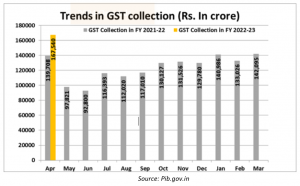

April 2022 witnessed an all-time high gross GST collection of Rs 1,67,540 crore. The graph below depicts the growth in GST collections, compared with the same month in financial year 2021-22. Some of the factors that contributed to the highest GST collections are: anti-evasion measures and strict enforcement action against errant taxpayers by the government with the help of data analytics and artificial intelligence. The release of standard operating procedures in March 2022 for scrutiny of GST returns for FY 2017-18 and FY 2018-19 demonstrated the seriousness the government to plug revenue leakages through intensified assessment and investigation measures.

April 2022 saw the filing of 1.06 crore Form GSTR-3B which is a filing percentage to 84.7% compared with 78.3% in April 2021. Similarly, the filing percentage for Form GSTR-1 in April 2022 was 83.11% compared with 73.9% in April last. These numbers clearly demonstrate the success achieved by the Union government in nudging taxpayers to file GST returns on or before due dates. Also, various states have taken monitoring measures to reach out to taxpayers who have filed delayed returns. It appears that these efforts have motivated timely filing of GST returns by taxpayers.

READ I Interest rate hike: Can RBI avert a hard landing

Panel to improve GST compliance

Recently, an eight-member group of ministers (GOM) led by the Deputy Chief Minister of Maharashtra has been formed. The GOM has proposed the integration of various government sources such as the Central Board of Direct Taxes, IceGate, National Payments Corp of India, state government databases, Directorate of Revenue Intelligence and the Directorate General of Goods and Services Tax Intelligence as well as third-party databases to identify various sources of tax evasion and to recommend changes in business processes and IT systems to plug leakages.

The recommendations of this GOM are expected to be around tax technology and on analytics. Also, the next steps agreed by the GOM would be interesting to look out for.

The compliance hygiene of taxpayers is determined on the ability to immediately extract any form of data or documentation without investing any effort in the event of an audit by tax officials. The data requirement for a conventional GST assessment is humongous and involves various reconciliations and collation of different documents such as input tax credit registers, revenue registers, reverse charge details, payment vouchers, self-invoices, revenue invoices, credit notes, debit notes, input tax credit invoices, vendor contracts and customer contracts.

Imagine multiplying this data spread over a period of 5 years that results in a gigantic pile of information which needs to be maintained in a systematic and classified manner for easy extraction.

READ I People’s participation can prevent forest fires of Uttarakhand

Taxpayers must embrace technology

The blind spot and a major headwind for any organization is that this data spread is often fragmented and found in the individual systems of the teams handling the tax functions. For instance, vendor communications providing evidence of disclosure of invoice in Form GSTR 1 [not reflecting in Form GSTR 2B] are mostly confined to procurement and to the systems of specific finance teams. Leveraging on such information on a common platform and having ready accessibility at critical times of GST assessments is the need of the hour.

Centralising and segregating this data spread, perhaps through audit readiness tools, should be a key focus area for taxpayers to be ready for audits by tax officials. Such audit readiness tools which would act as a centralized data center for all the information/documentation required during an audit would act as an insurance against possible data losses or change in finance and tax teams.

The use of technology is no longer limited to filing of GST returns and reconciliation of input tax credits with Form GSTR 2B/2A. Automations can be applied by taxpayers to other areas of compliance obligations such as refund computations, vendor risk management and QR code verification of e-invoices. Vendor verification tools provide much-needed ammunition for procurement functions to plan empanelment and contract negotiations on account of ITC losses caused by vendor non-compliances.

The essence of the above steps is that tax technology has made a significant headway from being a mere compliance tool enabler to a compliance engine. While the government has employed technology through data sharing/ data analytics to plug revenue leakages, taxpayers should continue to leverage the same to improve business processes.

(Mahesh Jaising and Sandeep Jaiswal are Partners at Deloitte Touche Tohmatsu India LLP.)