China, the world’s second-largest economy, faces a mounting crisis, sparking fears of a ripple effect on the global economic landscape. Recent developments, including a surge in youth unemployment and an official data report revealing deflation in July, have intensified worries about China’s economic health.

Adding to the growing unease, a prominent trust defaulted on payments for numerous investment products amidst a real estate downturn. This default, coupled with the deepening property sector crisis, raises concerns that the struggling real estate market could further suppress the nation’s economic growth, potentially leading to a domino effect on the world economy.

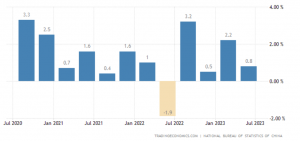

In response to these challenges, China’s central bank has acted by reducing its key policy rate. This move underscores the urgency to bolster economic growth, which experienced a sharp decline in the past quarter, ending in June. However, Beijing’s economic troubles are far from over. Just last week, the country officially entered a period of deflation, heightening the urgency for its leaders to take swift measures to stimulate economic revival.

READ | Deflation in Chinese economy will create global ripples

What’s ailing China’s economy?

The issue of unemployment is particularly troubling. A June survey indicated that a staggering 21.3% of urban individuals aged 16 to 24 struggle to secure jobs, even amidst talks of economic recovery following the end of strict Covid-19 lockdowns. This translates to over one-fifth of young Chinese facing unemployment in what is known as the manufacturing hub of the world. The revelation led to widespread criticism, prompting the suspension of unemployment data publication by age group.

China’s economic challenges extend beyond unemployment. Consumer spending growth has slowed, with July figures showing a decline to 2.5% compared to the previous month’s 3.1%.

China consumer price inflation

The trouble started with the Covid-19 pandemic which disrupted supply chains, dampened demand, and led to widespread lockdowns. The problems were worsened by the Chinese government’s crackdown on the tech giants such as Alibaba and Tencent, which led to job losses. China is also facing a demographic challenge with a rapidly aging population, which will put a strain on the economy in the years to come.

China GDP growth rate

The property market, which is a major driver of China’s economy, has been facing a slump for several years. This has led to defaults on loans and a decline in investment. Another reason for the Chinese economic crisis was the deleveraging campaign for reducing the country’s debt levels.

Manufacturing and exports also face hurdles. As the United States and Europe grapple with inflation, their respective central banks have been compelled to raise interest rates. This has dampened demand from these critical consumer markets, dealing a blow to the Chinese economy. Consequently, China’s factory output growth has slowed to 3.7% from 4.4%, according to recent data.

The repercussions of China’s economic turmoil extend globally. The implications are far-reaching, with experts agreeing that China’s problems have the potential to disrupt the global demand-supply equilibrium. This comes at a precarious time as the world is just beginning to recover from a slowdown caused by a convergence of factors including inflation, geopolitical conflicts, and extreme weather events.

Oil prices have surged in response to China’s economic challenges, as traders interpret China’s central bank announcement of property policy adjustments as a signal that China will not tolerate economic weakness.

China’s growth target of approximately 5% for the year is at risk of being missed. With China accounting for nearly 18% of global GDP in 2022, a slowdown in its economy has a significant drag on global growth prospects. Investment banks and the International Monetary Fund have already revised down their GDP growth predictions for China in 2023. The IMF’s latest World Economic Outlook estimates China’s contribution to global GDP at over 22%.

Chinese authorities are considering steps to stabilize the economy, including a potential cut to the stamp duty on stock trades. However, economists caution that these measures may fall short, advocating for more substantial actions such as tax cuts or government-funded consumption incentives to boost consumer confidence and business activity.

Unlike past slowdowns, experts suggest there is no quick fix to China’s current predicament. The Chinese government faces the formidable challenge of encouraging households to spend more and save less in an environment of economic decline, complicated by the threat of deflation. Swift resolution of China’s economic challenges is imperative to avoid the potential repercussions of a global economic turmoil stemming from the heart of the world’s second-largest economy.

Anil Nair is Founder and Editor, Policy Circle.