A year has gone by since the Russian forces began the invasion of Ukraine. On February 24, 2022, Russia launched an attack against Ukraine which has had huge humanitarian and economic consequences. The invasion which triggered widespread panic around the world continues to impact the global economy which is still reeling under the impact of bloodshed and terror. The conflict began at a time when the world was still reeling under the economic consequences of the coronavirus pandemic. The war aggravated the existing woes with fresh concerns — disruptions in the supply of grain, fertilisers and energy. Along with it came sticky inflation and economic uncertainty in a world that was already contending with too much of both.

While economists and multilateral bodies are talking about a global recession, the world has, so far, managed to avert a full-scale economic crisis. It is not lost on policymakers that companies and countries have been surprisingly resilient in the face of the geopolitical crisis and supply chain disruptions.

READ | India cannot ignore virtual digital assets, must regulate them

There war in Europe had three major repercussions. For one, inflation which has not left any country untouched. With higher prices for essential items such as food and energy, inflation has been sticky. This, in turn, translates into erosion of purchasing power for a large chunk of global population. Take India’s case for example. Despite months of efforts to tame inflation by the government and the Reserve Bank of India, India’s retail inflation has become a sore point. Consumer inflation surged to 6.5% in January.

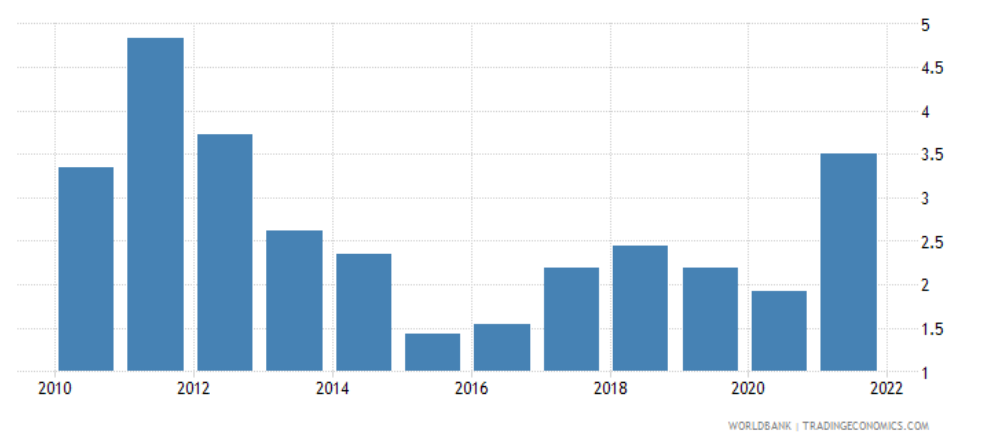

Consumer price inflation since 2010

Impact on global economy

According to the International Monetary Fund (IMF), the impact of the geopolitical conflict on the global economy will flow through three channels. While the first is higher inflation, the second is shrinking trade volumes. The third channel is weighed down asset prices due to reduced business confidence and higher investor uncertainty. This also comes with the tightening of monetary policy that led to heavy capital outflows from emerging markets.

In fact, a year back when Russia invaded Ukraine, there was a major impact on food and energy prices as both of the countries are major commodities producers. Together, Russia and Ukraine export nearly a third of the world’s wheat and barley, more than 70% of the sunflower oil and are huge quantities of corn. Russia is also the top global fertiliser producer. However, food became more expensive last year across the globe as Russian hostilities in Ukraine prevented grain from leaving the “breadbasket of the world”. The threat of shortages, hunger and political instability in developing countries became aggravated.

As of now, punishingly high food prices are inflicting hardship on the poor. Both Russia and Ukraine were major global suppliers to Africa, the Middle East and parts of Asia where many struggle with food insecurity. Prices of oil and gas soared to record levels. Europeans are still paying three times more for natural gas than what they did before Russia started massing troops on Ukraine’s border.

Before the Russian invasion, Brent crude prices hovered around $80 per barrel and the same hit $128 per barrel mark after the invasion. Crude oil prices scaled a new high with Brent crude reaching $122.8 per barrel on May 31. The impact was simple; countries which were dependent on foreign imports for meeting their energy demands (India is included in that) were bound to see wider fiscal and trade deficits and more inflation pressure. However, exporters such as those in the Middle East and Africa were expected to benefit from higher prices.

Like other major economies, India too bore the brunt of the Russian military operation in Ukraine. BSE benchmark Sensex crashed 2,700 points, while NSE Nifty50 plunged 815 points. Sensex on February 24, 2022 witnessed its worst fall since March 2020. It was also the index’s fourth worst fall ever. Secondly, as higher inflation posed a problem, the Reserve Bank of India was forced to increase repo rates to tame soaring commodity prices. In February last year, before the Ukraine conflict started, RBI had projected average inflation at 4.5% for FY23. The same shot past RBI’s comfort range.

To sum up, the effects of the war are to stay here. The global economy will slow down further. According to the International Monetary Fund, the growth expectations this year remain subdued. The total economic loss due to the Russia-Ukraine war can be pegged to the tune of $1 trillion in lost production. The risk of recession continues to loom large with economies like Europe still experiencing significant headwinds, according to analysts.