By Santosh Kumar Das

The world is fighting an unprecedented economic crisis. India is one of the worst sufferers of the economic disruption induced by the Covid-19 pandemic. The country is staring at a deep recession and an uncertain economic recovery. The recovery will depend to a large extent on the revival strategy adopted by the government. While looking for solutions, it is important to understand the magnitude of the current crisis.

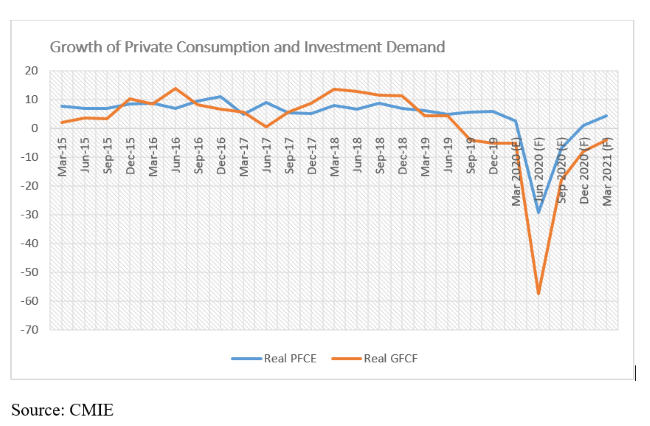

The key challenge for the Indian economy is a substantial contraction in domestic demand. Private consumption which constitutes more than half of the aggregate demand in the economy is facing a severe slump. According to a latest CMIE study, Consumer Pyramids Household Survey, nearly 12 crore people lost their jobs in April 2020. The survey also shows that about 49% of the households were financially better off last year compared with the current year. The survey estimates that the Private Final Consumption Expenditure (PFCE) has shrunk by 42% in April 2020. CMIE predicts that the consumption demand growth during the first quarter (Q1) of the current fiscal, on year on year basis is likely to contract by 29.3% due to demand compression. The PFCE growth, though likely to improve in the second quarter, will continue to be at a negative terrain (-6.8%).

READ I India must fortify foreign investment screening rules to escape WTO scrutiny

Similarly, the investment demand as reflected in gross fixed capital formation(GFCF) is also likely to see a significant contraction, though quarterly data suggests that investment demand did contract even before the pandemic struck. During the last three quarters of 2019-20, the investment demand contracted 4.1%, 5.2%, and 5%, respectively. CMIE predicts that the GFCF is likely to contract by 57.5% in the first quarter of fiscal 2020-21. The CMIE forecast also suggests that the GFCF growth will remain negative in the subsequent quarters of the current fiscal.

READ I Focus on life, livelihood key to an inclusive post-Covid economy

Ideally, an economy that is facing a deep recession due to contraction in demand should rely on fiscal measures for revival. Monetary measures have severe limitations in addressing the issue of large-scale unemployment, contraction in private consumption expenditure and excess capacity. Fiscal measures such as an increase in government spending can effectively pull the economy out of a recession by reviving demand.

During the global financial crisis of 2008 and the Great Depression in 1930s, fiscal policy measures have been effective in economic recovery. During the Great Depression, there was a considerable amount of government spending in the US in the form of personal transfers and employment schemes. Huge spending on employment schemes resulted in improvements in public infrastructure. More government spending led to demand revival which, in turn, resulted in economic expansion.

READ I India’s migrant labour exodus and the missing trade unions

Like several other countries, India has also announced an economic package to revive its economy. The Narendra Modi government has rolled out a Rs 21 lakh crore stimulus package. It includes fiscal measures of worth around Rs 13 lakh crore (6.4% of the GDP) and monetary and financial measures amounting to Rs 8 lakh crore (3.9% of the GDP). The fiscal measures include expenditure on food security, direct cash transfer, allocation for MGNREGA, while monetary measures include policy rate cuts as well as measures to boost liquidity.

The economic package, however, may not be effective, given the fact that the net fiscal impact is very less and the emphasis is more on the monetary measures like liquidity infusion and rate cuts. Various estimates suggest that the net fiscal impact of the steps announced on the economy is likely to be between 0.75% and 1% of the GDP. The net impact is low as the size of new spending is considerably low. Several measures announced as part of economic package are schemes that existed before.

In order to revive demand in the economy, the fiscal policy must play an active role. The government needs to roll out new spending to boost private consumption demand which, in turn, will drive investment demand. The government also needs to step up spending on employment schemes and transfers as they will have an immediate impact on consumption demand.

(Santosh Kumar Das is Assistant Professor, Institute for Studies in Industrial Development, New Delhi. Views are personal.)

Policy Circle is now on Telegram. For analysis & opinion on economy, policy, governance and more, subscribe to policycircle on Telegram.