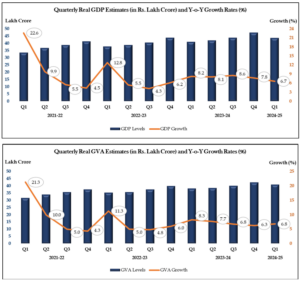

The official GDP growth figures for the first quarter of financial year 2024-25 reflects both the strengths and challenges as the Indian economy. The growth rate of a five-quarter low 6.7% reveals the economy’s resilience amid global headwinds. This figure, though indicative of the economy’s enduring vigour, calls for detailed examination of the forces at play and the broader implications for India’s growth prospects.

The data released by the National Statistical Office (NSO) on Friday reveals a divergence between GDP and Gross Value Added (GVA) growth figures. GVA, which excludes taxes and subsidies, grew at 6.8% in Q1 FY25, slightly higher than the GDP growth rate. Typically, GDP exceeds GVA due to the positive contribution of net indirect taxes, but the current scenario reveals a narrower gap. The slowdown in net indirect taxes, which rose minimally by 3.6%, along with a significant fall in subsidies by 10.9%, played a pivotal role in this alignment. This trend indicates that the growth rates of GVA and GDP may remain aligned in the coming quarters.

READ I Monsoon madness: India braces for heavy rainfall in September

GDP growth and sectoral performance

A sector-wise analysis offers insights into the factors influencing the GDP figures. Agriculture, which has traditionally been the backbone of the Indian economy, posted a modest growth of 2.7%, significantly lower than the 4.2% recorded in the same period of the last fiscal. The reduced agricultural output was largely a consequence of adverse weather conditions, including a poor monsoon in 2023 and heatwaves that dried up reservoirs, impacting crop yields.

The construction sector showed robust growth at 10.5%, driven by labour-intensive projects and increased activity in real estate. Similarly, the electricity, gas, and water supply sectors grew by 10.4%, reflecting increased infrastructure development and demand. Manufacturing, however, saw a slowdown, with growth dipping to 7%, a four-quarter low, as industrial production and corporate profitability faced headwinds.

Consumption and investment

Private final consumption expenditure (PFCE), a key driver of GDP, surged to a six-quarter high of 7.45%, indicating strong household spending. This rise in consumption was partially fuelled by lower food inflation which improved discretionary spending. However, government final consumption expenditure (GFCE) contracted slightly by 0.24%, reflecting a cautious fiscal stance during the election season.

On the investment front, Gross Fixed Capital Formation (GFCF), which represents infrastructure investment, grew by 7.5%, up from 6.46% in the previous quarter. This uptick was primarily driven by increased private sector and household investments, particularly in real estate. Despite a contraction in the Union government’s capital expenditure, which fell by 33% due to the general elections, private sector investment remained resilient, contributing positively to GDP.

Challenges and opportunities

The economic outlook for the Indian economy in the rest of the financial year remains cautiously optimistic. The monsoon season, which has performed well so far with 7% above-normal rainfall, is expected to boost agricultural output in the coming quarters. This, in turn, could enhance rural consumption and stabilise food prices, providing further impetus to GDP growth.

However, the path ahead is not without challenges. The slowdown in manufacturing and the cautious fiscal approach adopted by the government could weigh on overall economic momentum. Additionally, global geopolitical tensions and fluctuating commodity prices pose risks to India’s growth trajectory, potentially reviving inflationary pressures and affecting capital flows.

Chief Economic Advisor V Anantha Nageswaran has indicated that with continued structural reforms and a supportive monsoon, the Indian economy could sustain a growth rate of 7% in the medium term. This optimism is rooted in the alignment between demand and supply-side factors, with private consumption, capital formation, and net exports holding up well despite the headwinds.

India’s GDP growth in the first quarter of FY25 presents a complex picture. While sectors like construction and services show promise, the agricultural and manufacturing sectors highlight vulnerabilities that need addressing. The government’s ability to navigate fiscal constraints, bolster private investment, and leverage favourable monsoon conditions will be crucial in sustaining economic growth. As the global environment remains uncertain, India’s economic policy must remain adaptive and forward-looking to maintain its growth momentum in the coming quarters.