Lending activities shifted from physical to digital space during the Covid-19 pandemic. This situation boosted the digital lending market from its infancy to near-saturation. The primary reasons for its exponential growth are the emergence of a large number of start-ups, better internet connectivity, higher smartphone penetration, and proactive government reforms.

The disruption caused by digital lenders was driven by the need for superior customer experience, emerging business models, faster turnaround time, and the adoption of technologies such as cloud computing, artificial intelligence, and machine learning.

Digital lending takes place in several forms such as pay-tech, lend-tech, wealth-tech, insur-tech, reg-tech, prop-tech, health-tech, and agri-tech, which are together called fintech, shadow lenders, or neo-banks. These entities channelise financial services exclusively through digital platforms.

READ I RBI digital lending norms silent on lending scamsters

A sunrise industry

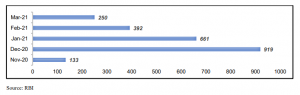

An EY report published last year says India’s retail digital lending space crossed the $150 billion mark in 2020 and is projected to reach $350 billion by 2023. The share of digital lending will rise from 23% in 2018 to 48% by 2023. Along with the growth of digital lenders, more than 600 illegal loan apps (mobile apps) also came into existence, leading to frauds and illegal financing deals. These illegal apps need to be checked before the bubble bursts (Figure 1).

Among the many features of digital lending, the concept of Buy Now Pay Later (BNPL) has become quite vibrant in the digital space. According to Global Payments Report by Worldpay, BNPL is emerging as India’s fastest-growing e-commerce digital payment method, estimated to capture 9% of the total e-commerce market share by 2024.

These neo-banks provide services to customers which come under the purview of the three financial regulators — the Reserve Bank of India, the Securities & Exchange Board of India, and the Insurance Regulatory & Development Authority of India. While there is no specific restriction on the operations of neo-banks, they are not directly subject to the regulatory oversight of the RBI’s licensing regime.

Number of complaints received

RBI’s digital lending guidelines

To overcome this issue and to protect the interest of the millions of customers in the digital space, the Reserve Bank of India circulated on August 10 some guidelines for digital lending service providers. The guidelines seek to restrain illegal lending activities, as these entities must comply with several due diligence procedures before providing financial services. They stipulate that these entities operate under the domain of regulated entities (RE).

The REs need to provide a key fact statement (KFS) to the borrower which specifies the annual charges, recovery mechanism and details of the grievance redressal mechanism before executing the contract. In addition, REs have to provide a list of digital lending apps and their website in the public domain for the customers.

In the OTT space, streaming services are required to store data in servers in India and to comply with various technology standards from time to time. The crux of the guidelines is the First Loss Default Guarantee (FLDG), an arrangement whereby a third party compensates lenders if the borrower defaults.

Shadow lenders took a hit during the pandemic, resulting in 10-15% loan defaults, leading to counterparty risks and significant operational risks owing to the lenders’ increased reliance on third-party service providers. This is seen as a threat to shadow lenders as digital lending mechanisms are becoming a tougher challenge with each passing day. This is more so because of newer financial innovations and fresh guidelines by the regulators.

Keeping in view the above issues from the perspectives of the regulator and the lender, the RBI working group has recommended the setting up of a Self- Regulatory Organisation under the supervision of the RBI. In addition, the set-up of the Digital India Trust Agency and the National Financial Crime Record Bureau is going to be a step toward a healthy digital financing ecosystem in the country. This will streamline digital financing and avoid chaos in future.

The biggest challenge for digital lenders while facing the recent guidelines, however, is adhering to the entire regulatory compliance latest by November 30, 2022. The RBI must take into account the business models of payment banks, or bring these neo banks under its regulatory umbrella to ensure uninterrupted funding services to millions of tech-savvy customers.

(Shiba Prasad Mohanty is Research Associate at the National Institute of Securities Markets, Mumbai.)