In her eighth consecutive Budget presentation, Finance minister Nirmala Sitharaman did a balancing act at a time when the economy faces multiple challenges. The key question before the government was how to catalyse growth while ensuring fiscal consolidation. As the most potent policy instrument available to the government, Budget 2025-26 had to be crafted with a focus on major economic goals such as consumption, investment, inflation, and interest rates. This year, consumption and capital expenditure (capex) took centre stage.

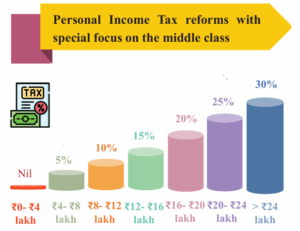

One of the highlights of this year’s Budget was the revision of income tax slabs. The increase in the tax-free income threshold under the new tax regime from Rs 7 lakh to Rs 12 lakh is expected to stimulate consumption, thereby triggering a virtuous cycle of demand and manufacturing growth. India’s middle class has been carrying a disproportionate tax burden, with personal income tax collections surpassing corporate tax revenue for the second consecutive year.

READ | Budget 2025-26: A pragmatic playbook for economic resilience

Budget 2025-26: Hobson’s choice for FM

This relief comes at a crucial time, as economic growth is projected to slow to 6.4% in 2024-25—its lowest rate in four years. Persistent inflation has further eroded purchasing power, while global uncertainties, including geopolitical tensions, trade disruptions, and rising commodity prices, have complicated the fiscal landscape. Given these challenges, the income tax revision was a step in the right direction.

However, public reaction to the tax relief was mixed. Many citizens pointed out that they do not earn enough to fall within the taxable slabs, diminishing the impact of the reform. Real wages have stagnated in recent years, causing widespread distress among the middle class. Addressing wage growth should be a priority for policymakers to provide meaningful, long-term relief. Some analysts argue that the nil taxation for lower-income earners is more of a political gesture, offering short-term appeal without fundamentally addressing structural income disparities.

Missed opportunity to kick off structural reforms

Despite some positive measures, the Budget fell short of expectations in several key areas. Analysts criticised it for avoiding bold structural reforms, instead opting for safer, short-term measures. Many economists had advocated for long-overdue reforms in land, labour, agriculture, and administrative systems—sectors that have long constrained productivity and economic growth.

Public and corporate expectations were high ahead of the Budget. While the middle class hoped for substantial relief in personal income taxation, corporate India anticipated measures to encourage private capital expenditure. However, the much-needed push for private investment was largely absent.

Corporate sector left wanting more

India Inc. remains hesitant to invest amid economic volatility, a trend that has been a major concern for the economy. The Budget failed to provide the necessary incentives to spur private sector investment. While micro, small, and medium enterprises (MSMEs) received some attention, large industries and multinational corporations saw limited direct benefits.

There were no major corporate tax cuts or regulatory relaxations to enhance competitiveness. Without a stronger commitment from the corporate sector, India’s growth trajectory will continue to face constraints.

Inflation remains unaddressed

Another major oversight was the lack of a clear strategy to tackle inflation. While the Economic Survey projected an easing of inflationary pressures, the Budget did not outline concrete measures to address the root causes of rising prices. Inflation continues to squeeze the middle class, yet the government has yet to present a robust plan to mitigate its impact.

Expectations were high for significant investments in railway modernisation, electrification, and new routes. However, the sector received an allocation of Rs 2.55 lakh crore for FY26—lower than the Rs 2.62 lakh crore allocated the previous year. This underwhelming budgetary support is likely to slow down expansion projects and impact key stakeholders.

Healthcare sector neglected

India remains one of the lowest healthcare spenders globally, allocating only 3.3% of its GDP to the sector—far below China’s 5.4% and the US’s 16%, according to World Bank data. The Budget did not introduce new healthcare initiatives or significant funding increases, disappointing investors and stakeholders. At a time when global health uncertainties persist, a stronger commitment to healthcare investment was expected but missing.

In summary, India’s Budget 2025-26 took a cautious approach but lacked ambition. This was reflected in the stock market’s subdued response. With fiscal policy now largely set, the focus shifts to the Reserve Bank of India (RBI), whose management of interest rates will play a crucial role in determining the country’s economic trajectory. While the Budget addressed some immediate concerns, it missed the opportunity to enact deeper structural reforms necessary for long-term growth.