Budget 2021: As the Finance Minister of India set to present Union Budget for FY2022, no doubt, people of the country are eager than ever before. The scar from the pandemic led uncertainties and disruptions are deeper than what we think. The biggest responsibility of the upcoming budget to revive economy in real terms and make the growth sustainable and equitable. Budget watchers expect the budget to strike a fine balance between maintaining fiscal strength along with much desired growth stimulus.

The focus is expected to be multi-pronged with thrust on employment generation, tax respites, channelized spending to give impetus to potential growth, rural and social focus and tackle the health distress emanating from the pandemic wave. Against this backdrop we analyse here certain macro lookouts for this year’s budget.

READ I Budget 2021: Five steps to boost manufacturing industry

Budget 2021 may see govt utilising FRBM window

In the previous fiscal itself, owing to challenging macroeconomic environment coupled with resource constraints from slowing tax collections Government tried to loosen its fiscal purse and revised the FY20 fiscal deficit target to 3.8% of GDP (Rs. 7.67 lakh crore) as against the budgeted estimates of 3.3% of GDP (Rs. 7.03 lakh crore).

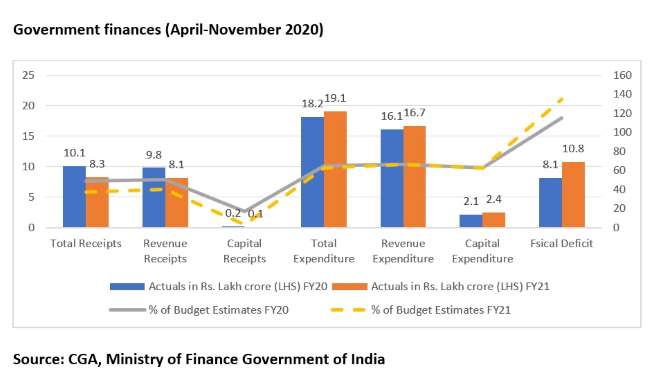

This year the pandemic induced headwinds added to the woes leading to twin challenges of falling revenue collections and higher than anticipated expenditure which took a toll on the exchequer. It becomes evident from the government data for April- November 2020 period with fiscal deficit balooning to 135% of the budget estimate.

READ I Economic Survey predicts V-shaped recovery, 11% growth

The resource constraints of the Union government remained a worry in the backdrop of a halt in commercial activities due to the nation-wide lockdown and regional restrictions. Meanwhile, the rural and social sector spending, especially the health outlay of the government, had to be stepped up to cushion the economy and society from the deadly virus.

The only way out to do this was market borrowings and thus the government announced an increase in its gross market borrowings programme by Rs 4.2 lakh crore, taking the gross borrowings to Rs 12 lakh crore this fiscal. In addition, the Union government borrowed an additional Rs. 1.1 lakh crore under a special window scheme to meet the shortfall in GST compensation to state governments.

READ I Budget 2021: What to expect from Nirmala Sitharaman’s budget speech

It is expected that the government will fully utilise the escape clause provided by the FRBM review committee to battle the unprecedented situation. At the same time, the government cannot loosen the purse strings completely, particularly to safeguard against the sovereign downgrades. Hence, budget maths along with the political situation suggest that the fiscal deficit will be budgeted at 5-6% of the GDP this year.

Higher receipts unlikely in Budget 2021

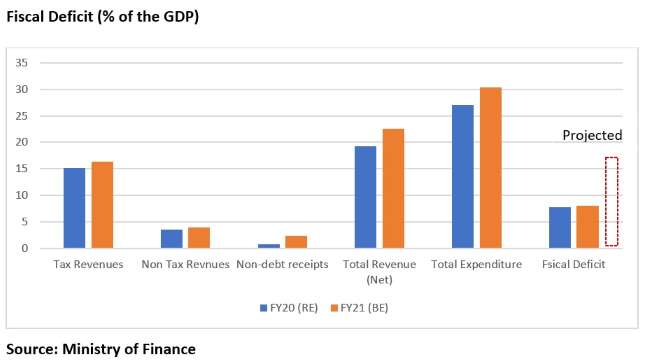

Given the pandemic impact, scope for higher receipts are limited at this juncture. However, tax revenues may see a moderate increase from FY21 levels. The announcements made through Aatmanirbhar Bharat to promote domestic manufacturing may lead to rising import duties. On the non-tax revenue front, dividends from RBI and PSU banks are expected to be lower. Meanwhile, it is expected that revenues from spectrum auction could add to the non-tax revenues this year. Revenue from disinvestments is expected to be Rs. 2.1 lakh crore for the year, as the current situation is not conducive for moping up funds through this route.

READ I Budget 2021: FM should focus on jobs, infrastructure

Higher expenditure likely in FY22

To deal with the persisting pandemic threat and its repercussions, Budget 2021 is likely to be an expansionary one with high expenditure on welfare measures and healthcare. Given the need to have rural focus, Budget 2021 will continue its agriculture and rural focus.

Budgetary allocation to rural schemes, as well as agriculture and allied sectors is again expected to see a double-digit increase. Spending is likely to be more focused on productive purposes like irrigation, crop insurance and expansion of digital services.

READ I RCEP: Asia Pacific trade pact will amplify Chinese power

According to Care Ratings estimates, the total expenditure may increase to Rs 32-33 lakh crore from the budgeted Rs 30.4 lakh crore in FY21. Revenue expenditure would see an increase, given the higher spending on government machinery during the pandemic crisis, economic packages and the vaccination programme. Capital expenditure will be higher due to infrastructure spending and social overheads inevitable for creating a multiplier effect in the economy.

In the current context, Budget 2021 could see fiscal deficit in the range of 5-6% of the GDP with a 15% growth in nominal GDP. Despite higher repayment to the tune of Rs 3.1 lakh crore in FY22, the gross market borrowings could be in the range of Rs 10-11 lakh crore for this year. In short, the Union Budget 2021 will be a tight-rope walk for the government as it will have to meet conflicting targets of fiscal discipline and stimulus for economic revival.

Dr. Aswathy Rachel Varughese is Assistant Professor at Gulati Institute of Finance and Taxation, Thiruvananthapuram, Kerala.