Tight prudential norms needed for cryptocurrency: Regulation and supervision are key to ensuring the safety of participants, stakeholders and the financial system. As money and monetary instruments are highly liquid, the regulation and supervision of these commodities has to be rigorous. Multilateral institutions like Bank for International Settlements and International Monetary Fund are helping countries understand the risks associated with cryptocurrency and reach a consensus on the regulatory framework for them, like they did for global minimum tax.

The norms have not been standardised yet because cryptocurrency is an immature asset class with more than 15,000 instruments, lack of uniformity of products and constant evolution. In view of the challenges related to cryptocurrency, including large-scale financial crimes in the short span of its existence, it is necessary to understand the instruments and the exchanges where settlements would take place.

READ I Cryptocurrency: India set to chart middle path between ban and free trading

Crypto regulation: Lesson from history

The history of paper money in the US is interesting and contextual. In February 1690 Massachusetts Bay Colony issued the first paper money in the US. Following this, during the American revolution of 1775, colonial leaders in the US tried to replicate the Massachusetts paper experiment by issuing continentals (without any backing of gold or silver) to fund the American revolutionary war. The continentals crashed by 1785 due to many reasons but primarily because of the lack of asset backing.

Similarly interesting is the history of the evolution of paper currency, starting with bank notes which can be traced back to the issuance of promissory notes and IOUs. Bank notes were issued by banks and could be converted into gold or silver as promised by the bank. For international trade purposes, bills of exchange emerged. In the 17th century, the goldsmith bankers of London began to give out receipts as payable to the bearer of documents, rather than account/deposit holders.

These instruments could be issued by private entities – business houses and even individuals, government banks, private banks and transportation suppliers such as canal, turnpike and railroad companies. Coal mining and lumber companies issued money (called scrip) to pay members. Merchants, farmers and community groups also issued their own money. In the free banking era in the 18th century, many entities issued paper currency.

The most important concern was that during a crisis, people suffered and the government had to intervene, as they did in the US in March 1933 when payment was suspended for four days by declaring a compulsory bank holiday. The multiplicity of instruments in the market and their issuers complicated the money market. Hence, in the US, the responsibility of standardisation of bank notes and issuing authority was fixed with the Federal Reserve in the 1930s. This practice was also followed in other central banks, including Bank of England.

READ I Cryptocurrency: Govt, RBI must exercise utmost caution

Cryptocurrency: A problem of multiplicity

There are more than 1,500 cryptocurrencies prevailing globally and there is a total lack of transparency. Thus, key factors in the present situation are the number and types of instruments, availability of the instruments, transparency of transactions, protection of the investors/consumers and redressal mechanisms. It is necessary to establish standards for crypto assets.

The data that monitors the crypto ecosystem by identifying data gaps needs to be strengthened. Regulatory mechanisms should be established for each of the risks that crypto assets could pose to the economy. In general, the macroeconomic policies and prudential norms of banks should be strengthened to build an inherent resilience in the economy and the financial system.

In the history of the evolution of money in the UK and US, especially paper currency, the authorities made efforts to standardise the negotiable instruments for the sake of regulation and supervision. Earlier, when commodity money was prevalent, the focus was on concentration of one commodity and gold emerged as the consensus commodity. Similarly, given the multiplicity of cryptocurrencies, the consensus would have to evolve around one currency before any credibility or universal acceptability is considered.

READ I Cryptocurrency: India should go in for an outright ban

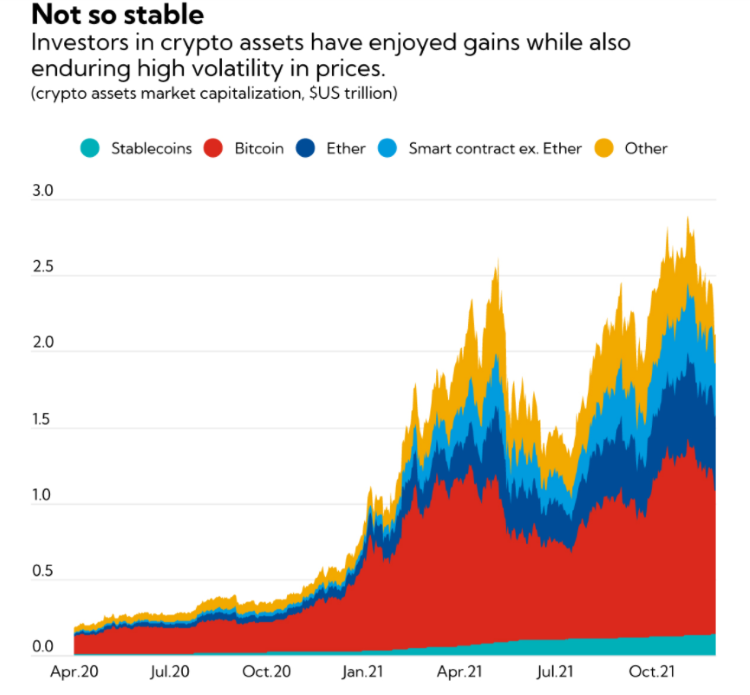

Cryptocurrencies have associated risks as unexpected changes in market sentiment can lead to sharp and sudden price movement that can have direct implications for the balance sheet of the individual or the firm. In a country like India, continent-sized with different income levels and a large segment of society which is risk-taking but financially vulnerable, uncertainty around the crypto ecosystem can harm the fragile financial stability. Therefore, India should cautiously experiment with new and risky instruments.

These new instruments present numerous risks for banks and so banks that acquire such assets should carefully institute mechanisms that collect monitorable data to ensure due diligence, disclosure, effective governance, risk management, and prudential supervision. The challenges of crypto assets include operational and financial integrity risks from providers in absence of adequate disclosures. The need is to enhance the ability to monitor the crypto ecosystem and ensure regulation corresponds with the risks crypto poses to the financial sector.

The risks associated with cryptocurrency should be closely monitored, given the inadequate operational and monetary framework in most jurisdictions. Most importantly, macroeconomic policies should be strengthened, especially in emerging markets, where crypto assets can circumvent exchange and capital control restrictions and also destabilize capital flows.

There are numerous aspects of cryptocurrency that are still evolving. Multilateral institutions have yet to formalize the norms to assess, estimate and establish governance for these instruments. The issue of prudential regulation also has to be determined but only after due identification of the instruments, issuers and working mechanism of the trading platforms/exchanges.

Given that the instrument is not understood even by financial pundits, the unknown motive of the invention by unknown miners and uncertain categories of investors, it would be most appropriate if the government and the RBI would consider constituting a high-powered committee to examine all the issues related to cryptocurrencies and then make recommendations for the government to adopt. The fiscal and monetary authorities should not allow opaque instruments to infect the economy and the financial system.

Dr Charan Sigh is a Delhi-based economist. He is the chief executive of EGROW Foundation, a Noida-based think tank, and former Non Executive Chairman of Punjab & Sind Bank. He has served as RBI Chair professor at the Indian Institute of Management, Bangalore.