China is positioning itself as the global leader in green hydrogen, a crucial element in the global shift towards low-carbon energy. This strategic move is part of a broader vision laid out in China’s national hydrogen plan, which identifies hydrogen as a key component in the country’s low-carbon energy transition. The ambitious targets and rapid advancements in green hydrogen infrastructure underscore China’s potential to lead the world in this vital sector.

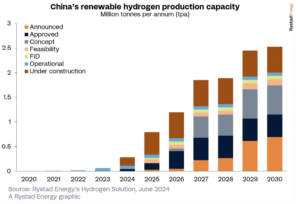

China’s commitment to green hydrogen is evident in its rapid expansion of hydrogen electrolyser capacity. According to recent reports, China is expected to install approximately 2.5 gigawatts (GW) of electrolyser capacity by the end of 2024, surpassing its annual green hydrogen production target a year ahead of schedule. This capacity is projected to produce 220,000 tonnes per annum (tpa) of green hydrogen, significantly more than the rest of the world combined. This rapid growth cements China’s position as a world leader in the adoption of hydrogen electrolyser technology.

In 2023 alone, China installed a cumulative 1 GW of electrolyser capacity, showcasing its commitment to scaling up green hydrogen production. This expansion is part of the country’s broader goal to achieve carbon neutrality by 2060 and peak emissions by 2030. However, the transition from grey hydrogen, produced through coal gasification or steam methane reforming, to green hydrogen is essential to meet these targets.

READ I Climate change: New study says 92% of global warming man-made

Strategic planning and geographical disparities

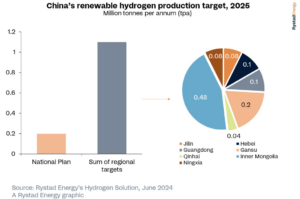

China’s National Development and Reform Commission’s hydrogen plan, known as the ‘Medium and Long-Term Strategy for the Development of the Hydrogen Energy Industry,’ provides a comprehensive roadmap from 2021 to 2035. While this plan is a significant step forward, it falls short of the stringent benchmarks set by European standards. The ambiguity in the definitions of ‘low carbon’ and ‘renewable’ hydrogen needs to be addressed by China. By adopting clear and stringent definitions that align with global best practices, China can enhance the credibility and impact of its hydrogen initiatives.

One of the critical challenges China faces is the geographical disparity between its hydrogen demand centres in the east and its abundant solar and wind energy resources in the north. Regions like Inner Mongolia and Gansu have set ambitious targets for renewable hydrogen production, but the mismatch between supply and demand necessitates an expansion of the hydrogen pipeline network. Notable projects include a 400-kilometer pipeline by Sinopec, connecting Ulanqab in Inner Mongolia to Yanshan in Beijing, and a 737-kilometer pipeline from Zhangjiakou to Caofeidian, which would be the world’s longest hydrogen pipeline if realised.

Harnessing renewables for green hydrogen production

China’s substantial solar and wind power potential, particularly in regions like Xinjiang, Gansu, and Inner Mongolia, supports the development of green hydrogen production. In 2023, China’s solar photovoltaic (PV) capacity surged to 217 GW of new installations, 2.5 times the amount installed in 2022. Wind installations also saw significant growth, with 76 GW added in 2023, double that of 2022. These regions are now home to most green hydrogen projects, capitalising on their abundant renewable capacity.

Despite these advancements, challenges remain in ensuring that electrolyser facilities can run at full capacity. Production of 1 million tpa green hydrogen will need around 20 GW of wind capacity. This competition for renewable energy between hydrogen projects and other electrification needs poses a significant hurdle. Additionally, operating electrolysers below nameplate capacity can lead to safety risks, as most alkaline electrolysers used in China have an operating range between 30% and 100% of their maximum yield. Ensuring a stable power supply to these electrolysers is crucial to prevent shutdowns and potential safety hazards.

Challenges and opportunities for China

China’s rapid expansion of green hydrogen capacity mirrors its previous success in scaling up solar and wind industries. By 2030, China’s four largest green hydrogen projects are expected to account for up to half of the country’s total production capacity. This growth trajectory is a testament to China’s ability to lead in renewable energy technologies.

However, for China to maintain its leadership position, it must address several key challenges. First, clear and stringent definitions of low-carbon and renewable hydrogen must be adopted to ensure alignment with global standards. Second, the expansion of hydrogen pipeline networks is essential to bridge the geographical disparity between production and demand centres. Third, significant investment in renewable energy infrastructure is needed to support the growing hydrogen industry and ensure stable power supply to electrolyser facilities.

China’s strategic investments and rapid advancements in green hydrogen position it as a global leader in this crucial sector. The potential for green hydrogen to decarbonise hard-to-abate industries, such as steel production, shipping, and aviation, underscores its importance in the global energy transition. By continuing to invest in green hydrogen technologies and addressing the challenges associated with its production and distribution, China can drive significant progress towards a sustainable and low-carbon future.

China’s commitment to green hydrogen and its strategic approach to expanding electrolyser capacity and renewable energy infrastructure place it at the forefront of global efforts to transition away from fossil fuels. As the world grapples with the urgent need to mitigate climate change, China’s leadership in green hydrogen offers a promising pathway towards a cleaner and more sustainable energy future. The time to act is now, and China is poised to lead the way.