasing and unemployment started declining.

A unique situation emerged with rising inflation, positive nominal wage growth, declining real wages and rising employment in many economies, especially the US. This cycle of wage price spiral persistent over many quarters is unique to macroeconomic analysis. Historically, such situations did not last long, and real wages remained unchanged. In the case of other advanced economies like the UK and the euro area, higher energy and food prices contributed significantly to inflation.

Theoretically, there is a positive relationship between inflation expectations and wage setting process. Therefore, it is important to anchor inflation expectations at moderate levels to control inflation. The advanced economies are attempting this through aggressive interest rate hikes.

Consumer inflation stays sticky

This is not an easy task as inflation has been high in different countries for varied reasons such as (a) shock to production capacity due to lockdown and social distancing; (b) international trade costs due to increasing shipping costs; (c) commodity prices especially energy and food prices accentuated by the Russia-Ukraine war; (d) increase in private savings; (e) changes in composition of consumption; (f) liberal fiscal policy support during Covid-19 pandemic, and (g) unprecedented monetary policy expansion in most advanced economies.

Empirical evidence suggests that supply chain inflationary shocks have temporary effect on inflation and wage growth. They do not lead to wage price spiral. If inflation expectations are anchored tightly, then supply chain shocks do not have long lasting impact.

Recent trends – India and the world

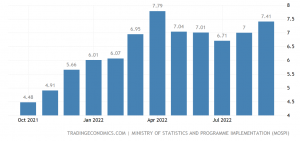

In India, the Reserve Bank of India successfully followed multiple indicator approach (MIA) till 2015 which covered different aspects of the economy like exchange rates, growth, liquidity conditions, stability of financial institutions, employment and inflation. In 2016, the Reserve Bank of India (RBI) formally adopted flexible inflation targeting framework with price stability as the primary objective and maintaining operational target of inflation at 4% with a band of +/- 2, as measured by the Consumer Price Index. This approach has come under stress in recent quarters as CPI inflation exceeded the 6% limit due to multiple reasons.

A moderate inflation in any economy is considered healthy as it signifies economic growth driven by growing demand. In India, the threshold level for inflation is around 6% which implies that 4% inflation target may not be suitable for India. There is research to show that if inflation is lower than the threshold level, then potential output growth cannot be achieved and the system would remain in long-run disequilibrium requiring constant policy interventions, and thus not optimal for sustainable growth.

In sharp contrast to other major economies, India has been performing well in the recent period. India is the fastest growing large economy and all forecasts predict steady growth in the next two years. Inflation as measured by the wholesale price index (WPI) has been declining for food and fuel in recent months. The consumer price index (CPI) for food and all-commodities is less than 7% which implies that domestic inflation is above the upper band of RBI’s inflation target, and not 4-5 times the targets/trend like in the US, UK or euro area.

The inflationary pressures in India are not due to expansionary monetary policy as in the case of the US, or wage price spiral (US) or fiscal policy (the UK). It was triggered by a rise in commodity prices due to the Russia-Ukraine war, and is seen as temporary in nature. The correction in the prices of crude oil has already begun and that due to food would ease with the new harvest of paddy/wheat in next few months. Agriculture sector is doing well with good monsoons. In contrast, correction in prices in the US and other advanced economies is expected to complete in two years because the reasons are embedded in expansionary monetary policy since 2008 and fiscal policy since 2020.

Globally, the aggressive increase in the interest rates by the central banks of advanced economies to check rising energy prices could trigger concerns about financial stability. India is expected to be an engine of growth for the world economy in next few years, given the able stewardship by fiscal and monetary authorities which is reflected in the growth and inflation scenarios.

Dr Charan Sigh is a Delhi-based economist. He is the chief executive of EGROW Foundation, a Noida-based think tank, and former Non Executive Chairman of Punjab & Sind Bank. He has served as RBI Chair professor at the Indian Institute of Management, Bangalore.