Non-Banking Finance Companies have emerged as key financial sector players with their credit growth outpacing that of commercial banks. Customers are attracted towards the NBFCs due to their well-developed collection system, quick decision-making procedure, and prompt service response. NBFCs are also ready to take additional risk and lend to small and medium enterprises and other businesses whom banks were unable to lend due to issues related to creditworthiness.

The housing finance companies stand out among the various categories of NBFCs due to the innovative business models and concentration in the niche market. They have emerged as an alternative service provider to commercial banks. They are the second largest borrower of funds from the financial system, with a gross payable of around ₹7.40 lakh crore, compared with ₹12.46 lakh crore for the entire NBFC sector as of March 2022.

READ I Vikram S success marks private sector success in space industry

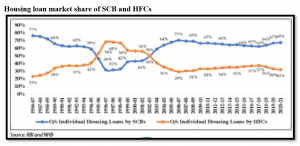

The commercial banks have been offering housing loans to customers through separate housing finance verticals. The commercial banks which entered the housing space have cornered a major market share and the pace of growth in banks’ home loan portfolio remained higher than that of HFCs since 2003-04. The banks now have a 68% share in the market for individual housing loans compared with 32% share for HFCs. This shows the rising competition from the banks in the housing space.

Setback for housing finance companies

The image of the HFCs suffered a blow after the collapse of the two leading housing finance behemoths — Dewan Housing Finance Ltd and Reliance Housing Finance. These events in 2019 affected the entire housing sector in 2019. DHFL collapsed due to the non-payment of its short-term debt. The credit pressure pushed them into selling ₹ 30,000 crore worth of retail loans.

Reliance housing defaulted an amount of ₹10,123 crore payment obligations to the lenders. As a result of these incidents, the lenders and the markets were reluctant to provide finance to HFCs. Many HFCs were struggling to manage their finances, as they are dependent on external borrowings and commercial papers.

READ I What is the loss and damage fund? Why is it key to war on climate change

The downfall of two leading housing finance companies raised numerous questions on the governance, liquidity management, asset liability mismatch, regulatory supervision, and due diligence. It was evident that the scenarios were different and dynamic. The problem started with housing finance and ended in infrastructure finance.

The problems might be different from entity to entity because of differences in business operations, but the common factor was either poor governance or an asset-liability mismatch, or both. As the housing finance companies use short-term funds to finance their long-term business, they naturally face an asset-liability mismatch. Immediate need for short-term funds could drag them into a liquidity crunch and a possible collapse.

The Covid-19 pandemic broke out in the first quarter of FY20, affecting all industries, including automobile, housing, services, and manufacturing, The first quarter saw a nationwide lockdown that led to slow growth. India entered a complete lockdown phase on March 25, 2020 and all economic activity came to a standstill. Operations stagnated because of the majority of HFCs had to shut down their branches. Since the underlying businesses were temporarily closed, there were no lending opportunities. Alongside these sectors, the micro, small, and medium enterprises have also been impacted by the crisis.

On August 6, 2020, the RBI authorised HFCs to conduct a one-time restructuring of stressed loans due to the Covid-19 pandemic. HFCs were affected more than commercial banks because they had to grant moratoriums to their clients. The RBI provided policy support by way of a moratorium on the payments to the lending entities which alternatively affected the cash flows.

The liquidity issue again aggravated for some housing companies during that time. Due to Covid-19, many HFCs redefined their business models with the help of big data and artificial intelligence. In this aspect, several entities collaborated with Fintech firms to capitalise on technology advancements.

The pandemic intensified the asset-liability issues of the HFC sector. To ease liquidity pressure on HFCs, the RBI took multiple steps including a targeted long-term repo operation (TLTRO) for the sector to the tune of Rs 50,000 crore and a special financing window through SIDBI, NABARD and NHB for another Rs 50,000 crore. COVID-19 also resulted in a deterioration of asset quality of the housing sector.

The HFCs and NBFCs in general have been battling a liquidity crisis since 2018 which resulted as the collapse of some leading housing companies. During FY2020, the transition of supervision of HFCs from NHB to RBI was announced. With this change, all players in the housing finance sector are now governed by a single regulator. To tighten supervision and to create a bank like ecosystem, the RBI implemented scale-based regulation and updated NPA recognition norms in 2021.

Income Recognition Asset Classification (IRAC) standards kept write-offs elevated compared with the previous fiscal. HFCs were required to reduce total borrowings to 12x of their Net Owned Funds (NOF) and Capital Adequacy Requirement (CAR) was increased to 15% in a phased manner by March 31, 2022. The RBI maintained the minimum NOF for HFCs at Rs 20 crore.

For existing HFCs, the limit continued to be Rs 15 crore till March 2022 and Rs 20 crore by March 2023. Numerous prudential norms have been imposed by the RBI in a short span of time to bring the situation under control. The much-criticized business model of HFCs was put to test by demonetization, implementation of GST, the collapse of leading HFCs, and by the Covid-19 pandemic.

Many HFCs managed to weather the storm without breaking down, a testament to their fortitude. Out of top 10 leading housing finance companies, market leader HDFC announced the merger with HDFC bank, while PNB housing finance and Canfin Homes are backed by commercial banks. Bajaj Housing Finance, Tata Capital and Indiabulls Housing Finance have strong liquidity support through parent entities. DHFL, the fifth largest HFC, went for bankruptcy process and was acquired by the Piramal Group.

The imposition of tight regulation has forced HFCs either to exit the market or to continue the business by merging with strong entities. The recent merger of HDFC with HDFC Bank is an example. The merger was done to increase the credit size and to enhance their reach in the priority sectors. This was done in view of the market conditions to escape tight regulation imposed on the sector.

The time has come to think about several alternative business models for the HFCs in the country. As we are experiencing the entry of many leading market players such as Piramal Finance and Poonawalla Fincorp into the space of housing finance through acquisitions, the regulators and market players should collectively list out innovative business models for the survival of the other players which are struggling to stay afloat in the market.

(Shiba Prasad Mohanty is a research associate with National Institute of Securities Markets, Mumbai.)