The Federal Reserve’s 0.25 percentage points rate cut comes amid heightened economic uncertainty, as President-elect Donald Trump prepares to assume office. The combination of monetary easing and anticipated fiscal changes sets the stage for what could be a profound shift in US economic policy. The Fed’s approach to rate cuts under Chair Jerome Powell seeks to manage inflation while maintaining stable growth, but the incoming administration’s aggressive proposals on taxes, tariffs, and immigration could introduce fresh complexities into the mix.

Under Powell’s leadership, the Fed has focused on restoring inflation levels closer to its 2% target while managing stable employment. Recent data suggest inflation has moderated after peaking in the earlier part of the decade, enabling the Fed to shift toward a more neutral stance. This latest rate cut, along with potential additional cuts in December, seeks to support economic growth without stoking inflationary pressures. Yet, Powell emphasised the need for caution, acknowledging the challenges of evaluating new fiscal policies.

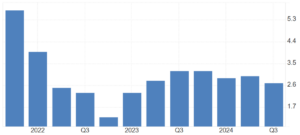

United States: Annual inflation rate

For now, the economic outlook is relatively stable, and Powell expressed confidence in the Fed’s ability to “keep it that way.” However, Trump’s proposed tax cuts and tariffs could radically alter the economic landscape, potentially creating an inflationary environment that complicates the Fed’s rate policy. Analysts from major financial institutions, including JPMorgan Chase and Deutsche Bank, warn that rapid policy shifts might slow the Fed’s rate-cutting cycle or even reverse it if inflation pressures mount.

READ I Trump 2.0: India’s strategic gains and economic challenges

Trump’s economic agenda

President-elect Trump’s proposals have raised concerns about inflation, which could force the Fed to halt or even reverse rate cuts sooner than planned. His plan to introduce broad-based tariffs could lead to higher consumer prices by raising the costs of imported goods. The ripple effect on inflation could compel the Fed to tighten monetary policy sooner than expected, limiting its ability to stimulate growth.

United States: Annual GDP growth rate

Economists, including those at Bank of America, warn that Trump’s tariff policies may derail the Fed cutting cycle if implemented aggressively. Import taxes and heightened spending could increase government borrowing costs, raising bond yields and limiting the Fed’s manoeuvrability. With Treasury yields already rising, the potential for a volatile debt market is high, and mortgage rates could surge, increasing borrowing costs for US households and potentially dampening consumer spending.

Political tensions and monetary independence

Trump and Powell share a complicated history. Trump appointed Powell as Fed Chair in 2017, but tensions arose over monetary policy disagreements. Trump has previously criticised Powell’s reluctance to pursue deep rate cuts, suggesting a preference for a more compliant Fed. Although Powell recently affirmed he will complete his term through 2026, Trump’s renewed influence could place additional pressure on the Fed’s independence, especially if his policies clash with Powell’s priorities.

Any attempts by the White House to influence Fed policy directly would challenge the institution’s independence. The legal framework protecting the Fed from executive interference underscores the delicate balance of maintaining central bank autonomy in the face of political pressures. Powell’s insistence on remaining in office signals a commitment to this independence, yet the potential for conflict remains.

Fed rate cut: Impact on China, India

Trump’s policy mix could have implications beyond US borders, impacting economies from China to emerging markets like India. China, a prime target of Trump’s tariff proposals, may respond with increased fiscal stimulus, potentially triggering trade tensions that could destabilise global markets. Economists predict that China could roll out a stimulus package equal to 2-3% of GDP to offset the impact of US tariffs. Such measures would likely divert foreign investments toward China, drawing resources away from markets like India, which would need to adjust its monetary policy in response to capital flow changes.

Emerging markets may also experience currency volatility as Trump’s policies could push the dollar higher, straining economies reliant on foreign capital. For India, the shifting rate differentials between US and domestic markets could either attract or repel foreign portfolio investments, depending on the Fed’s policy direction.

The recent rate cut holds significant implications for the Indian economy, influencing both capital flows and currency stability. Lower US interest rates may increase the attractiveness of Indian assets for global investors seeking higher yields, potentially bringing an influx of foreign portfolio investment (FPI) into Indian equities and bonds. This could buoy the Indian stock markets and strengthen the rupee in the short term. However, if Trump’s proposed policies, such as tariffs on Chinese goods, fuel inflation in the US, the Fed may be compelled to reverse its rate-cutting stance, leading to volatility in global markets.

For India, the heightened uncertainty around US policy could mean a more cautious stance from the Reserve Bank of India (RBI) in its upcoming policy decisions, as it weighs the balance between supporting growth and maintaining currency stability amidst shifting global financial conditions.

Prospects for growth, investment

Trump’s fiscal expansion plans, notably tax cuts and increased government spending, could initially stimulate the economy, especially in sectors benefiting from defence and infrastructure investment. However, the long-term effect on inflation and interest rates remains uncertain. While tax cuts may spur corporate investment and stock market growth, higher consumer prices due to tariffs could erode disposable income for middle-income households, dampening consumer spending.

The Fed’s monetary policy, while aiming to boost employment and growth, may eventually conflict with fiscal policies that prioritise rapid expansion, leading to a more turbulent economic environment. This divergence raises questions about the sustainability of growth under a Trump administration, where a combination of higher inflation and interest rates could dampen both business investments and household purchasing power.

Future of the Fed’s rate-cutting cycle

The Fed’s latest rate cut reflects confidence in the US economy’s resilience, but the long-term outlook depends on how quickly Trump’s policies materialise. JPMorgan forecasts gradual rate cuts into 2025, with the Fed aiming for a 3.5% federal funds rate. However, the pace of these cuts could slow or halt altogether if fiscal policies trigger inflationary pressures. Analysts predict that Trump’s administration may ultimately lead the Fed to adopt a more conservative stance, potentially concluding the rate-cutting cycle earlier than expected.

The next Fed meeting in December will offer further insights, but for now, the central bank’s direction remains contingent on economic data and fiscal developments. The balance Powell seeks between supporting growth and controlling inflation may become harder to achieve if Trump’s policies fuel inflation or destabilise financial markets.

The US economy stands at a crossroads as it enters a new presidential era, one marked by potentially conflicting economic policies. The Fed’s recent rate cut signals its intention to support steady growth, but Trump’s ambitious fiscal agenda could reshape the economic landscape in unpredictable ways. As the Fed navigates this environment, its independence and responsiveness to inflation risks will be critical to preserving economic stability.

The road ahead will require delicate balancing by both the Fed and the incoming administration to foster sustainable growth without triggering the kind of inflationary spiral that could derail the current recovery. For the time being, the US economy is in a “very good place,” as Powell described it, but how long it stays there may depend on how these complex fiscal and monetary dynamics unfold.