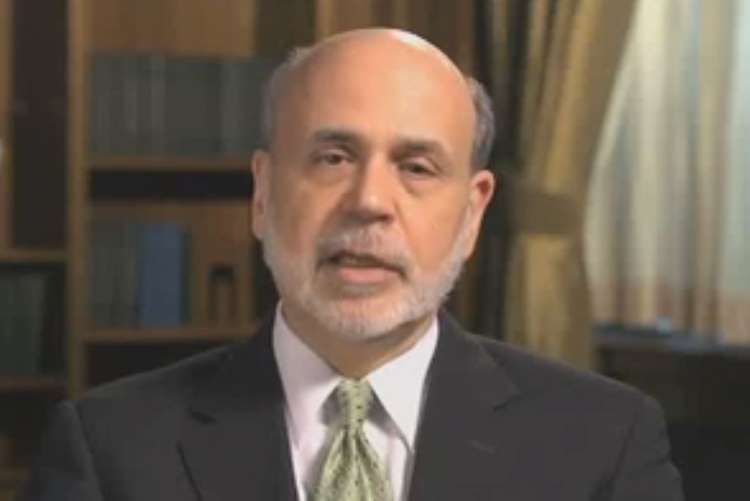

Three economists including former US Federal Reserve Chairman Ben Bernanke have been conferred the prestigious Nobel Economics Prize for their work on the relationship between banking crises and the economy. The trio of American economists Bernanke, Douglas W Diamond and Philip H Dybvi received the prize for their research that showed how bank collapses could impact efficient allocation of capital and bring the economy to a standstill. Their research clarifies how to make banks less vulnerable in crises and how bank collapses exacerbate financial crises.

Their study is of great practical importance in regulating financial markets and dealing with financial crises, the Royal Swedish Academy of Sciences said. The research came in handy when the Covid-19 pandemic broke out in 2020. The governments were able to take significant steps to avoid a global financial crisis. The laureates’ insights also played a critical role in ensuring that crisis did not develop into deep depressions with catastrophic consequences for the society.

The economics prize is not one of the original five awards founded in 1895 as per the inventor of dynamite Alfred Nobel. Instead, it was established by Sweden’s central bank and was awarded first in 1969. The formal name of the prize is Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel. The award carries a prize money of 10 million Swedish kronor which equates to nearly Rs 7.31 crore. The same is shared equally between the laureates.

READ I eRupee explained: How will India’s CBDC work

Research that bagged economics Nobel

Before Bernanke came up with his research, it was believed that a financial crisis leads to banking collapse but his paper proved otherwise. His 1983 paper proved it was exactly the opposite — that bank failures were the cause of financial crises. His work analysed the Great Depression of the 1930s which saw banks collapse everywhere, people being forced to leave their homes, and widespread starvation occur even in relatively rich countries, the Academy said. While what began in the US as a fall of industrial production, the crisis spread like wildfire and led to a deep depression in most of the world.

Countries like Great Britain, Germany and Australia were engulfed by the crisis and started reporting massive job losses. In Chile, national income fell by 33% between 1929 and 1932. Bernanke established that bank runs were the key reason why normal recessions spiraled into economic crises. He further demonstrated that the economy did not begin to recover until the government finally implemented powerful measures to prevent additional panic.

The research by the trio raised pertinent questions such as: if banking collapses can cause so much damage, could we manage without banks; must banks be so unstable and, if so, why; how can society improve the stability of the banking system; and why do the consequences of a banking crisis last so long.

READ I Rural development: Data use for recreation limits potential of digital technology

A fundamental problem was also discovered which makes banks and money volatile and vulnerable to shocks sometimes. Earlier this year, China saw bank runs as people were unable to withdraw their money from a few rural banks. A bank run may happen where many savers try to withdraw their money simultaneously in a panic. Banks run out of money and dives into bankruptcy.

Diamond and Dybvig worked together to develop theoretical models explaining why banks exist and how their role in society makes them vulnerable to rumours about their impending collapse. Since the financial collapse of 2008, banks are being seen as institutions which mooch people off their money. Diamond Dybvig’s research states that a world without banks will make any long-term investment impossible. Diamond highlighted the how banks can provide depositors open access to their funds while giving the option of long-term loans to borrowers.

The research puts the onus of lessening the vulnerability of banks on the society. These insights form the foundation of modern bank regulation, the Academy said. It is often discussed how banks need to be more cautious in assessing the loans they give out, or how bailing out banks in crisis might turn out to be.

With the rise of cryptocurrencies, banks around the world are scrambling to stay relevant. The shift towards digital currencies and the general digitisation of money also poses a challenge to the future of banks. Many are now looking into developing their own central bank digital currencies (CBDC). Most recently, the Reserve Bank of India (RBI) released an outline for plans of a digital rupee CBDC.

Questions over Nobel to Ben Bernanke

The academy says this research has been useful for central banks. But alas, it did not help the Federal Reserve stave off the meltdown in 2008 when Bernanke was holding key positions with it. The monetary policy followed by Bernanke and his predecessor Alan Greenspan has been accused of creating the monetary conditions that led to the biggest financial crisis after the Great Depression.

Bernanke was Fed Governor between 2002 and 2005. He kept on claiming that a possible deflation was the biggest threat to the US economy and convinced Greenspan to keep interest rates unusually low in the runup to the big crisis. This led to asset bubbles — one of which led to the sub-prime crisis that led to the collapse of the banking system.

Bernanke as Fed Chairman between 2006 and 2014 again failed to anticipate the great meltdown. Under him, the Fed ignored the asset bubbles created by easy monetary policy and believed regulation can ensure financial stability. Suppressed interest rates and quantitative easing demolished markets in 2008. Fed under Chairman Jerome Powell followed this disastrous course of action during the pandemic crisis. So, where did Bernanke’s research help? The world can only hope that the current crisis will not lead to another financial meltdown.