Budget 2025: The interim budget for 2024-25 will be presented by Finance Minister Nirmala Sitharaman on February 1. Despite this exercise being an interim budget, various sectors of the economy have expectations from the exercise. The middle class is focused on income tax concessions, as their savings and expenditure have been impacted by inflation. Savings, a crucial macroeconomic indicator, influence both investment and future consumption levels. There is a positive relationship between interest rates and savings: higher interest rates incentivise increased savings, leading to more loanable funds and boosting future consumption.

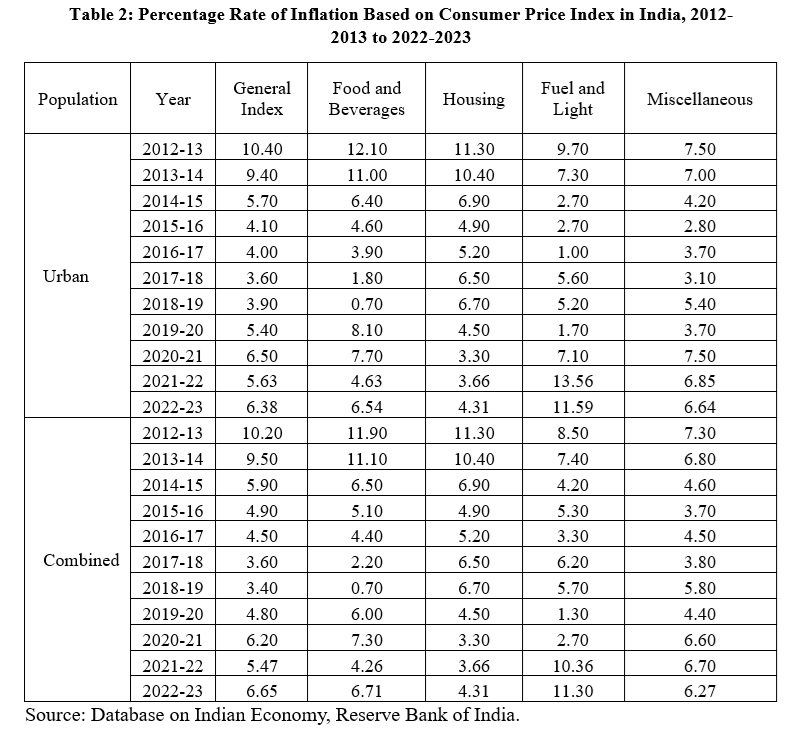

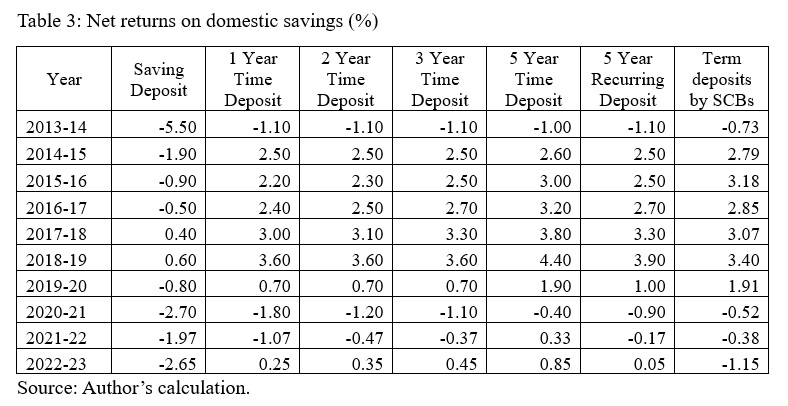

However, the relationship between interest rates and savings is not straightforward. Inflation plays a crucial role in determining the real return on savings. If inflation outpaces interest rates, as has been the case in India for much of the past decade, savings can actually depreciate in value. This discourages individuals from saving, potentially impacting aggregate demand and hindering future investment opportunities.

READ | Budget 2025: Infrastructure blitz may continue; green energy, welfare schemes focus areas

At the household level, interest rates can have both an income effect, due to increased interest earnings, and a substitution effect, where current consumption is deferred in favour of future consumption. However, this relationship is influenced by several economic variables including inflation.

The real return on savings is determined by the inflation rate; if inflation exceeds the interest rate, savings yield negative returns, prompting individuals to prefer current consumption, which can reduce future consumption expenditure and the availability of funds for investment, potentially impacting aggregate demand significantly. John Maynard Keynes argued that in developing countries like India, effective demand could be generated through increased investment and consumption expenditures, which have a significant impact on national output and the value of the multiplier, respectively.

Additionally, taxation adds another layer of complexity. Higher tax rates directly impact the net return on savings, further dampening the incentive to save. This is particularly critical for India’s development goals, which rely heavily on domestic savings to fuel infrastructure and manufacturing projects. The country faces unique challenges in terms of low urbanisation, limited per capita income, and a large middle-income population, all of which contribute to lower national savings rates. Therefore, implementing policies that encourage savings becomes even more crucial.

India’s development needs, particularly in infrastructure and manufacturing, rely heavily on domestic savings as the primary source of loanable funds. However, challenges such as low urbanisation, low per capita income, and a significant middle-income population impose constraints on national savings levels, necessitating incentives to encourage savings.

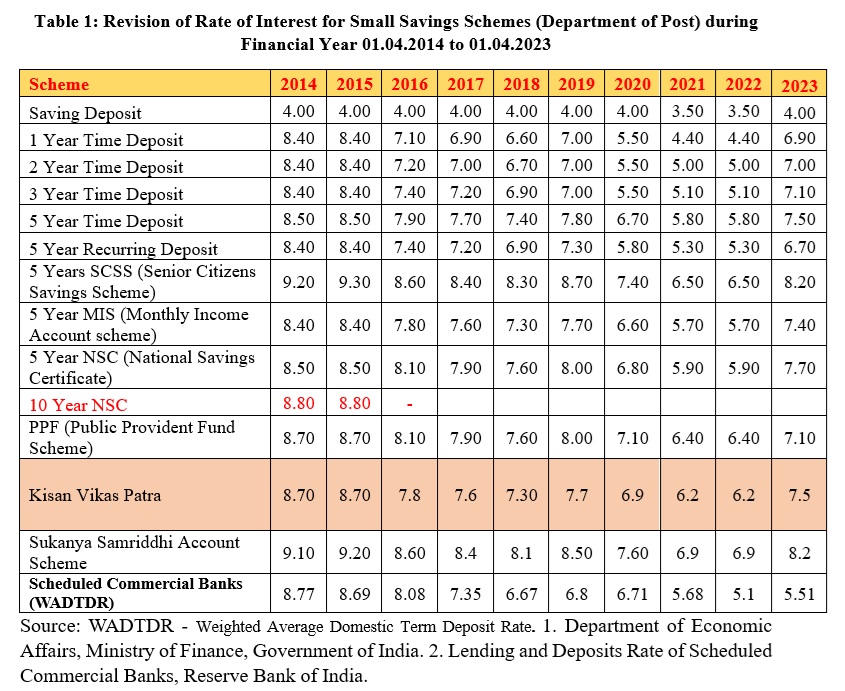

Over the past decade, interest rates on savings, including those offered by post offices and scheduled commercial banks (SCBs), have been on a downward trend. For example, the savings rate of SCBs has decreased from a range of 3.50 percent to 4.00 percent before August 2017 to between 2.70 percent and 3.00 percent. Similarly, term deposit rates have seen significant reductions, affecting popular schemes like the Public Provident Fund (PPF), National Savings Certificate (NSC), and Kisan Vikas Patra, with the NSC for 10 years being discontinued.

Conversely, inflation has remained high over the last decade, eroding the purchasing power of savings. With inflation rates often exceeding the target of 4 percent per annum, savings have seen negative or low returns, especially in demand deposits and term deposits at SCBs. This situation has led to a serious loss of purchasing power for savings account holders, with net returns (interest rate minus inflation rate) on various types of domestic savings being negative in recent years.

Budget 2025 can help boost savings

Given these trends, policymakers are urged to implement measures in the upcoming full-fledged budget that incentivise savings. One proposal is to make interest income on deposits of less than five years tax-free, including both demand and time deposits, and to consider making interest income on demand deposits entirely tax-free. Such policies would not only encourage future consumption expenditure but also increase the supply of investible funds, a critical need for the Indian economy at this juncture.

In the upcoming full-fledged budget, policymakers have an opportunity to address these challenges head-on. One potential solution is to introduce tax-free interest income on deposits, particularly for shorter durations like five years or less. This would directly address the erosion of savings by inflation and make saving more attractive for individuals in all tax brackets. By increasing the overall savings rate, such policies can drive future consumption, boost the availability of loanable funds, and fuel the investments needed to propel India’s economic growth.

(Nagendra Kumar Maurya is Assistant Professor of Applied Economics at Lucknow University. Puneet Kumar Shrivastav is Assistant Director at NILERD, Delhi. Views expressed are personal.)