The performance of the Chinese economy in 2023 is a story of mixed signals. The world’s second largest economy bloomed with surprising strength, boasting growth in retail sales, industrial output, and investment. This initial vigour has fuelled optimism, but beneath the surface, a question about the sustainability of the growth momentum lingers.

China narrowly surpassed its 2023 growth target of 5%, clocking in at 5.2%, according to official figures. However, the year also saw some vulnerabilities of the economy getting exposed. Retail sales growth slowed in the latter half of the year, and the property sector remains sluggish, with residential sales continuing to decline. Despite a recent uptick in commercial property, concerns linger about the potential for bad loans to impact major banks.

The Chinese economy saw manufacturing activity expanding in March, after shrinking for five consecutive months beginning October 2023. The manufacturing purchasing managers index rose to 50.8 from 49.1 in February, signalling a recovery on the world´s second largest economy. The PMI number offers the first official confirmation of an economic resurgence.

Observers signal a cautious optimism, tempered by the reality of higher interest rates dampening borrowing and hints of lenders tightening the reins. The duality of growth and fragility is emblematic of the Chinese economy’s current state.

READ I Current account deficit narrows on services boom; trade deficit worries linger

Chinese economy at a crossroads

Looking beyond the immediate, Chinese economy stands at a crossroads, its future trajectory fraught with both promise and peril. The narrative of China’s economy is shifting from one of unprecedented growth to a more nuanced story of adaptation and transformation.

A crucial perspective to consider is how China’s economic trajectory is entangled with global economic dynamics. The US-China trade tensions and shifts in global supply chains represent significant variables that could influence China’s economic performance. The recalibration of global trade networks, partly fuelled by geopolitical tensions and a push for supply chain diversification, could either pose challenges or open new avenues for China’s export-driven sectors. This element of global economic interdependence is critical to understanding China’s economic sustainability and growth potential.

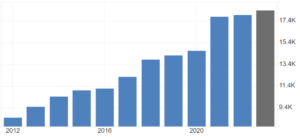

China gross domestic product ($billion)

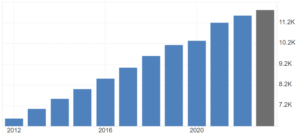

China GDP per capita (in $)

The nation’s once-thriving engines of growth — industrialisation, urbanisation, and globalisation — are yielding to new imperatives. The transition to a consumption-driven, value-added, and technologically advanced economy is the new chapter in China’s economic evolution. This shift is not merely a policy choice but a necessity, as the traditional drivers of growth wane in potency.

Another missing piece in the analysis is the role of technological innovation and intellectual property (IP) rights in shaping China’s economic future. As China transitions from an investment-led to an innovation-driven economy, the emphasis on technological advancement and the protection of IP rights will become increasingly prominent. The nation’s efforts to climb the technological value chain, underscored by investments in sectors like semiconductors and artificial intelligence, hinge on robust IP frameworks. This will not only bolster domestic innovation but also affect China’s trade relations and its position in the global economic hierarchy.

Balancing growth and sustainability

The real test for China will be in balancing short-term economic revitalisation with long-term sustainability. The transition towards a ‘new economy’ emphasises sectors like green technology, digital infrastructure, and advanced manufacturing. These are not just buzzwords but the pillars upon which China’s future economic aspirations rest.

As China endeavours to redefine its growth model, the global investment community remains watchful, weighing the scales of opportunity against risk. The narrative is no longer about whether China can grow, but how it will grow, and what this means for global economic dynamics.

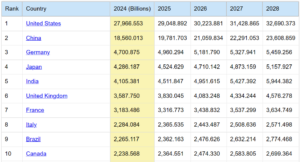

World’s largest economies in terms of GDP

The environmental sustainability agenda and the emergence of green finance are also pivotal to China’s economic recalibration. As China commits to peak carbon emissions by 2030 and carbon neutrality by 2060, the role of green finance in facilitating this transition is paramount. The burgeoning market for green bonds and sustainable investments in China not only reflects the country’s environmental commitments but also represents a growing sector that could drive future economic growth. This green transition, coupled with China’s advancements in renewable energy technologies, positions the nation as a potential leader in the global shift towards sustainability.

The way ahead for China

The rise of Chinese economy is emblematic of a broader global shift, where traditional growth narratives are being rewritten. As it expands, the implications resonate far beyond its borders, signalling a new era of economic realignment. The story of China’s economy is not just about numbers and targets; it is about strategic shifts, resilience, and the quest for a sustainable future.

China’s economic future holds not just challenges but also opportunities for reinvention and renewal. The global audience, from policymakers to investors, watches keenly, knowing that in China’s economic narrative lies clues to the emerging global economic order.

To understand China’s economic strategy, it is essential to understand the impact of domestic policy measures and global economic forces. China’s approach to managing its economic transition is multipronged, focusing on strategic sectors that promise sustainable growth while maintaining its trade relations and rolling out domestic restructuring.

For instance, the push towards technological innovation is not just about economic growth; it is about establishing a new paradigm in which China moves from being the world’s factory to a global leader in high-tech industries. This transition requires not only investment in technology but also the cultivation of a skilled workforce and the establishment of legal and regulatory frameworks that protect intellectual property and encourage innovation.

Similarly, the emphasis on green finance and sustainable investment reflects a broader recognition of the need for environmental stewardship as a core component of economic policy. This move towards sustainability is not only about meeting international commitments on climate change but also about tapping into new economic opportunities that these sectors present, from renewable energy to eco-friendly technologies.

China’s economic future is not just a story of overcoming current challenges but also of seizing new opportunities. The nation’s ability to balance these elements will determine not only its own economic destiny but also the shape of the global economy in the decades to come.