China gold discovery: The recent discovery of a huge gold deposit in China’s Hunan province has sent ripples through global markets. With an estimated reserve of 1,100 tonnes valued at $83 billion, this marks one of the largest gold finds in history. Unearthed in the Wangu gold field, the deposit’s high-quality veins have reignited conversations about gold’s role in the global economy, bullion markets, and as a hedge for investors.

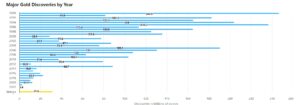

At a time when global gold reserves face depletion, this discovery is not just significant but transformative. For perspective, this deposit surpasses South Africa’s South Deep mine, long considered the world’s largest reserve. Such a find has consequences far beyond China’s borders.

READ | Stock market in 2025: Investors eye gains as Dalal Street meets Trump 2.0

China gold discovery: Impact on supply and prices

China, already the largest gold producer, contributes 10% of the global supply. However, its consumption far outstrips its production. While the new discovery could reduce China’s dependence on imports from nations like Australia and South Africa, it is unlikely to revolutionise the global supply-demand balance overnight.

The news initially caused gold prices to surge to $2,700 per ounce, near-record highs. This paradoxical price movement underscores how markets view the long-term strategic importance of gold. With inflationary pressures and geopolitical uncertainties on the horizon, gold’s allure as a safe-haven asset remains undiminished.

Analysts project that gold prices could reach $3,000 per ounce in the coming year, citing factors such as central bank purchases and geopolitical tensions as key drivers. This projection aligns with the recent trend of central banks increasing their gold reserves to diversify away from the US dollar and mitigate risks from inflation.

The World Gold Council anticipates a more modest growth trajectory for gold in 2025, following a record year in 2024 where prices rose by 28%. They attribute the expected slowdown to decreased consumer demand, particularly in China, where a significant portion of gold consumption is linked to luxury goods and investments. However, the WGC notes that central bank purchases and increased interest in gold ETFs will continue to provide price support.

Central banks worldwide, including India’s Reserve Bank, may use this opportunity to strengthen their gold reserves. This is particularly relevant as nations pivot to gold to hedge against currency fluctuations and geopolitical instability. Increased reserves could stabilise currencies and offer long-term economic resilience.

Implications for bullion and jewellery demand

China’s cultural affinity for gold is well-known. From jewellery to gold bars and coins, Chinese consumers have consistently led global demand. In 2023, this segment accounted for 630 tonnes, a 10% increase from the previous year.

This discovery will likely reinforce China’s position as the world’s largest gold consumer and producer. However, an increase in domestic supply could stabilise local markets and temporarily moderate global gold prices, offering a potential opportunity for international buyers.

A short-term window for buying

India, one of the largest gold importers, stands to benefit from any temporary stabilisation in gold prices. For retail investors, this discovery presents a short-term opportunity to purchase gold at relatively moderate prices before potential future price hikes.

Gold’s role as a portfolio diversifier and inflation hedge cannot be overstated, especially in uncertain economic times. Indian investors should monitor global gold prices closely, as market corrections could open doors for strategic accumulation.

Indian companies involved in gold trading and jewellery, such as Rajesh Exports and Titan, could see volatility. Lower raw material costs might boost profit margins, but any significant dip in global gold prices could affect their revenues. Conversely, increased demand for gold products could offset these challenges, benefiting long-term stakeholders.

A safe haven amid uncertainty

Gold’s intrinsic value lies in its ability to hedge against economic instability. Events like China’s gold discovery reaffirm gold’s enduring role as a store of value. As governments worldwide face mounting debt, trade imbalances, and geopolitical tensions, gold remains a bulwark against economic shocks.

The discovery could also spur renewed interest in gold-backed financial instruments like exchange-traded funds (ETFs) and sovereign gold bonds, particularly for investors seeking long-term stability.

China’s strategic leverage

The discovery could bolster China’s geopolitical clout. By increasing its gold reserves, China may use the precious metal to strengthen its currency and challenge the dominance of the US dollar in global trade. This move aligns with China’s broader strategy of diversifying its foreign exchange reserves and reducing reliance on Western financial systems.

With the newfound reserves, China could strengthen its financial markets by backing its currency with gold reserves, a move that may amplify its role in international trade and reduce dependence on Western financial systems.

For nations like India, this underscores the need to enhance domestic gold production and explore alternative strategies to safeguard economic interests.

China’s monumental gold discovery is more than a geological marvel; it is a game-changer for global markets. While its immediate impact on supply and prices might be limited, the long-term implications are profound.

For the world economy, this find symbolises both opportunity and challenge. For investors, it reiterates the timeless value of gold as a hedge against uncertainty. As nations and markets adapt to this new reality, the shimmering promise of gold continues to captivate economies and portfolios alike.

Indian investors, in particular, must remain vigilant. This discovery could reshape gold dynamics in unexpected ways, offering both risks and opportunities. The key lies in staying informed and strategically leveraging the golden moment. By keeping a close eye on global gold trends, investors can turn this glittering news into a golden opportunity.