The Union Budget 2025-26 presented by finance minister Nirmala Sitharaman has introduced significant income tax relief measures aimed at alleviating the financial burden on the middle class. In light of slowing GDP growth and declining consumption, the government has revised tax slabs under the new tax regime, offering much-needed relief. However, the move has also raised questions regarding its economic impact, potential fiscal constraints, and long-term implications.

The income tax relief was made necessary by a confluence of economic and policy imperatives. Stagnant wage growth, coupled with persistent inflation, has eroded household purchasing power, particularly for the middle class. Rising costs of essential services like healthcare and education have further squeezed disposable incomes, necessitating fiscal intervention. Additionally, India’s tax slabs had remained largely unchanged despite shifts in economic conditions, making reliefs crucial to restoring parity. By easing the tax burden, the government seeks to stimulate consumption, enhance savings, and provide a cushion against economic uncertainties, ultimately fostering a more resilient and growth-oriented economy.

READ | Deep correction: India’s stock market may experience a hard landing

Highlights of income tax reforms

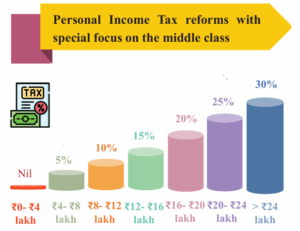

Nil tax for annual income up to Rs 12 Lakh: The tax-free income threshold under the new income tax regime has been raised from Rs 7 lakh to Rs 12 lakh, significantly increasing disposable income for middle-class households.

Increase in basic exemption limit: The basic exemption limit has been hiked from Rs 3 lakh to Rs 4 lakh under the new regime, marking a continued effort to expand tax relief.

Senior citizens’ tax benefits: The tax deduction limit for senior citizens has been doubled from Rs 50,000 to Rs 1 lakh, providing much-needed support to retirees.

Rationalisation of TDS: The government has proposed simplifying the Tax Deduction at Source (TDS) regime to enhance ease of compliance.

New Income Tax Bill: A comprehensive new tax legislation is set to be tabled, which the FM describes as an effort to ensure fairness and justice in taxation.

Why these changes were necessary

Government data show that while inflation has remained persistently high, wage growth has not kept pace. The lack of inflation-adjusted tax reforms over the years had left the middle class burdened with relatively higher taxes. The latest changes seek to correct this imbalance by increasing the tax-exempt limit and reducing overall liabilities.

The Economic Survey 2025 projected GDP growth at a four-year low of 6.4%, with a slightly better outlook for FY26 at 6.3%-6.8%. To counter the slowdown, the government aims to put more money in the hands of taxpayers, hoping that increased consumer spending will drive economic momentum.

The concessional tax regime introduced in Budget 2020 has gained traction, with 72% of taxpayers opting for it in FY24-25. The government appears to be incentivising its adoption by further sweetening the deal. The long-term objective may be to gradually phase out the old tax regime and create a simplified, exemption-free taxation system

Reports suggest a steep decline in mid-income home sales, with cities like Hyderabad, Mumbai, and Delhi-NCR seeing a 36% drop in two years. High loan interest rates and stagnant wages have discouraged home buying. Tax reliefs, especially in combination with potential housing incentives, may help reverse this trend and spur real estate demand.

Fiscal trade-offs of tax cuts

While these tax cuts will bring relief to individuals, the government is set to forego Rs 1 lakh crore in direct tax revenue and Rs 2,600 crore in indirect taxes. This raises important questions:

Will Capex Be Affected? Experts are concerned that to offset revenue losses, the government may cut back on capital expenditure (capex), which is crucial for infrastructure and economic growth.

The government must strike a balance between immediate relief and maintaining a sustainable fiscal deficit. While increased consumption may boost GST collections, it remains uncertain whether it will fully compensate for the revenue loss.

Implications for the economy

Higher disposable income could lead to a rise in consumer spending, potentially benefiting sectors like FMCG, automobiles, and real estate. However, much depends on whether people choose to spend or save their additional income, especially in an uncertain economic environment.

Interestingly, despite the significant tax relief, the stock markets remained tepid, with Sensex and Nifty showing only marginal movements. This suggests that investors may be more concerned about potential fiscal constraints than short-term boosts to consumption.

The government’s consistent push towards the new tax regime raises speculation about whether the old tax structure will eventually be phased out. While the new regime offers lower rates, it eliminates deductions and exemptions that benefit long-term savers and homebuyers.

The tax relief measures in Union Budget 2025-26 are a step towards making taxation more equitable and responsive to economic realities. While these changes provide immediate financial relief, their long-term success will depend on whether they stimulate economic activity without compromising fiscal stability. As the government prepares to table a new income tax bill, taxpayers and economists alike will be watching closely to see if this marks the beginning of a broader tax reform agenda.